At the onset of the COVID-19 pandemic, the need for fast and effective virtual contact centers was apparent. Companies shifted the majority of contact center employees to work from home to maintain business continuity. How has the shift to virtual contact centers impacted the customer and employee experience? What challenges did companies encounter and what changes will remain after the crisis passes? TTEC recently surveyed 62 contact center leaders representing 34 clients across different industries to find out. Here are the key takeaways.

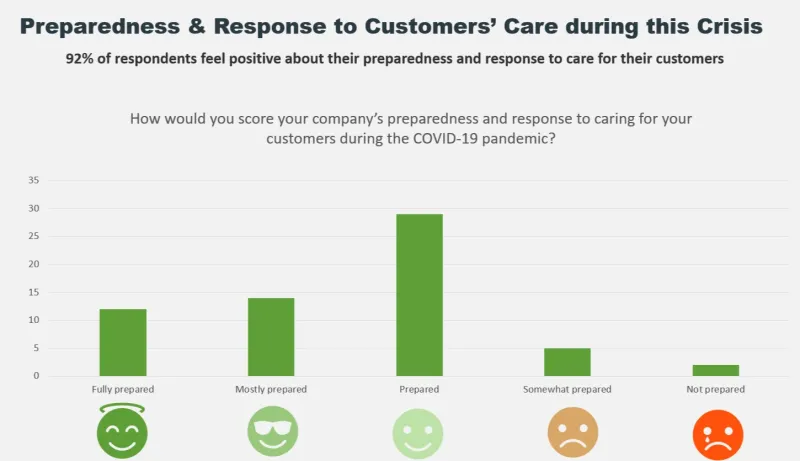

Customer care preparedness & response

A majority of clients said they were prepared to respond to customers in the midst of the crisis with little or no impact to the customer experience. 92% of respondents feel positive to their preparedness and response to care for their customers, with only two respondents saying they were not prepared for the pandemic.

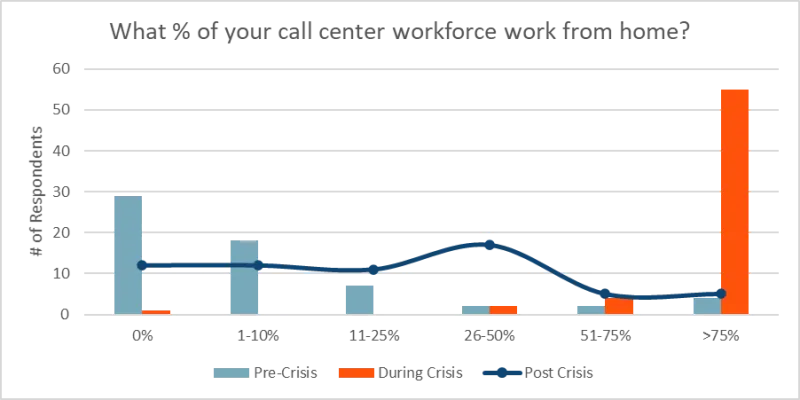

Who is working from home, and for how long?

While most companies scrambled to enable short-term virtual contact center operations, more than one-quarter of companies plan to keep agents working remotely going forward.

- During crisis: 89% of respondents pivoted more than 75% of their agents to work from home during the pandemic

- Post-crisis: 27% forecast that nearly half of their workforce will continue to work from home

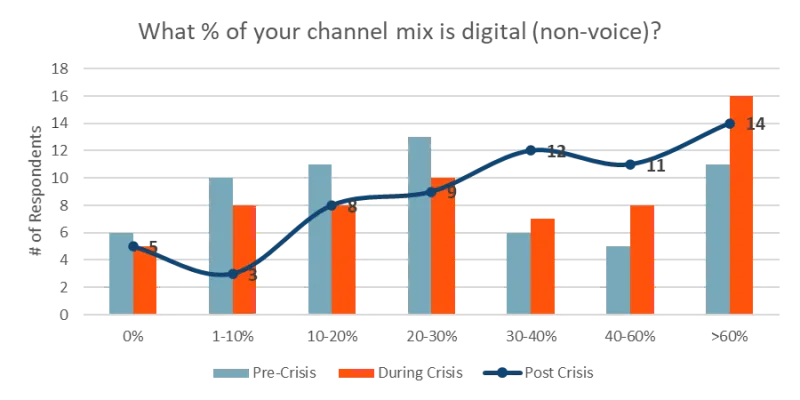

Less effort, more happy through digital channels

COVID-19 reinforced customer demands for effortless and secure digital-first customer support and information. This has led to increased investments in a digital channel mix and automation.

