Many banks, even those with highly advanced customer-centric strategies, are throwing money away and ruining their customer experiences by miscalculating a vital, yet often overlooked equation: customer focus plus rightsizing the staff of individual branches equals profitability.

Each branch is its own entity, yet many banks use one-size-fits-all strategies when it comes to staffing. Or, worse, they look at one or two metrics to decide staffing. Banks can't sacrifice their financial stability for customer centricity, nor can they sacrifice the customer experience to keep costs down. Ultimately, the decision of how to staff each branch requires a balance of meeting customer experience expectations while considering costs and operations.

How many tellers?

Though alternative delivery channels such as contact centers, online, and mobile show promise among financial services institutions, the branch is still the most dominant and impactful channel for the origination of relationships, customer experience, and sales. Most customer moments of truth take place in the branches, such as waiting for service at the teller windows or asking for advice from sales consultants. However, the branch channel can also be the most expensive when it comes to serving customers.

"How many tellers do we need at each branch?" It's one of the most important questions a bank needs to answer. Common wisdom says to staff by the size of the branch or follow the competition's lead. But every bank is different. Their unique attributes must be considered.

The decision of how many tellers to employ at any time should be informed by the workload of the branch and the customer segments that create this workload. This is a very bank-specific decision and it should be based on the bank's own dynamics and strategies. For example, some banks may intentionally choose to have less-than-optimal staffing in the branches to encourage customer migration to lower-cost channels. Other banks may choose to exploit the advantage of a large branch network by using it as the main contact point with the optimal number of tellers.

Peppers & Rogers Group has developed a strategic framework to address this issue and designed an analytical model to calculate the optimum staffing levels for banks. We call it effective capacity planning.

Analytics reveal optimal staffing levels

Effective capacity planning is a methodology that financial institutions can use to determine the staffing levels within a wide network that produce various business objectives while retaining customer-centricity (e.g., optimal wait times based on customer value). It's composed of simulation models and optimization tools.

With the right capacity planning, banks can distribute their resources optimally, ensuring that different positions like tellers, sales reps, and portfolio managers manage the right amount of customers and handle the required number of transactions. Banks can also measure customer wait times and teller transaction times to identify improvement opportunities. This leads to healthier targets and employee performance programs by including customer metrics. In addition, cross-sell ratios and related income will increase as operational personnel find time for sales activities.

No matter the individual situation of the bank, each can break down its effective capacity planning into four steps:

- Prepare data

- Develop simulation models

- Execute current and target state simulation

- Develop a staffing-level optimization tool

The first step, where the data is prepared, is the basis of all bank customization. Here, data such as historical workload and customer waiting times data is considered.

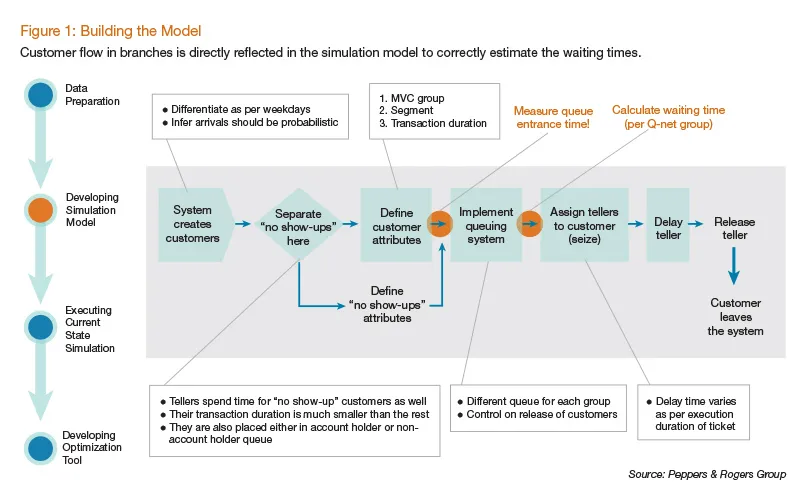

In the second step, a separate model is created per branch to mimic real-world scenarios. The model takes the branch setup (e.g., transaction data, queuing data, teller count) as input. For output, each model generates a detailed report with several parameters, such as average wait times, number of customers per segment, and number of transactions per type.

The third step is critical to evaluating the reliability of the simulation models. All the simulation models are run with the historical data.

Once the reliability of the simulation is ensured, optimization—the fourth step—can take place. The optimization tool runs the simulation models, checks the marginal benefit, reruns the simulation models, checks the updated marginal benefit, and stops when the marginal benefit is at the maximum. This is the optimum state.

1. Prepare data

Working with data can always be a challenge, and this first step of effective capacity planning is no different. Much of the necessary data may live in various data warehouses without common fields, making it difficult to integrate. Yet it's imperative to combine data from across disparate systems before creating rightsizing models. These databases will include the data related to customer groups, internal resources, and activity.

The project team, composed of business units such as human resources or business architecture, will first identify and verify the source data sets, then merge the various data sets and create common fields. The data must then be modeled per statistical distributions and formatted so it will be ready for the simulation and analytical models in future phases. This can be as simple as an Excel file, or as complicated as an advanced database.

It's possible to glean valuable insight even in this first step of the process. One bank we worked with determined that Monday was the busiest traffic day for in-branch activity after measuring "total number of screen records per weekday." With this information alone, the bank could improve the branch staffing level by analyzing just the most crowded day. As a result, the bank might decide to open some branches on weekends, or entice customers to visit the branch on less busy days by offering discounted transaction fees on those slower days.

