Businesses across every vertical — from retail to banking, healthcare to high tech and travel — might want to take a cue from fraudsters. In a word: Data.

Scammers have been very successful at account takeovers (up 56%) and chargebacks (up 78%) in the past year, thanks to the robust data sets they are exploiting. Business would do well to step up their game and expand how they source and mine data, according to two experts sharing fraud mitigation insights and strategies on the LinkedIn Live webinar, “Securing trust: Tackling digital payment fraud while elevating CX,” hosted by TTEC.

“When we ingest more robust information, our reporting gets to be more robust” and that leads to better insights and proactive decision-making by leadership, said Alexander Hall, trust and safety architect at AI-powered fraud platform Sift.

Rich, multidimensional data

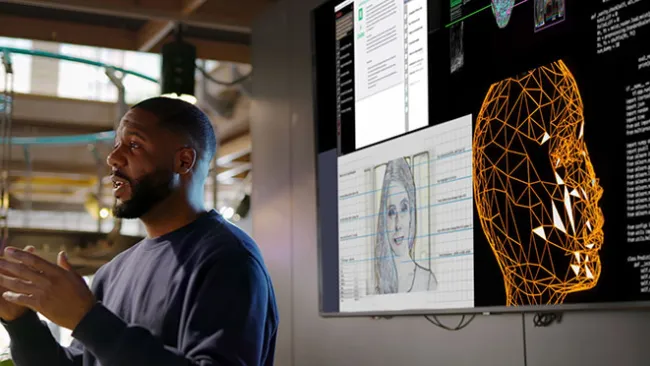

There is a fundamental evolution under way affecting how companies approach fraud mitigation, said Hall. AI and machine learning play a key role, but equally important is the ability to leverage richer data sets — from within and beyond an organization, across platforms, networks, and even “inferred” data to make predictions — all while leveraging human capacity to detect and interpret nuances in ways that machines just can’t.

Gone are the days of using rigid rules to prioritize case investigation, triangulating 10-15 signals, and spending weeks to review, escalate, and respond to suspected fraud, said Philip Say, vice president, solutions and product management, TTEC.

“Now, one individual can process 20,000 signals almost instantaneously, triangulated against many factors, to produce a real-time rule score that’s transparent to upper levels of management,” he said. “It’s just night and day. We’ve gone lightspeed ahead with these types of capabilities.”

Context key for the right outcomes

The crux of the challenge, Say added, is balance: How to introduce fraud techniques without adding friction that harms the experience and alienates customers. It’s here that context comes into play.

“Humans are really great at determining context over machines. We have a great ability to identify anomalies,” he explained. “Machine learning can repeat the recognition of those anomalies but they are not really good at understanding context.”

For example, a human can understand that some high-value customers travel across the globe with great frequency and their patterns of transactions, while analogous, are if fact, legitimate, whereas an algorithm might generate false positives that flag these same transactions as suspected fraud.

“Good leaders, good managers can understand and can coach their teams to recognize these nuances,” Say said. “All these AI and ML tools can help our productivity, but we need to balance that with operational discipline and experience.”

Hall agreed: “There’s always going to be a human element to fraud prevention, no matter how much automation there is, no matter how much technology we’re leveraging.”

Say added that some executives view fraud management as a “set it and forget it” proposition, when in fact, the opposite is true: “The good news is you can get a lot of leverage from a very small team — but that team has to be empowered to do the right things.

“It’s no longer task-oriented style of work but more high-level decisioning, pattern recognition, interpretation, and anticipating where the business is growing and evolving. The good news is the industry has caught up, but the organizational models have to catch up, as well.”

Validate, verify, identify

Whenever rolling out something new — a digital form for customers to complete, a new buy-now-pay-later payment option, or a new app — anticipate that fraudsters will discover and target these customer-facing touchpoints.

Hall said it’s essential to validate newly created accounts, but that’s not enough. It’s crucial to go further, to verify that account creators are whom they claim to be. This is where device intelligence uses geolocation to flag suspicious activity, synthetic credentials, and bots used in account takeovers (ATOs).

Next: Identify, he said.

Companies need to analyze how users interact with their platforms to identify and understand what constitutes behavior of legitimate customers versus fraudulent behavior. This third step to identify good and bad behavior is what enables leaders to make informed decisions about workflows for handling activity that sends up a yellow, orange, or red flag.

“There’s a saying in fraud prevention that goes, ‘If you haven’t seen it, you haven’t seen it…yet,’ ” Hall said. “If a particular platform hasn’t seen it yet, the platform up the street has.” That’s the value of expanding data analysis beyond just transactions and accounts.

“We’re seeing social engineering of the consumer, of the platform, and employees of the platform pick up,” he said.

“We’re seeing all these very different, very expansive fraud methods taking off across the network. By plugging into cross-platform, data-sharing networks, we’re going to be able to proactively see [a threat] before it hits our platform. There’s tremendous value in sharing data across platforms.”

For more color and commentary from Hall and Say, watch the full event on-demand, “Securing trust: Tackling digital payment fraud while elevating CX.”