Customer-centric companies have long understood the need to manage their customer portfolio, rather than just their portfolio of products or services. These firms know that the customer portfolio must be the fundamental factor guiding how a company is organized, what it manages, and what it measures.

A segmentation strategy provides companies with the insight they need to manage their businesses profitably and with a customer focus. Segmentation delivers that insight by subdividing a customer portfolio into multiple categories, based on such attributes as behaviors, value, and needs. Additionally, segmentation asks questions to identify such groups as the highest revenue-generating customers, value-destroyers, which consumers should be targeted for acquisition, and who should be earmarked for cross-selling. This, in turn, enables organizations to better address customers' needs and requirements, as well as predict customers' future behavior, including the likelihood of churn.

Companies benefit in many other ways from segmentation. On a strategic level, it gives them the knowledge to revise their core business direction. They can use segmentation, for example, to determine which markets to enter or exit. Segmentation also helps with decisions on such issues as the optimal organizational structure and what budget to allocate for a particular business initiative. At a more tactical level it can help fuel decisions on what campaigns to execute, what products to offer, which channels to innovate, and what services to introduce. Market segmentation, where the focus is on the total market rather than the company's consumer portfolio, provides customer acquisition–related insights.

Segmentation methodologies that focus on behavior, life stage, and needs help companies identify the characteristics of a product, service, or channel that appeal to specific customer groups. Moreover, looking at consumers' needs and behaviors without a specific product, service, or channel in mind can lead to innovative ideas that can help to meet those needs.

Ultimately, segmentation provides companies with insight into actionable consumer segments, along with the best ways to meet their needs and increase their value. However, to maximize the benefits of segmentation, companies need to understand their customers from multiple dimensions: demographics, life stage, financial contribution, potential value, profitability figures, behaviors, and needs. An ideal customer segmentation strategy should consider all these dimensions in order to provide a holistic view of the consumer.

But all these dimensions should not be embedded in the same segmentation model. We prefer a more compartmentalized method, with dimensions that provide related insight, for example combining financial contributions and potential value within one model. Thus, the same customer will be in various segments used for different models, all interrelated and complementing each other. A multidimensional segmentation strategy is far better than a single-dimensional approach as it gives the company the option of following customers' trends in different areas through different segmentation methodologies.

Implementing a segmentation strategy

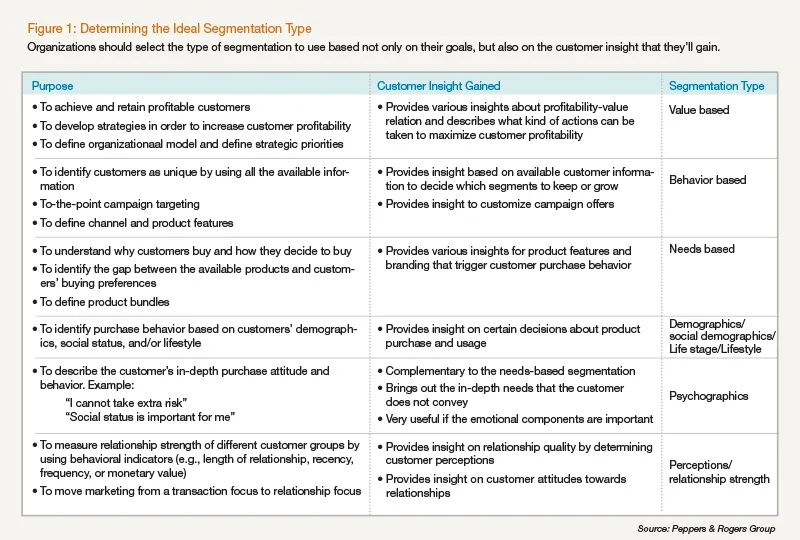

The first step towards a successful segmentation strategy is to determine a company's expectations and objectives (see Figure 1). Different usage expectations require different segmentation methodologies. Strategic objectives, including revisions of core business direction, organizational structure changes, and financial planning initiatives, require more stable and strategic segmentation methodologies. On the other hand, more tactical objectives, including product and service developments and marketing actions, require more frequently revised and detailed segmentation methodologies.

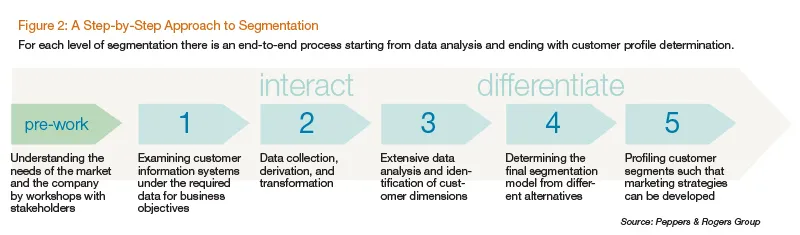

Once the expectations and objectives are clarified, we suggest starting to plan the data environment for the segmentation methodology; each method requires a different set of information. Strategic segmentation requires a long history of financial consumer data, looking at what products or services the consumer purchased, how much was spent, and for how long. Marketing-focused segmentations—such as behavior, needs, and lifestyle—require a more detailed set of customer data, such as what products or services the customer uses, the motives behind this use, the customer's response to campaigns, complaint data, and customer's perception of the brand. Most of the time companies already have the required data, usually housed in siloed systems. So the next step is to complete this dataset by integrating information from the different sources and generating an analytical data mart to use for segmentation. Then use data mining tools to devise the segmentation model (see Figure 2).

We advise that companies use not only a segmentation framework, but also take specific actions to adopt it throughout the organization. Once companies show a willingness to apply segmentation across functional areas and put required procedures in place, the financial impacts are observable within a short period of time.

Additionally, organizations must keep their segments up to date. Segmentation is a continuous process that should be repeated periodically, allowing companies to keep track of segment trends and changes, identify which segments are likely to grow, and treat different segments differently based on their needs at a given time.

Added insight and growth potential

Once a segmentation framework is in place companies will gain new insight into their customers' value and potential value. For example, in every customer portfolio there is a group that does not generate financial value. It is critical to identify this group and then decide on the best strategy for handling these customers. Segmentation not only clearly identifies lower-value consumers, but also tracks their changes.

Our recommendation is to not ignore the lower-value segments, but rather to optimize the company's resources to match customer value and improve the bottom line. Using a multidimensional segmentation framework allows companies to decide on the optimum allocation of resources, including not wasting scarce and expensive resources on lower-value segments.

Furthermore, it helps companies to identify ways to improve the value-generation capacity of those lower-value segments. This is when multidimensional segmentation becomes critical because it provides companies with a deeper understanding of the behaviors, life stages, and needs of lower-value consumers and enables the development of new, less costly products, services, and channels that match these criteria. Thus, companies can increase the financial value generated from this segment.

A methodology that considers the potential value of the consumer, as well as the current and past financial value—like multidimensional segmentation does—will uncover customer segments that fall short of generating financial value today and in the future, as well as segments that have the most future potential.

Although the ultimate aim is to maximize profitability, segmentation does not need to be based solely on profitability. In fact, we don't directly use profitability as a metric in segmentation models we create. Instead, we base our segmentation and segments using a top-line perspective, while providing a close link to profitability. This approach gives companies the option of measuring, forecasting, and tracking profitability while maximizing the value of each customer through a multidimensional segmentation methodology.