With 2025 fast approaching, businesses are doubling down on their commitment to combat fraud. Growing complexity and volume of threats are leading many organizations to prioritize robust fraud prevention strategies to stay ahead.

The focus is clear: Leverage a powerful combination of advanced technology and skilled teams to address challenges like policy abuse, refund fraud, first-party misuse, account takeover (ATO), chargebacks, identity theft, and card-not-present fraud. The goal is not just prevention, but also meaningful reduction of these costly risks.

A recent survey of financial chief risk officers found that 44% considered fraud a top-tier risk for 2025, behind only cybersecurity. To fight back, the average merchant now deploys five fraud detection and prevention tools, including AI, ML models, and risk scoring, according to the Merchant Risk Council.

Tools aside, who within the organization actually owns “fraud?” Is it customer support's problem? Or product? Or finance? Or risk management? The answer: It’s all of them.

In our work with clients, however, we’ve seen many companies conditioned to operate in narrow silos. Without a big picture view of fraud across the business, it’s easy to miss root causes or obvious areas to fix.

Most firms have a fraud operations team, but they often suffer from working in a silo. This reduces the impact and could lead to redundant or even conflicting fraud prevention activity.

Meanwhile, everyone has a stake in solving the problem. Fraud in 2025 is predicted to cost merchants and others over $200 billion. Companies that dissolve silos around fraud prevention will be in a better place to lower this risk in 2025 and beyond. When fraud challenges are everyone's mandate – product, support, operations, C-suite – it leads to better results.

3 ways to optimize fraud prevention

1. Start at the top, with intelligence and clear metrics. What's needed is an executive mandate for every organization to focus on how their systems or processes could be susceptible to fraud. There needs to be intelligence and metrics that transcend the fraud ops team and are visible to all teams in a company.

2. Have a fraud mindset. Businesses need to accept that there are bad actors in the marketplace. Most decisions and processes only presume good and fair actors. Unfortunately, it's not the case. Recommend viewing the marketplace with a Pareto-type 80/20 rule of good to bad actors.

3. Pair the mandate for CX and fraud. Often these are treated as separate and different mandates. They are not. They are part of the same mandate to improve customer confidence and customer data protection.

CX trend: Break data insight barriers to fight fraud

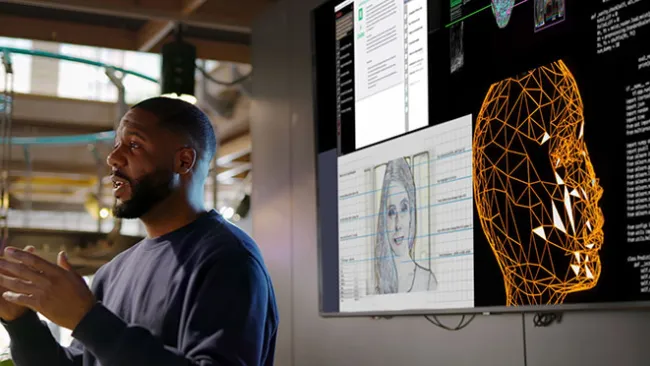

Without a solid, integrated data strategy, holistic fraud prevention will be impossible. That’s one of the reasons why we predict 2025 will be a year when companies get serious about connecting data and systems around their organization. It’s one of TTEC’s 5 CX trends for 2025 in our annual trends report.

As data’s role in fraud prevention and customer experience becomes more strategic, it’s essential to have systems in place that allow data to flow securely and seamlessly internally and externally between brands and customers across all channels. Contact centers traditionally tend to be very segmented, but in 2025 watch silos of all kinds break down.

Other CX trends that influence fraud prevention include the rise of AI agents for self-service and associate support, a CX workforce that is more technical and highly skilled, expansion of CX operations around the globe, and a deeper understanding of customers for maximum value creation.

Get the full report to prepare yourself for a great 2025.