Banks around the world face a number of serious challenges: financial volatility, debt crises, emerging customer markets, increased customer expectations, and regulatory changes, to name a few. To tackle these complex internal and external obstacles, many retail banks are increasing their customer focus.

Peppers & Rogers Group partnered with the European Financial Marketing Association (Efma) to examine the prevalence of customer centricity among retail banks in Europe, the Middle East, and Africa. The study generated insights from more than 70 banks in 38 countries. The research found that banks are embracing basic customer-centric activities, but there is still a long way to go to fully optimize customer relationships and financial value potential.

The current state of retail banking

The current state of the banking industry is not very rosy. Of those surveyed, 43 percent said customer trust in the industry decreased from 2011 to 2012, while only 27 percent said it increased. The market is slowly recovering from the global recession, though many consumers still feel the pain. The trust simply isn't there, and for some consumers it's eroding rather than growing.

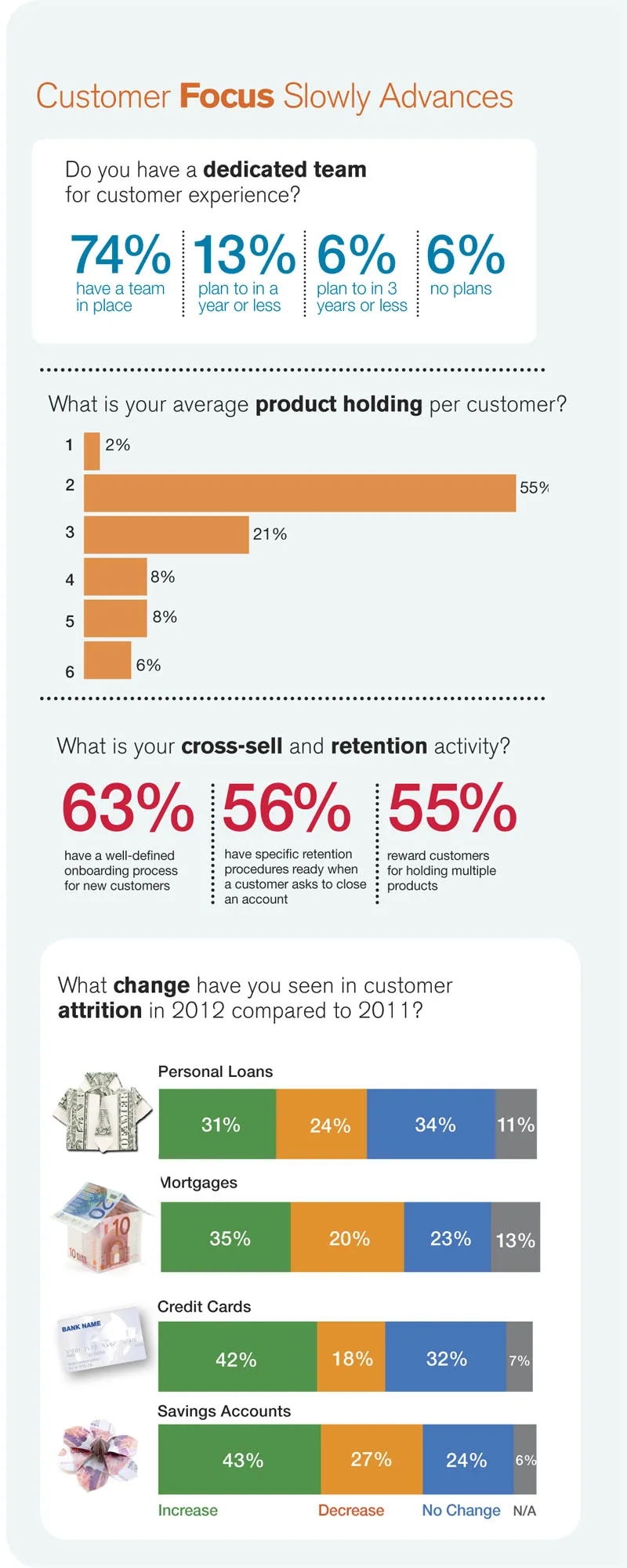

As a result, customer attrition is still a top concern for banks. More than 30 percent of respondents indicated that their customer attrition levels have increased in the past year for products such as credit cards, personal loans, and savings accounts. And while a majority of banks (55 percent) report that their customers hold two products, there is tremendous opportunity to further grow share of wallet with more strategic customer interactions. Only 63 percent of those surveyed have a well-defined customer onboarding process, and only 56 percent have a retention plan in place if a customer asks to close an account. A large percentage of banks are missing out on easy ways to build relationship strength with customers.

And while customer-focused culture is often discussed as a top priority, even today nearly one in four banks reported that they do not have a dedicated team in place to focus on the customer experience.

Socializing bank channel strategy

Optimizing channels is on the top of nearly every customer executive's to-do list. Banks are looking to innovate, particularly with emerging non-branch channels like mobile apps and self-service kiosks. But respondents still consider the branch the apex of the customer experience ecosystem. When asked to rank their interaction channels by customer satisfaction scores, respondents rated the branches highest, followed by online, contact centers, and mobile, respectively.

