When I started in the customer care industry many years ago, the quality of the person hired and how they were trained were paramount. Today, that is truer than ever. When a customer reaches out and needs help, the quality of the interaction on the other side has the power to make or break the relationship that the customer has with the brand forever.

While new technologies, regulations, and industry changes are impacting how those relationships are forged, managed, and measured, we maintain that people are still at the heart of delivering exceptional customer experiences. That said, it’s a tough time to be finding, hiring, and managing the best talent. Economic shifts locally and globally are changing the entire sector.

U.S. unemployment has seen a steady reduction since a high of 9.61 percent in 2010. Today it stands at 4.93 percent, its lowest rate since 2007. At the same time, the U.S. Bureau of Labor Statistics predicts that the customer care industry will grow by 10 percent through 2024, faster than average for other occupations. This is great news for the economy and for potential employees, but it is a scary fact for those in charge of talent acquisition and retention. Low unemployment rates mean that employers must compete for quality employees and work hard to keep them once they are hired. Geography, skillset, culture fit, and the size of the potential job pool all must be taken into consideration. And in an industry as churn-prone as customer care, this is a difficult task.

Employment costs are also on the rise. For decades, “real wages” (adjusted for inflation) haven’t kept up with changes to the cost of living here in the U.S. This unsustainable situation created the need for substantial increases in minimum wages in a short timeframe. Instead of gradual increases, some advocacy groups are fighting for $15 an hour, more than double the current federal minimum wage of $7.25. Some states have already taken action. Of the 29 states and D.C. whose minimum wages are above the federal level, 12 increased their rates through legislation passed in 2014 or 2015, while two states automatically increased their rates based on cost of living. So don’t expect the federal minimum to stay at its current rate for much longer.

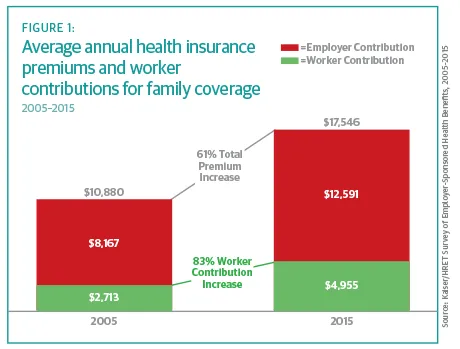

Besides paychecks, healthcare costs have skyrocketed over the past five years, adding on extra burden to employers. Health insurance costs increased 50 percent in five years, with the average total medical cost per covered employer per year estimated at $12,591 in 2015 (see Figure 1). These costs are shared by both employers and employees. Nearly 60 percent of U.S. employers offer health benefits to at least some of their employees, according to the Kaiser Family Foundation. For those who don’t have employer benefits, Affordable Care Act penalties will be set at $695 per individual, plus inflation, in 2017 for those without health insurance.

As costs rise, so do consumer demands. We’re serving a new kind of customer, one whose expectations are high and tolerance of poor service is close to zero. We have all become that new kind of customer, the one who wants efficiency, personalized service, and a frictionless customer experience through our channel of choice.

These customers are willing to spend money with the right brands. Consumer confidence in the economy is back to pre-recession levels, and according to the University of Michigan Surveys of Consumers Chief Economist Richard Curtin, “Real consumer spending can be expected to rise by 2.7 percent in both 2016 and 2017.” Whether or not you can capture some of that spending depends on how well you meet expectations during customer interactions.

All of these economic factors point to the fact that the industry is in transition. Customer care as a pure cost play won’t cut it anymore. The value of an interaction will supersede costs to drive efficiency, satisfaction, and ultimately revenue. The quality of interactions will be more important than quantity. Companies will need to do more with less. Therefore, we recommend taking a deep breath and embracing the change.

This is a job for technology-fueled SuperAgents

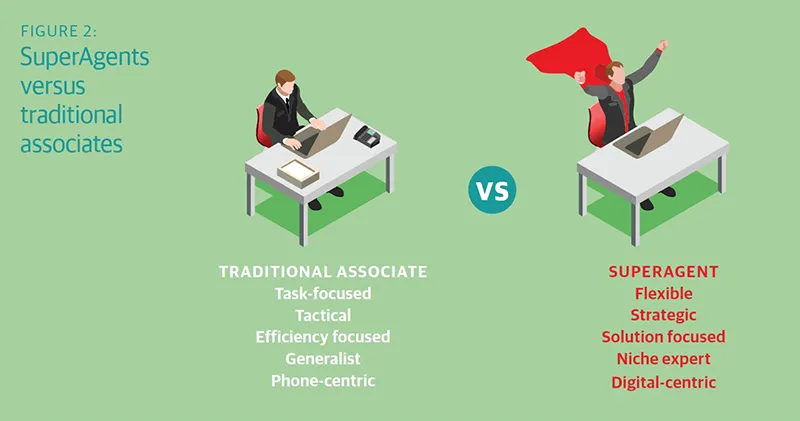

In this environment, to get ahead and stay ahead, a company needs a new type of employee to interact with the most valuable asset—its customers. We call them SuperAgents. These employees are hired and trained as customer experience experts who are empowered to deliver best-in-class service through any channel, whether a customer is connecting through voice, chat, video or mobile. They are digitally savvy, flexible, and empowered. They can personalize interactions based on the consumer’s need, not a workflow. They think strategically about how to resolve issues. They are well versed in the industry they work in, and can anticipate and proactively manage customer concerns.

The customer experience center of the future will have fewer, but more empowered SuperAgents. We’re already transitioning to intuitive customer self-service, real-time service bots, 24/7 omnichannel support, and mobile service options to delight customers. But there must be people behind the scenes to support digital operations with a personal touch. SuperAgents can use their expertise to solve complex issues. They will be armed with data and new tools that will reduce friction and costs while enabling personalized customer journeys.

Share the burden with a CX partner

In addition to leveraging internal technologies, businesses will need to work with partners with the expertise, scale, and reach to succeed in the customer experience arena. They can use analytics and best practices to identify potential SuperAgents who fit the ideal skill and personality profile, are most likely to have a longer tenure, and be the best fit for the role.

Customer experience partners can help design personalized and simulated learning programs to develop more specialized associates who will ramp quickly and be comfortable working in multiple channels. Artificial intelligence will fuel smarter knowledge bases. Employment-focused workforce management systems will enable a friendlier scheduling process and increase employee access to management.

To minimize risk for this new model, companies will need to find partners who can help them make big moves fast—saving time and costs required to put these strategies into action. By leveraging the expertise of an outsourcer that lives and breathes the customer experience every day, companies will be rewarded with not only happy and loyal customers, but a bottom line that will be the envy of even their greatest competitors.

The U.S. economy has its ups and downs, but one thing remains constant: the value of people. Economic shifts in the market will see companies narrow their focus and invest wisely in people who will have the most positive influence on the customer experience. Those who get ahead of the curve by monitoring leading indicators will have the upper hand.