In today’s hypercompetitive and oversaturated communications landscape, telecom operators are constantly fighting to retain their most valuable customers and extract value from their existing customer base.

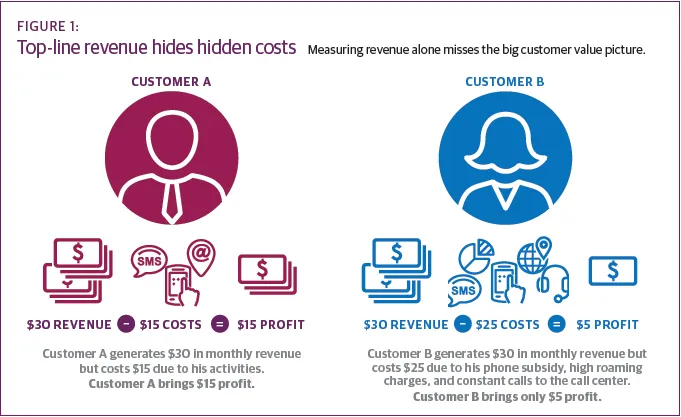

Often companies will define programs and provide preferential treatment to customers they deem to be most valuable based solely on their spending on products and services. Figure 1 highlights why this approach can be deceptive and inaccurate, as both Customer A and Customer B would be treated the same based on top-line revenue contribution.

The problem is that most operators currently cannot fully understand the profitability of customers on different plans, subsidies, or with multiple SIM cards. In addition, the profitability of customers is not always clear. This creates difficulties when trying to optimize products and services offerings.

Telecom companies tend to calculate their EBITDA at an overall company level. In most cases, the level of depth will at most stretch down to the operating unit level or in rare cases, department level.

Take a new approach to measure profitability

Saudi Telecom (STC), which operates in the Middle East, India and Africa, recently adopted a granular approach to understand the exact contribution each customer makes to its bottom line, in order to enhance operations and treatment of its truly most valuable customers. The approach has been coined Customer Level Earnings Before Interest, Taxes, Depreciation, and Amortization (CEBITDA).

“Most companies compete by lowering their prices until the price of the products is lowered to the point that all of the economic profit disappears,” says Luca De Carli, general manager of Customer Lifecycle Management at STC. “Instead, CEBITDA helps us avoid price wars by monitoring the market at the most granular level and helps us to make decisions in near-real time to increase customer value consistently and proactively decrease the number of unprofitable customers.”

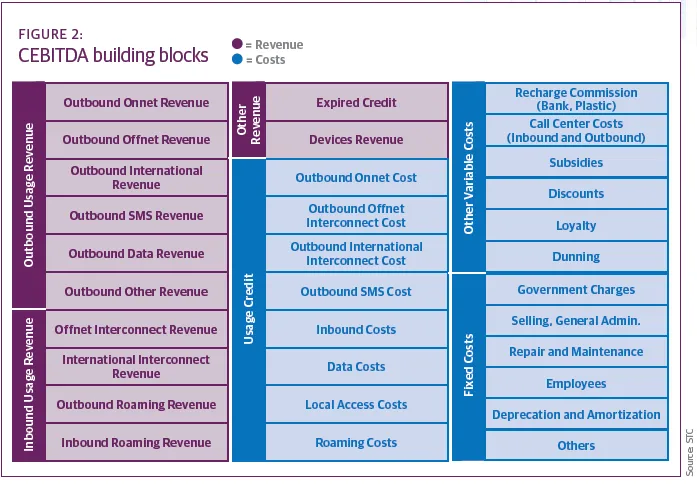

The starting point for the work was to identify the various elements to be considered for the model. Figure 2 shows some of the 120 data elements used to calculate the revenue and costs generated by each customer.

The majority of costs and revenue elements are derived from customers’ incoming and outgoing usage. Inputs were needed from multiple departments including finance, sales, network, wholesale, customer experience, and call center. The Customer Value Management (CVM) team, part of the Customer Lifecyle Management department, is responsible for integrating the data and creating the accompanying programs.

For the most part, variable costs are easy to calculate, as they are directly correlated with customer incoming and outgoing usage, says Ahmad Hussain, director of Customer Value Management at STC. The main challenge faced during the CEBITDA calculation phase is the assignment of costs for network elements. It requires an understanding of the type of traffic being transmitted across the network and assignment of costs accordingly.

STC identified three ways to calculate the costs of serving customers and distributing network costs:

1. Consult the books. The simplest method is to determine the total volume of data, minutes, and SMS transmitted over the network. By then taking the total cost of the network from finance, operators are able to define a unit ratio to calculate cost per MB, minute, and SMS.

