The subject of customer experience in retail banking has never been more important, timely, and essential to achieving and maintaining business success. Banks win by getting, keeping, and growing customers. How to get more customers, keep them longer, and increase the value of each customer—that is the critical challenge that must be met in order to grow organically. Overcoming that challenge starts with the realization that the quality of customers' experiences is key.

To help banks descriptively understand the state of the customer experience and to guide improvements through prescriptive recommendations, Peppers & Rogers Group and Efma (European Financial Marketing Association) jointly conducted primary research. From an examination of a rich set of qualitative and quantitative data gathered from more than 100 banks in 37 countries, three recommendations emerged:

1. Organizational Leadership and Ownership

Customer experience success isn't managed—it is led. It requires senior organizational leadership to break down internal barriers and to coordinate efforts across functions, all of which are obstacles to delivering exceptional experiences and all of which are ultimately of no concern to customers.

Customer experience success also requires vision; a clear roadmap (that integrates internal customer experience processes and external best practices); consistency of purpose; the establishment of measurable and achievable milestones; and the alignment of financial and human resources, performance appraisal, and incentives systems with the goal of achieving business success through the execution of a customer experience strategy. Supporting the importance of organizational leadership and ownership for customer experience success are research findings addressing (a) resource allocation and (b) personnel accountability.

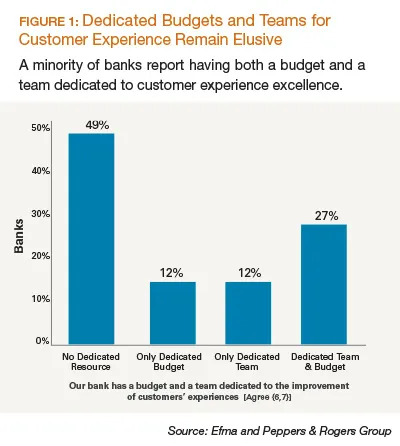

Resource allocation. Although customer experience is often a stated priority, nearly half of all banks report having neither a dedicated budget nor a dedicated team for the improvement of customers' experiences (see Figure 1, page 46). In many cases, this may be a reflection of the struggle to "walk the walk" and to provide a tangible commitment to customer experience excellence, and may also be due to a lack of a cross-functional governance structure for customer experience management—a critical organizational component for improving customers' experiences. Fortunately, about one quarter of banks have succeeded in securing budgets and personnel focused on enhancing customers' experiences, and more than half (55 percent) of these anticipate increases in their budgets in the next fiscal year.

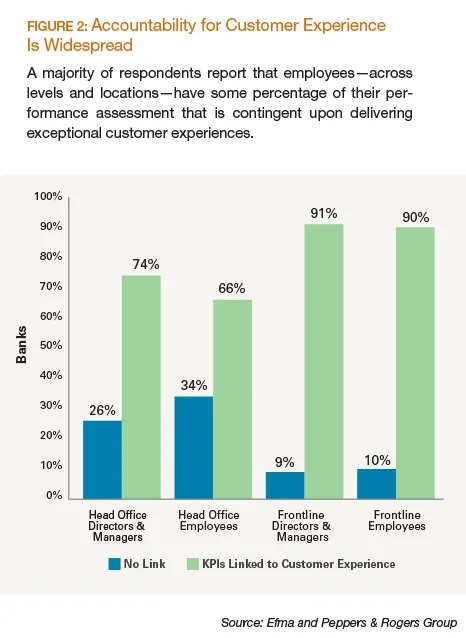

Accountability. When asked the percentage of the performance appraisal assessment that is contingent upon delivering exceptional customer experiences, a majority of respondents indicated the existence of some level of accountability for personnel at both the head office and on the front line, as well as the director/manager and individual contributor. (see Figure 2). The level of accountability was highest at the front line for both director/manager personnel and for employees below the manager level, signifying widespread accountability for the achievement of customer experience excellence among customer-facing employees. One third of the respondents report that more than 20 percent of the performance appraisal assessment for frontline staff is focused on customers' experiences. Although comparatively lower, accountability in the head office is still strong. This pattern of results is promising— there is a durable link between customer experience and performance management, driving improvements in the awareness of and responsiveness to changes in customers' experiences.

2. Customized Value Propositions

In order to deliver exceptional customer experiences, a bank must be able to deliver customized value propositions. This requires the enterprise to take customer behavior and needs into account. The more customized the value proposition, the more difficult it will be for the competition to re-create it.

Personalized value propositions help lock in loyalty and so does the proper handling of "moments of truth." As a consequence, it is essential for banks to identify these moments of truth for their customers—on an overall basis, and also those that are specific to each customer segment. To do so, begin by examining customer complaint data to generate a list of potential moments of truth, and use qualitative focus group research among customers to narrow the set to those that are most salient. Next, employ quantitative customer research to understand the magnitude of each problem and its prevalence within each customer segment. Finally, consider the bank's capabilities to address each moment of truth and create a two-dimensional matrix of opportunities defined by the axes of customer impact and ease of implementation. Those moments of truth that are both high impact and comparatively easy to address should be the first priority.

Three general facets of banks' capabilities related to the delivery of customized value propositions and properly handling moments of truth were investigated: (a) organization, (b) process, and (c) information and technology. Banks were asked to rate the current quality of these capabilities and the quality of their customers' experiences.

Organizational capabilities. Banks' self-reported ratings of several facets of their current organizational capabilities were generally moderate on an overall basis, not deviating far from the midpoint (4) of a scale ranging from "poor" (1) to "excellent" (7). As a consequence, there exists substantial room for most banks to improve these capabilities. Consider, for example, that the highest-rated capability—sustaining a strong customer-focused culture—was rated on average at only 4.5 (see Figure 3).

