The global recession has taken its toll on nearly every industry, and the financial services sector is no exception. Coupled with the fallout that’s occurred from the credit crisis that began in 2007, some banks, insurance companies, and other financial organizations have seen customer attrition rise and transaction volumes drop as consumers have become frustrated by increased credit restrictions and plummeting performance on their investments.

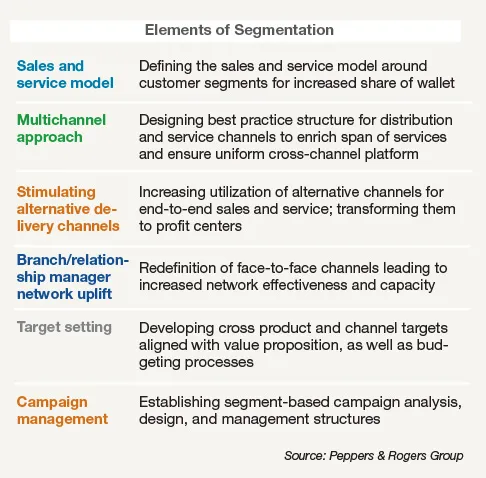

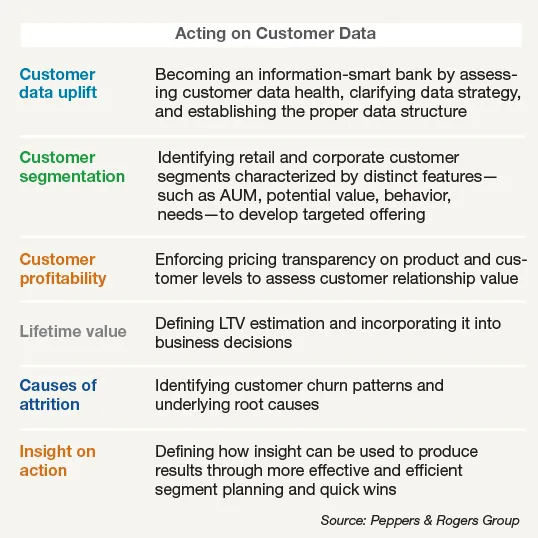

To help address customer churn, strengthen relationships with high-value customers, and attract quality prospects, leading financial services companies have stepped up their use of customer data and analytics. Forward-thinking banks, brokerages, and insurance companies are using these tools to help identify their customers, the products they want, and their short- and long-term value, as well as to segment customers by value or propensity to buy certain products, according to Orkun Oguz, a partner at Peppers & Rogers Group.

As a result, top performers are discovering that the road to riches begins with providing customers with optimal and customized experiences, regardless of the channels they use.

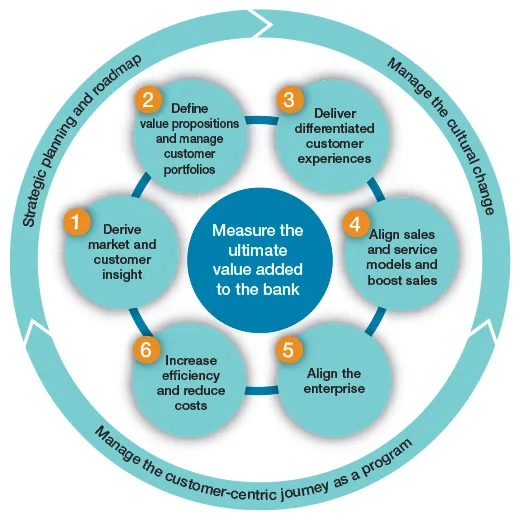

A Roadmap for Developing a Customer-Centric Strategy

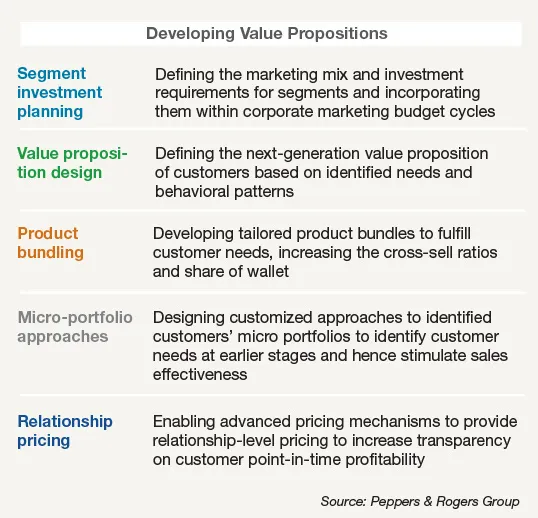

Historically, many financial services companies have relied on product-centric strategies to drive growth, paying scant attention to instilling customer strategies to help meet their business goals. Banks and other firms taking a customer-centric approach to growth should develop a framework for managing the customer experience. This process begins with data. Financial services firms often have knowledge about customers at an asset level or at an account level, but there’s little effort made by them to understand customer needs, behaviors, and expectations, explains Caglar Gogus, a partner at Peppers & Rogers Group. Once firms gain that understanding, they can move through such stages as creating and delivering differentiated customer experiences and aligning business models with customer segments.

