Loyalty. AI. Omnichannel. That’s the trifecta for the banking and financial services universe heading into 2025.

It’s on these three fronts that the industry stands to make the greatest leaps to improve the customer journey and thrive in an increasingly competitive environment. In TTEC’s new strategy guide, “CX Trends 2025: 5 ways customer experience ushers in a new era,” we explore the evolving CX landscape, emerging technology, and the growing role of data and insights to inform strategy in 2025.

The linchpin of loyalty

Every industry has confronted the customer loyalty stakes in their own ways, at different times, with wildly different outcomes. Think Starbucks rewards, Amazon Prime free shipping, Sephora’s Beauty Insider, and Virgin Atlantic, which offers a flight into space for customers who’ve amassed 2 million rewards points.

It is a world where 17,000 Bank of America points could earn you a command performance from an Elvis impersonator and 5,000 Chase points could be redeemed to attend a screening of Mad Men with the TV show’s cast. Inventive? Yes. But that was more than a decade ago and today, banking and financial services organizations know that the next frontier is mastering customer loyalty.

That’s because the game keeps changing. Retaining customers long term will be harder in 2025 because people are better informed about their options, new market entrants offer enticing value propositions, and the Consumer Financial Protection Bureau’s latest rule approved in October makes it easier than ever for customers to say “Bye” before defecting to the competition.

The new CFPB rule facilitates transfer of personal financial information from one institution to another, at no cost to consumers who request it.

“Too many Americans are stuck in financial products with lousy rates and service,” said CFPB Director Rohit Chopra. “Today’s action will give people more power to get better rates and service on bank accounts, credit cards, and more.”

Banks have always been aware of customer churn, but never fully able to address it. Given the newfound ease of switching and the level of competition, it’s a new game. There’s a lot of focus on loyalty now and I see it increasing in the months to come.

To win loyalty, strategy needs to focus on service and other dimensions to differentiate a company. How we talk to customers matters. Ethos matters. Some 77% of consumers are motivated to buy from companies committed to making the world a better place. Consumers want the businesses they patronize to be forthcoming about their values and priorities.

Consider PNC’s “brilliantly boring” marketing campaign. This is super smart because it connects with customers by distancing itself from all the drama of the banking crisis a couple years ago to say: “Let’s make banking boring … so you can be un-boring in life.”

AI, the heromaker

When AI assists humans in the workplace, they become better at what they do. Unburdened by manual steps like retrieving information, contact center associates can instead focus on the unique needs and intents of the person whom they are assisting. Less reliant on scripts, associates connect on a deeper level because they are able listen more actively and personalize the interaction.

In 2025, banks and financial institutions will experiment further to integrate AI into the contact center and the entire CX ecosystem. Banks have not done this very well in the past so there’s a real opportunity here to up their game. Instead of siloed teams and processes for mortgage accounts, credit card holders, and checking accounts, AI can bring all the data together so banks can reap the benefits of a single view of the customer.

The vast majority, 72%, of CX leaders expect AI agents to be an extension of their brand’s identity, reflecting its values and voice, according to ZenDesk.

Omnichannel, yeah … and still

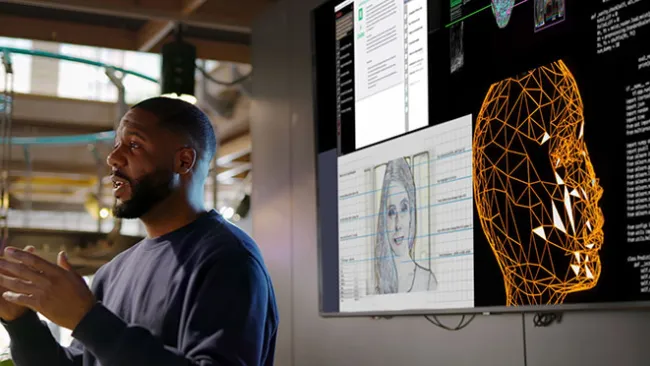

Data’s role in CX is only going to grow more crucial, so it’s essential you have systems in place that allow data to flow seamlessly between brands and customers across all channels. Contact centers traditionally tend to be very segmented, especially in the banking space and across product families. But in 2025, thanks to a concerted effort by many institutions and investments in technology, those siloes will break down.

Insights will become even more powerful. AI will be extremely accurate at predicting the best methods for resolving customer issues based on behavior and sentiment, so brands should prepare to embrace an increasingly channel-less and omni-modal approach. Real-time data, the right AI tools to analyze it, and experts who can put those insights to work, will be foundational to CX success in 2025.

While omnichannel insights mattered in 2024, they will matter even more in 2025 because:

- 75% of customers expect a consistent experience regardless of which channel they interact with a brand

- 77% of strong omnichannel companies store customer data across channels

In TTEC’s new strategy guide, we identify top forces CX leaders face in the year ahead across banking, financial services, and all industries. The guide highlights opportunities to elevate CX and contains a few prognostications. Download the “CX Trends 2025” here.