Achieving a culture that embraces the importance of customers' experiences is supported in part through training. Training employees for delivering excellent customer experiences was comparatively highly rated by banks overall and even higher by those banks now delivering an excellent customer experience. Training, when done well, helps employees to understand what to do, how to do it, and why they are doing it—thereby strengthening the company's culture.

Comparing all banks against those now delivering excellent customer experiences, noteworthy gaps in performance appear. In particular, hiring employees who have a strong focus on customer satisfaction and empowering employees to treat the customer right are two organizational practices that are known to be crucial success factors. When employees have the right attitude coupled with the right authority, the quality of customers' experiences improves.

A struggle for banks, however, is adequately equipping their employees with customized tools in order to enhance customers' experiences. This suggests that improvements may be needed in the banks' ability to identify and anticipate their customers' needs; to translate that insight into differentiated product, pricing, channel, and communication strategies; and to develop and deploy those strategies consistently across all relevant channels. Yet, even among those banks now delivering excellent customer experiences, this is an area recognized as needing improvement.

Process capabilities. Customer-centric business processes align the internal organization with the external needs of customers. Among those processes identified as most in need of improvement are identifying and capturing key life-stage events and customizing interactions for individual customers (see Figure 3, page 48). Both are essential for delivering a differentiated customer experience, based on knowledge of each customer's value and needs. Even among those banks now delivering excellent customer experiences, these processes exhibit significant room for improvement.

Banks now delivering excellent customer experiences report a higher quality of performance in providing prompt and effective complaint resolution than banks overall, a key consideration since resolving complaints in a timely and thoughtful manner may actually increase a customer's loyalty. However, while it is important to solve customers' complaints and to improve the complaint management process itself, it is more important to prevent complaints by identifying and addressing their root causes.

Information and technology capabilities. On an overall basis, banks struggle most with transforming comprehensive insights into relevant action. The continuous collection and integration of customer data to reflect the complete relationship history is an area of improvement for banks generally and even for those now delivering excellent customer experiences. This capability is a foundation for the continuous analysis of collected data to generate customer insights and for transforming derived insights into proactive actions to enhance the customer experience, both of which are rated moderately low for banks overall. Maintaining the relationship history also has consequences for providing consistent and seamless service, the absence of which hinders the continuity of interactions over time and across channels (see Figure 3).

3. Measurement

The goal of measurement is to enhance the quality, the certainty, and the speed of business decision making. In the context of customer experience, measurement should seek to clarify the current state of the three critical dimensions of customer experience: (a) the delivery of operational excellence, (b) the creation of customized value propositions, and (c) the maintenance of a strong reputational presence.

By focusing on root causes or the factors that contribute to fluctuations in customer experience performance, measurement becomes actionable. To be actionable, a measurement of customer experience cannot be generic—it must be granular, such as: (a) the friendliness and helpfulness of staff when assisting a customer whose debit card has been lost, (b) the customization and personalization of services for a demand deposit account provided to a high-value customer, or (c) the monitoring of—and participation in—customer social networking communities to answer questions and offer advice. For each of these illustrative cases, metrics must be developed that reliably quantify the underlying construct. Each metric should include documentation that defines the metric, the data sources used, the method used to compute its value, the frequency of its update, the person responsible for the reporting of the metric, and the manager responsible for setting the target goal of the metric. In total, it constitutes a customer experience measurement plan.

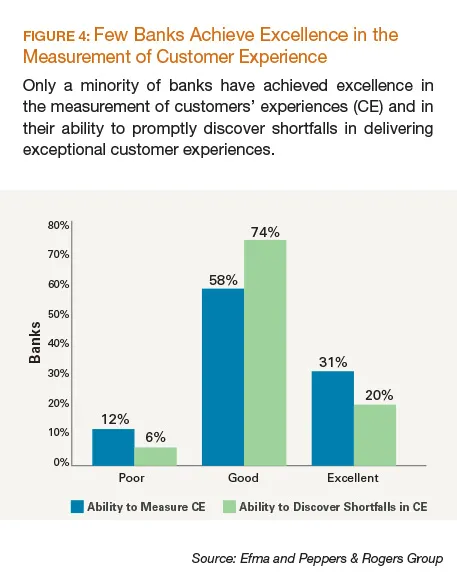

Measuring customers’ experiences. Banks’ ability to quantitatively measure changes in the quality of customers’ experiences is an area in which few excel—and in which even fewer are able to promptly discover difficulties in delivering exceptional customer experiences (see Figure 4).

In the absence of quantifying the quality of customers’ experiences (across the entire customer base, and by customer segment and by channel), it is difficult to identify areas in which success is occurring and which can be replicated more broadly across the enterprise through the sharing of best practices; to support accountability for performance (see Figure 2, page 47); to sustain continued investments in customer experience through a rigorous business case; and to most effectively allocate resources to experiential touchpoints in need of improvement. Among banks now delivering excellent customer experiences, however, a majority (69 percent) report success measuring customers’ experiences—more than twice the overall average. As a consequence, there exist considerable opportunities for improvement for those banks in which the measurement capabilities are at or below average.

Conclusion

Banks are at a precipice. Focus on what matters most to customers—the quality of their experiences—or prepare for a precarious future. Banks that deliver operational excellence in every interaction; that customize products, pricing, and promotions to match the needs of each individual customer; and that establish a positive reputation are on the path to success.

Begin by adopting a broad perspective for customer experience that encompasses all three of these components, by setting a clear direction and developing a roadmap to guide the journey from today’s state to tomorrow’s future, by making sure that all customer experience initiatives are supported by a cross-functional team with dedicated resources, and by linking performance management to customer experience success with measures and incentives to increase awareness and responsiveness within the organization. And, begin now.