Source: Peppers & Rogers Group

Boosting Sales by Aligning Distribution

Financial services companies must ensure that they’re meeting customer needs and delivering on the customer experience. To support these efforts decision-makers should identify “moments of truth” or critical events that matter most to specific customer segments. For affluent retail banking customers, a moment of truth might be the first time they receive personalized services from a relationship manager. For mid-value customers, such an occurrence might be marked by a change in product pricing that helps to strengthen their loyalty.

It’s also critical for financial services companies to identify the channel, product, and support preferences for segmented customer groups and then strive to meet those expectations, according to Mehmet Eryilmaz, a senior consultant at Peppers & Rogers Group. “One way to identify preference is to set up customer councils to get closer to customers and take action to improve customer loyalty,” he says. From there, companies should align segment targets with operational and performance targets to meet their strategic goals, adds Mateusz Bonca, a manager at Peppers & Rogers Group.

Setting the Bar

Financial services firms that aim to differentiate themselves from the competition should strive to collect the right behavioral, attitudinal, and value data about customers and apply analytics to match product campaigns with customer needs and value, according to Sandra Vela, a manager at Peppers & Rogers Group.

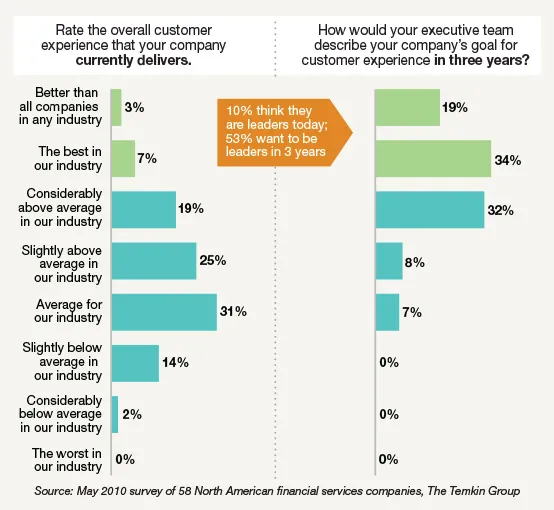

“If financial services firms want to excel at customer experience, they need to focus more on the needs of customers and less on their products,” adds Bruce Temkin, managing partner at The Temkin Group. This will require a different cultural approach within financial institutions. “Instead of pushing cross-sell strategies, they need to build true loyalty by earning the right to help customers with more of their financial needs,” Temkin says.

Paying a Premium

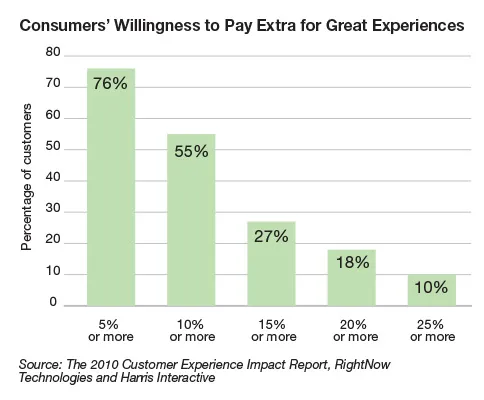

Each customer generates different value and potential to financial services firms. As such, banks and related companies should differentiate services based, in part, on customer value and needs. In fact, many customers expect and welcome differentiated service.

According to a recent study conducted by RightNow Technologies and Harris Interactive, 85 percent of consumers are willing to pay above the standard price for a product or service if they’re ensured a great experience. “If you have a Ferrari, you park it in a garage, you don’t leave it on the street,” Gogus says. “If a bank has a customer that generates $10,000 in annual business, you take extra care of them.”

Tying Data to the Customer Experience

There’s an old management adage: You can’t manage what you don’t measure. Unless financial services companies gather, analyze, and act on customer data to help identify the value, needs, and behaviors of segmented customer groups, they won’t be able to provide customers with optimal experiences. Nor will they be able to deliver the right support or the right products to the right customers. “Happy customers will reward companies with repeat business, greater cross-sell and upsell opportunities, and word-of-mouth recommendations to other high-value friends and family,” Gogus says.

Still, it’s important for decision-makers to take a broad view of what’s meant by customer experience and not focus solely on channel interactions or results from customer feedback. “Customer experience should be closely tied to the design principles in almost all components of the operating model, from people capabilities to process definitions, from performance management principles to channel investment decisions,” says Simge Alpargun, a manager at Peppers & Rogers Group.