2. Determine technology type costs. A more accurate method tabulates network elements against technology type (2G/3G/4G) and defines the amortized cost of different network elements. Operators are also able to identify the cost per MB, minute, and SMS for customers connected through different technology types by mapping the costs associated with each data/voice traffic route.

3. Understand cell site-level costs. The most accurate approach, given availability of data, is to define the MB, minute, and SMS rate for each cell site, along with relative backbone infrastructure within the network. This approach provides a more accurate representation of the cost to serve each customer.

Once customer level profitability was calculated and validated, customers were categorized into value-based segments. The segments provide an accurate indication of each customer’s contribution to STC’s bottom line and will be used in conjunction with revenue0based value segments to define treatment plans for customers.

With the value calculation and segments in place, STC has begun to define areas of opportunity and use cases to derive value from the CEBITDA project. The team is in the process of implementing a number of initiatives related to customer service, product and pricing strategy, customer retention, and loyalty activities.

What success looks like

The aim of the program is to significantly reduce costs per customer while increasing profits with smart planning. By simply optimizing the cost elements and bringing unprofitable customers to a breakeven point, for example, STC expects to increase profits by approximately 16 percent. Here is a snapshot of some of the insights created from the CEBITDA program.

CUSTOMER SERVICE:

Within the customer service arena, one of the key objectives is to reduce costs by migrating customers to self-service channels such as online portals, applications, and kiosks. Identifying which customers to migrate to these channels is a common challenge among telecom operators. By adopting the CEBITDA approach, STC can identify exactly which customers are providing value to the firm and prioritize them for treatment at high cost, more personalized channels. At the same time, it can continue to move low revenue generators to self-service channels and incentivize all customers to use lower cost channels to conduct simple transactions that do not require human intervention.

It’s also important that segment treatment plans are created for each CEBITDA value segment. For example, the lowest value segment will be pushed to digital channels for simple inquiries, while the highest value segment can be served through the call center.

With current technology, the ability to prioritize high profit customers using an operator’s network is also important. Customers generating value for the company should be considered a priority when making calls and data sessions, and be exempted from potentially damaging strategies such as throttling.

PRODUCTS AND PRICING:

Gaining an understanding of customer-level profitability enables a plethora of different views to be created that can be used to optimize how an operator bundles and prices products and services.

• International callers: The profitability of international callers has always been a hot topic in telecommunications. STC CEBITDA analysis found that within the prepaid base, the profit percentage between international and regular users was very similar. However, within the postpaid base there were significantly different figures, with heavy international callers generating more profit.

• Chat application users: Through the use of surveys, STC identified customers who use different chat services. Combining these insights with the CEBITDA model enabled the CVM team to understand the value brought by app users. Our insight highlighted the importance of these customers due to significant revenues brought through their data package purchases.

• Subsidized handset and multi-SIM plans: Postpaid packages offer options for both subsidized devices, as well as multiple SIMs to share allowances across families. The profitability of customers with one or both of these features was examined. Results were extremely eye opening and are soon to be utilized by the pricing and product teams to optimize the options available to customers.

RETENTION AND LOYALTY:

In addition to migrating low-profit customers to alternative channels, we strongly advocate for the expansion of high-value customer programs to include high-profit customers who may not be within the current program ecosystem. Most programs select customers purely based on revenue contribution. By adding high-profit customers, soft benefits such as priority treatment and event invitations can build deeper bonds with these customers to retain them. The migration of high-profit customers into the program and low-profit customers out of the program must be carefully executed so as not to upset customers and trigger potential unwanted sentiments and churn.

In addition, the current global practice for retention activities uses customer spending to define acceptable dilution levels when assigning retention offers. The theory is that taking a short-term hit on revenue is advisable to prolong the customer’s lifetime and revenue contribution. With the cost element introduced by CEBITDA, this activity can be further optimized.

These insights will be used to improve the company’s fraud detection activities, optimize its customer portfolios, and reduce costs, says Hussain. He and De Carli recommend other companies look to customer level profitability as a way to enhance customer relationships.

“Spend the necessary amount of time to implement the project properly by carefully evaluating and then allocating each cost and each revenue down to the single customer,” Hussain says. “Start with cross-department alignment based on strategic goals, and a phased approach based on improving major costs first.”

Conclusion

The bottom line for companies around the world is their bottom line. Profit maximization is a key objective and is linked to the rewarding of shareholders and employees, and enables investment in enhancements to stay ahead of the curve. Gaining visibility into customer level profitability provides the best opportunity to make decisions about how to treat different customers differently to achieve company objectives.

*Note: STC is a client of Peppers & Rogers Group, a TeleTech company