2. Develop simulation models

Once the data has been prepared, it's time to put it into models that will help ascertain the ideal balance between the customer experience and efficient operations.

For rightsizing, the simulation model is the foundation. The goal of a simulation model is to develop a customized methodology to understand the internal dynamics of the branch system. It is designed to give reasonable responses to various actions that take place in real life. It also gives banks the ability to measure the impact of enhancements prior to implementation, and can predict outcomes of those decisions. And it is flexible and scalable enough to adjust to changing conditions. Additionally, it provides a visual representation of the data model to bank executives (see Figure 1).

All customer parameters except the control parameter, which is the average waiting time, should be included in the simulation model. The average daily customer visits to the branch (separately calculated by customer segment), the average number of transactions per transaction type and per teller, and the average number of man hours per teller are direct inputs to the simulation model.

Simulation models rely on specific business rules for each bank, and in some cases, each branch. Before implementing the simulation system, the organization must have a clear understanding of its current branch situation. Some questions to ask include:

- Which type of staff (tellers) are working in the branch?

- How many hours is the staff expected to work daily?

- Is there any extra mandatory workload for the staff (e.g., time-sensitive paperwork, loading ATM machines)?

- Is the branch manager authorized to increase or decrease the number of tellers dynamically within the same day?

- Is there any transaction that is not mentioned in job de-scriptions, but heavily performed within the same day?

In addition, be aware that simulation results will never match 100 percent with real-life measures, since there will be assumptions made for modeling the branch mechanism in simulation and all systems have exceptions and manual interventions. This should be communicated to stakeholders from day one.

3. Execute current and target state simulation

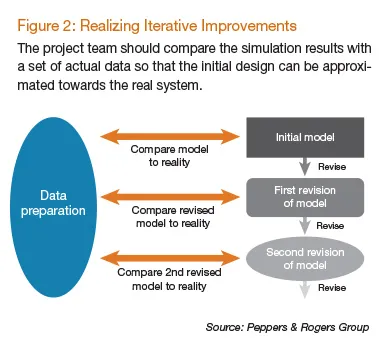

Models are effective, provided they are reliable. In this step, banks compare the simulation results with the actual data parameters to verify the model (see Figure 2). In addition, the project team can make adjustments to the model and verify any assumptions made in the simulation. Banks must also assess their current and future state of staffing in relation to the customer experience. It's in this phase that the team can identify gaps in realizing target state scenario simulations for a limited number of branches, and share the impact of these target state scenarios with stakeholders.

4. Develop a staffing-level optimization tool

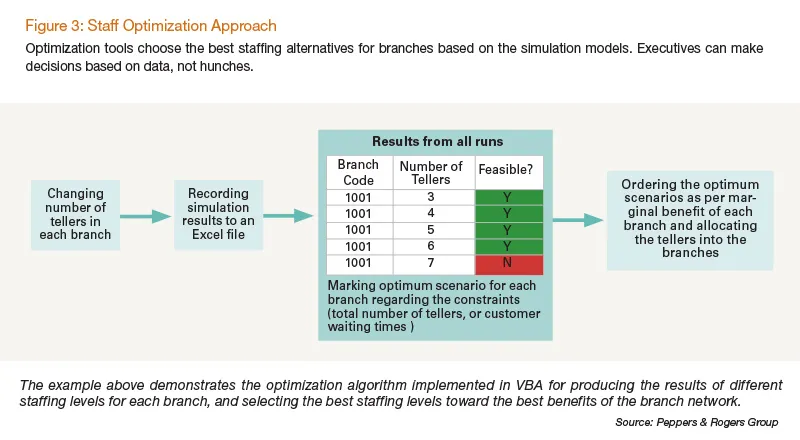

The last step in the methodology coordinates various simulation models via an automated optimization tool that can be run by business users. Optimization is the methodology used to uncover the best or most feasible available solution for a complex problem, given that there are considerable constraints and a well-defined objective function (see Figure 3).

The staffing-level optimization tool uses the simulation models to choose the best alternatives for all branches based on several network-wide constraints. Constraints may include the maximum number of tellers that can be employed at any branch, the minimum number of tellers that need to be employed at any branch, the maximum total number of tellers that is possible, and the maximum utilization rate per teller for any branch.

First, the company must identify specific optimization goals—for example, minimize staffing costs, maximize teller utilization, or minimize customer waiting time. Then, business rules must be set regarding related internal processes. For instance, there should be at least one teller in each branch, but the maximum number cannot exceed 14. Or no associate will work more than 25 hours per week.

Customer-specific constraints should not be overlooked. For example, the optimization tool can take as input the constraint of "not allowing a private customer to wait for more than 10 minutes at any branch for any transaction." Such customer service levels can be given as constraints to the optimization model and the tool will ensure that they are satisfied with the optimum solution.

Business implications

Staff rightsizing and optimization is important for branches, but it can be implemented in a multichannel environment, as well, such as the contact center, operations, and channels such as ATMs and Internet banking.

Rightsizing is not a case of measurement for measurement's sake. The outcome of the models sheds light on critical business questions that banking executives are challenged with every day. It deals with the complex problems of optimizing large-scale delivery channel networks and improving staffing levels.

It's a challenge to balance a customer-centric strategy with cost containment and efficiency. A comprehensive rightsizing plan based on data and models instead of hunches and guesses will drive decision-making in the right direction based on facts.