Welcome to our first installment of a new blog series covering fraud trends and fraud prevention in specific industries. This month, we tackle the issue of fraud in the iGaming sector, define the types of scams bad actors are trying, and discuss strategies iGaming businesses are employing to reduce fraud, and see if these strategies are working.

According to TransUnion’s 2024 State of Omnichannel Fraud Report, the gaming sector has the highest rate of suspected digital fraud in the United States, at 10.9%. That’s up 9% from the year prior.

iGaming — what does that mean?

iGaming is defined by any type of monetary betting activity conducted online or via mobile applications. It has seen explosive growth over the last three years, accelerated by the adoption of web and mobile sites, and the loosening of regulations.

There are two dominant segments in the iGaming space: Sports betting and online casinos. The industry is quickly diversifying into many other variants for online wagering but here we’ll focus on the largest two segments. According to Statista, online casinos have grown to $50 billion in revenue worldwide, and sports bettors to $39 billion in revenue worldwide, with a growth rate of 11.7% annually.

Fraud threats in iGaming

As iGaming customer adoption and growth expands globally, so does the scope and diversity of fraud schemes. Here is a short list of common schemes that threaten iGaming companies and their customers.

- Multiple account fraud, bonus fraud: Multiple account fraud happens when scammers create many fake accounts using made-up or stolen information. Often, they do this to collect welcome bonuses like free chips or credits that gaming sites offer to new players. With these free credits and multiple accounts, they can then cheat in several ways. They might bet on every possible outcome of a game to guarantee they win (“bet matching”). Or they might put several of their accounts at the same poker table to help one account win (“gnoming”). Or they might have one account lose on purpose to move money to another account (“chip dumping”). All these scams steal money from gaming sites and honest players.

- Affiliate fraud occurs when deceptive tactics are used to gain personal profit from affiliate marketing programs. Examples include using stolen data to generate fake sales, creating or hijacking domains that are similar to the brand of a company (“typosquatting”), and using adware to insert affiliate codes automatically. This can be a serious problem for iGaming platforms who use affiliate marketing to help attract new players to their sites.

- Account takeover fraud involves criminals hacking into accounts of legitimate players. Fraudsters typically change account passwords to lock out the real owner, then drain any stored funds or payment methods. Beyond immediate financial losses, these attacks erode player trust and platform security. Gaming operators increasingly combat this threat through machine learning-based detection techniques and stronger authentication measures, including biometric verification.

- Payment fraud hits gaming companies through two main tactics: stolen credit cards and mobile payment abuse. Criminals use stolen cards to buy gaming credits, leaving companies to deal with costly chargebacks. They also exploit mobile payment systems by using VPNs to access regional pricing discounts, or by tricking users into funding their accounts through top-ups. These schemes damage both company finances and reputation.

Fraud prevention techniques in iGaming

iGaming firms need to implement multi-layered prevention strategies to combat fraud. Verifying identities, analyzing behaviors, securing payments, conducting regular audits, and training staff are all part of this strategy. Examples include:

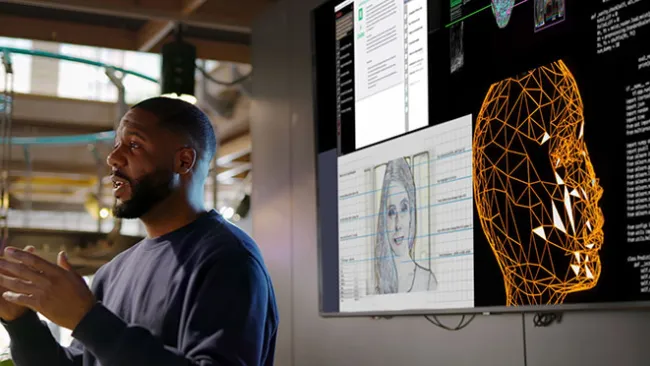

- AI and machine learning: Artificial intelligence tools help gaming platforms detect both fraud and problem gambling by analyzing player behavior patterns. Machine learning models continuously improve at spotting identity fraud and catching AI spoofing attempts and organized fraud rings. This technology enables platforms to verify players more accurately while protecting vulnerable users through early intervention.

- Liveness detection confirms a real person — not a photo or deepfake — is present during identity verification. Basic checks ask users to blink or smile, while advanced systems can verify liveness from a single selfie. This prevents fraudsters from bypassing biometric security with fake images or videos.

- Voice biometrics prevents iGaming companies from being attacked by synthetic voice systems calling their customer support teams to secure customer identities or account values. These systems validate the integrity of customer support calls and reduce the volume of fraud attacks that leverage phone channels of iGaming companies.

- Agent monitoring: iGaming companies with contact centers use fraud prevention that focuses on monitoring agent behavior for suspicious patterns. Key safeguards include recording all calls, tracking unusual account access, limiting agents’ ability to process loyalty points, payouts, or other sensitive transactions. Regular audits of agent activities help identify concerning patterns like frequent password resets, unusual timing of account changes, or clusters of suspicious transactions.

Balancing trust, transparency and customer experience

Gaming platforms face a critical balancing act: They must deliver seamless experiences to attract and retain players globally while defending against increasingly sophisticated fraud. Every friction point in authentication or payments risks frustrating legitimate players and reducing conversion rates. Yet insufficient security measures expose platforms to evolving threats like account takeovers, bonus abuse, and payment fraud that can devastate profitability and player trust.

The challenge intensifies with global operations. Platforms must navigate different regulatory requirements, payment systems, and fraud patterns across regions while maintaining consistent security. For example, strict transaction monitoring that makes sense for high-risk regions might unnecessarily burden players in stable markets. Success requires adaptive fraud prevention strategies that adjust based on risk signals, user behavior patterns, and regional context. The goal is finding the sweet spot where security measures protect the platform and good users without creating barriers that drive them to competitors.

iGaming companies partner with TTEC to help them safeguard their platforms, meet strict compliance requirements, protect customer experiences, and adapt to a rapidly changing market landscape with good and bad actors.