- Pre-crisis: 55% of respondents had <30% of their channel mix as digital

- During crisis: Respondents that had invested >60% in digital channels pre-crisis increased their dependency on digital by 45%

- Post-crisis: Respondents say they will be more reliant on their digital channels, starting at 30% investment on digital channels

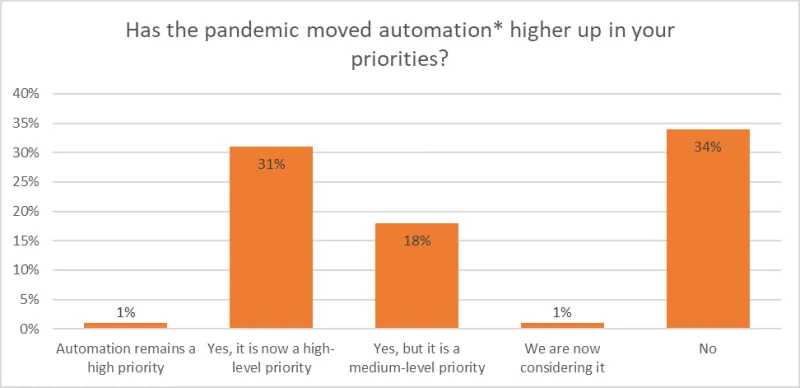

Contact center automation: A work in progress

The results show a majority of clients are now in various stages of prioritizing automation to increase efficiencies. The survey found that 67% of respondents consider automation a priority while 58% have increased sentiment towards automation. However, still more than one-third of respondents haven’t moved it up the priority list. This suggests that contact center automation is still very much in the early days and many contact center leaders have not seen a reason to speed up adoption rates.

Challenges to virtual contact center success

Quickly adapting to new technology and communications requirements were among the prime challenges that companies faced in adjusting to a remote contact center workforce. This suggests a growing market for technology solutions and operational expertise that removes friction for remote employees.

Top gaps in work-from-home contact center operations

1. Technology -- 21%

2. Communications & Support -- 19%

3. Performance management -- 16%

4. Training -- 15%

5. Security -- 14%

6. None -- 10%

7. Other – 5%

How are different industries prepared for a remote contact center future?

Nearly every industry forecasts an increased percentage of employees working from home even after the crisis passes, along with digital representing a greater percentage of the channel mix. Most industries TTEC researched said they are “fairly” prepared to care for customers, while financial services and retail consider themselves prepared. Here are some industry breakdowns.

Telecommunications

Fairly prepared to care for customers

Anticipate shift of workforce to work from home from 0% pre-crisis to 26-50% post-crisis

Move more of channel mix to digital (non-voice) from 1-20% pre-crisis to >60% post-crisis

Financial Services and Insurance

Prepared to care for customers

Anticipate shift of workforce to work from home from 1-10% pre-crisis to 26-50% post-crisis

Move more of channel mix to digital (non-voice) from 20-40% pre-crisis to 30-40% post-crisis

Retail

- Prepared to care for customers

- Despite major shift during crisis of >75%, NO anticipated shift of workforce to work from home post-crisis

- Move more of channel mix to digital (non-voice) from 30-40% pre-crisis to >60% post-crisis

Automotive

- Fairly prepared to care for customers

- Major shift of workforce to work from home from 1-10% pre-crisis to 26-75% post-crisis

- Move more of channel mix to digital (non-voice) from 10-20% pre-crisis to 20-30% post-crisis

Technology

- Fairly prepared to care for customers

- Work from home workforce sky-rocketed from 0-10% pre-crisis to >75% during crisis and is slated to settle down to 11-25% post-crisis

- Move more of channel mix to digital (non-voice) from 30-40% pre-crisis to >60% post-crisis

Healthcare

- Fairly prepared to care for customers

- Work from home workforce sky-rocked from 0-10% pre-crisis to >75% during crisis and is slated to mostly settle down to 26-50% post-crisis

- Move more of channel mix to digital (non-voice) from 1-10% pre-crisis to >60% post-crisis

Customer centricity is evolving

While contact centers and companies are in a state of flux, creating effortless experiences for the customer is still a priority. What the survey tells us is that how companies prioritize customers is changing. Remote work is becoming part of normal operations for many organizations. Investments in digital channels and automated solutions to reduce customer and employee effort are accelerating. With an urgency for fast and expanded customer support comes a heightened need for customer-centricity. It is no longer a nice-to-have; it is a must-do.