Deriving Customer Insight and Needs

Financial services companies should endeavor to collect as much information from each customer interaction as possible—from segmentation characteristics to lifetime value to reasons for attrition, etc. This should be done not only to identify and segment customers by value, behavior, and needs, but also to provide financial services companies opportunities to conduct predictive modeling to create the right campaigns for customer segments, says Pepper & Rogers Group’s Vela. “It’s essential to gather customer feedback to continuously monitor and respond to customers’ needs,” Vela says.

Tying Value Propositions to Customer Needs and Behaviors

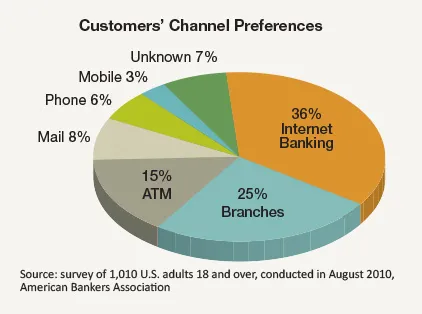

As retail banking customers continue to migrate from traditional branch banking to alternative channels such as online, voice, and mobile, many banks have failed to identify why customers prefer specific channels for certain transactions, Alpargun says. “As part of their efforts to better understand behavioral drivers, banks must evaluate customers’ readiness to use various channels for different purposes,” he says. In addition, channel investments should be accompanied by a business case that clearly states the cost benefits of various channels, assesses and prioritizes the various migration planning options available, and considers the optimal pricing and bundling options based on customer needs and preferences.

Delivering the Goods

Providing customers with consistently positive experiences will help engender trust, says Don Peppers, founding partner, Peppers & Rogers Group. In turn, trust will help fuel increased loyalty and a propensity for customers to conduct additional business with their preferred financial services company.

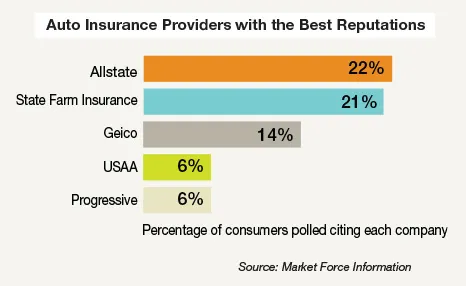

A recent survey of 2,800 U.S. consumers conducted by Market Force Information, for example, listed top auto insurers based on their reputations. The study found that a key driver in customer satisfaction among automotive insurance companies is their competence in processing customer claims.

It’s a Matter of Trust

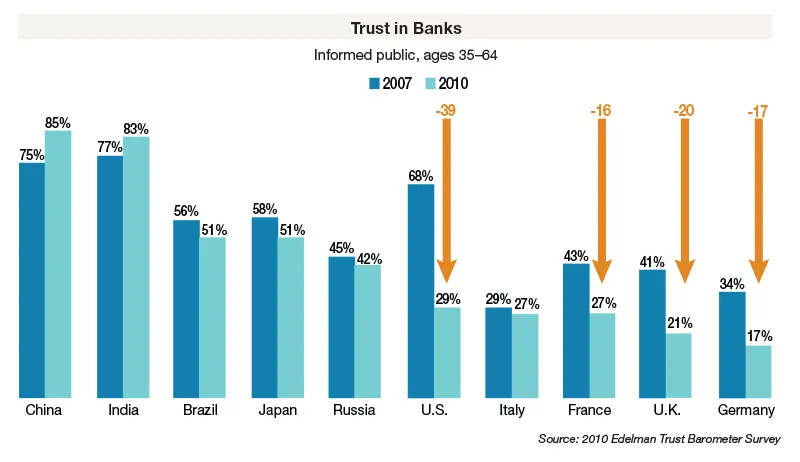

A major impediment to growth in financial services is the serious erosion of customers’ trust since the mortgage and credit crisis began in 2007. In order to regain customers’ trust, banks and other financial services companies need to demonstrate that their intentions are in customers’ best interests and that they’re competent at carrying out what they promise to customers.

Planning for the Future

“Although financial services companies are upping their investments in newer channels, such as online and mobile, they often fail to fully examine and draw upon the unique capabilities and strengths offered by each channel,” says Dietrich Chen, a director at Peppers & Rogers Group.

“Banks that are trying to imitate the branch experience on the Web are missing the main point,” he says. “Instead of attempting to replicate the branch experience, they should be looking at how each channel can deliver differentiated experiences and meet the specific needs of distinctive customer segments.”

For instance, Chen points to the convenience of a mobile iPhone application that J.P. Morgan Chase provides its customers that allows them to make check deposits right from their handsets instead of forcing them to stop at an ATM. “That’s a really innovative use of technology, which enhances the customer experience,” Chen says.

