Ask company executives if customers find their business trustworthy, and most will of course say yes. But ask their customers, and often you will hear a different answer.

According to the "Edelman 2012 Trust Barometer," consumer trust in businesses to "do what is right" averages only 53 percent globally. The report states that banks and other financial services firms are the least trusted industries for the second straight year. Only 45 percent of respondents trust financial services firms to do what is right. And even the best-performing industry—technology—garners the trust of only 79 percent of those surveyed worldwide. This status quo is not sustainable, from a customer or business standpoint.

Many factors are at work when it comes to the perception of customer trust. But contrary to popular opinion, trust is not an intangible, feel-good attribute out of a company's control. It's up to businesses to influence what they can with a structured approach to building trusted relationships. The health of their business depends on it.

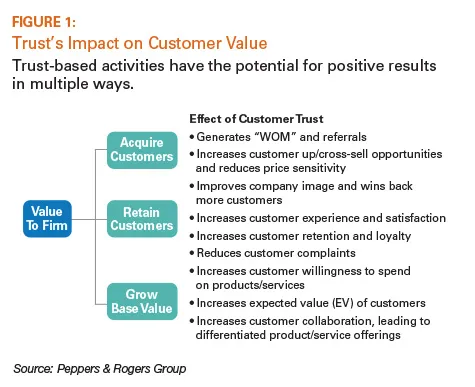

Trust-based initiatives have real business impact. Trust makes customers less price sensitive and less interested in competitive offers. It creates a sustainable competitive advantage. Higher customer engagement means greater value to a firm—and trust can lead directly to the acquisition, retention, and growth of the firm's customer base (see Figure 1).

Six building blocks of trust

The need for a trust-based relationship can't be denied. But marketing executives who want to build customer trust have one question: How?

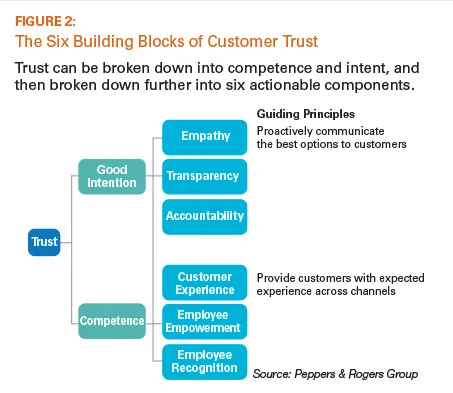

It starts with building a framework and guiding principles, which can be translated into specific actions for employees to take during interactions with customers. In their book Extreme Trust: Honesty as a Competitive Advantage, Don Peppers and Martha Rogers, Ph.D., write that trust comes from two places: intent and competence. You must have pure intentions of acting in the customers' best interests to create a trustworthy environment. And you must also have the capability to execute against those good intentions. Without competence, it's just lip service. Neither one on its own is enough to build trust. They must work together.

Going a step further, we identify six drivers of trust based on intent and competence that any organisation can operationalise (see Figure 2):

- Empathy

- Accountability

- Transparency

- Customer experience

- Employee empowerment

- Employee recognition

The foundation of intent

Empathy, transparency, and accountability are three building blocks of intent. Having empathy for customers, and treating them the way you would want to be treated, is one of the most important elements of goodwill. Empathy requires firms to proactively anticipate customer needs and reach out to them to offer relevant products and services, even if it means losing money in the short term.

One way to operationalise empathy is to develop an associated guiding principle, such as "Proactively communicate all the best options to customers," to empower employees to take the necessary actions to build trust with customers. For example, the customer care team at a telecom operator can proactively adjust a customer's rate plan to a new plan that best suits his needs and is $20 cheaper. This may mean losing $120 in the short term (assuming the customer has six months left in his contract). But it can lead to the customer renewing his contract, potentially generating $450 over the course of the customer's lifetime value (24 months).

Transparency, meanwhile, sounds simple enough, but in practice it can be difficult. Some firms equate transparency with giving up control. That's not the case. Simple activities like clarifying the language of your policies, actively using external social media channels to communicate with customers, and being open to feedback and criticism from customers are all good examples of transparency. Transparency is increasingly important as items like hidden fees or service changes are now quickly broadcast across the Web once just a few customers discover them.

Accountability is about taking responsibility when customers go through any negative experiences. This may involve compensating customers for the inconvenience, as well as making any changes internally to people, processes, or systems to make sure mistakes are fixed and future errors are avoided.

Competence drivers

Competence comprises customer experience, employee empowerment, and employee recognition. Customer experience is about being consistent and credible to customers. It goes beyond delivering high-quality products and services and involves building relationships with customers that will encourage positive word of mouth and referrals. A tactic to operationalise the customer experience is to develop an associated guiding principle, such as "Provide customers with expected experiences across all channels," which sets up internal processes and systems that enable the experiences customers expect.

For a telecom operator whose customer care operation receives large numbers of calls due to network issues, this might mean sending a simple text message to customers who experience dropped calls with an offer of free minutes or other credits as compensation. Or it could also mean letting customers know that the operator is aware of the network problem and is proactively working to resolve it. In the short term these actions may result in some costs, but the long-term benefit could save millions of dollars as a result of reduced calls to customer care.

Employee empowerment requires firms to train and authorise employees to take necessary actions to earn customers' trust and to provide the necessary information to do so. Recognition requires firms to reward employees for their trust-building initiatives with customers. Some firms may need to restructure internal policies, employee roles and responsibilities, or the firm's compensation structure to operationalise empowerment and recognition.

Building customer trust is not a simple internal sell, and potentially comes at short-term costs. It requires fact-based analysis of customers and their needs, understanding the firm's competitive position and market share, and performing in-depth gap and capability assessment. Many companies simple aren't ready to undertake trust-related initiatives. But those that identify and act on the six trust components can achieve powerful financial results.