Distinguishing Channel Preference

One way financial services companies can meet customers’ channel preferences is to personalize customer experiences based on regional preferences, according to Chen. For instance, Chen explains that while most U.S. customers prefer banking online, consumers in places such as Latin America and parts of the Middle East prefer branch banking to other channels. And Eryilmaz adds, “Some banks, such as HSBC, have improved queue management at branches by evaluating how specific customer groups use different services in the branch environment and have taken steps to streamline services and reduce customer wait times.”

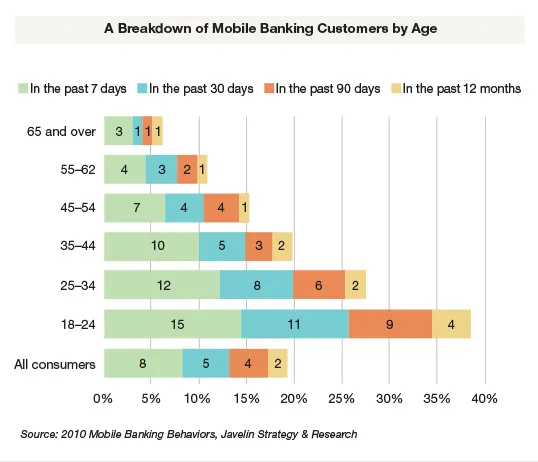

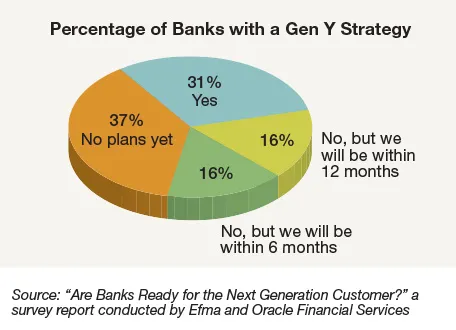

Demographics Drive Adoption

According to a recent survey by Intuit, more than one third of Americans are now managing their finances using online tools provided by financial institutions. The use of online and mobile financial management tools by younger consumers is even higher than that of other audiences. “It’s critical for financial institutions to play to the strengths of their customer demographics,” Gogus says. For instance, according to industry research, a high percentage of Gen Y banking customers use their mobile phones to check balances and conduct transactions.

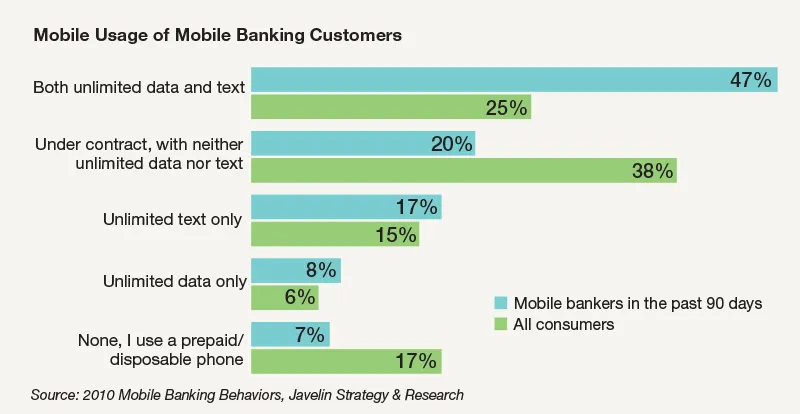

Understanding Mobile Preferences

The increasing use of unlimited data and text plans by mobile customers is helping to fuel the use of mobile banking applications. Still, it’s important for bankers to identify and act on customers’ mobile preferences. For instance, according to recent research by Orange, 70 percent of mobile users in the U.K. favor using browsers versus applications to access content. Knowing how their customers prefer to use different channels can help financial services companies to create optimal customer experiences.

Understanding Mobile Preferences

Targeting affluent financial services prospects is important, but it shouldn’t be an end game. Savvy business leaders are targeting upwardly mobile Gen Y consumers (18–30-year-olds) as their incomes and investment needs continue to expand. By 2018 their aggregate income is expected to reach $3.39 trillion in the U.S., surpassing the collective income for Baby Boomers.

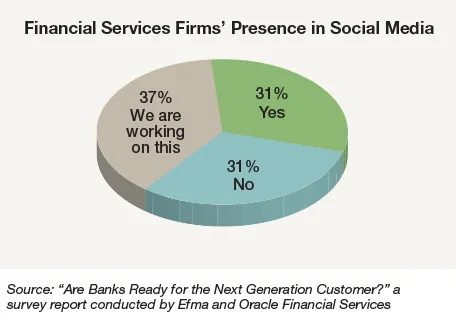

Social CRM in Financial Services

Social CRM provides financial services companies with prime opportunities to listen, monitor, and respond to customer service issues quickly, personally, and cost-effectively, Peppers explains. Companies such as Fidelity, American Express, and Charles Schwab use their Twitter accounts to address customer problems.