As part of their efforts to better understand behavioral drivers, banks must evaluate customers' readiness to use various channels for different purposes. In addition, channel investments should be accompanied by a business case that clearly states the cost benefits of various channels, assesses and prioritizes the various migration options availalbe, and considers the optimal pricing and bundling options based on customer needs and preferences. Consumers will consider a customer experience to be excellent when the delivery of products, services, and communication is seamles, regardless of whether it occurs in one channel or multiple ones.

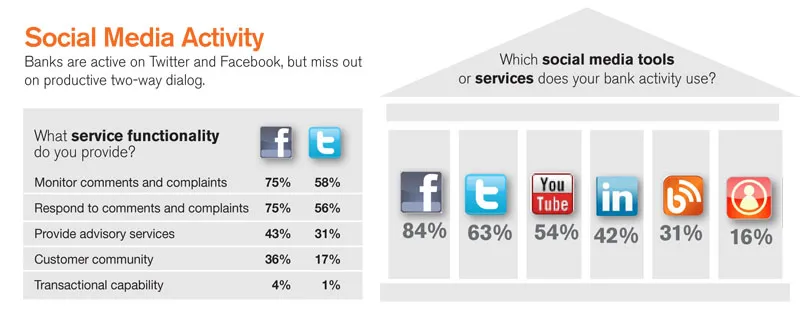

The research delved into banks' usage of social media, for example. A growing number of banks have extended their use of social channels throughout their sales, marketing, and customer service efforts, but still few banks actively use social media as a strategic channel. There is substantial room for many banks to improve how they use social media, especially for social channels other than Facebook.

Even among banks now actively using social media, most of the communication is one-way: either the bank blasts promotional messages, or consumers submit feedback—most often complaints—on places like Facebook and Twitter. It's good to be where your customers are, but not enough banks leverage the benefits of direct customer interactions. Nearly one-third of respondents indicated they do not have any social media tools for customer service.

The challenge is that most banks have not formalized their social media strategy. And for banks that do have formal social media programs, the research finds that social media efforts are predominantly managed by marketing and communication departments, without alignment to other parts of the business. Succesful customer-centric banks not only collect deeper levels of insight via social channels, they also map the insight to their overall customer interaction strategies across the organization.

When it comes to service functionality in social media, respondents mostly monitor customer comments and complaints or respond to customers on Facebook and Twitter. However, only a very few do anything more, such as providing advisory services, payments, or internal customer communities. Additionally, although Twitter has proven to be an effective channel for resolving customer issues, it is used nearly by half, and still less than Facebook (see Social Media Activity chart).

Still, many banks overlook opportunities to leverage their connections with customers on social networks to develop deeper, more meaningful relationships. For example, a majority of banks that do not have current capabilities do plan to use social media in the next three years.

In addition to social networking capabilities, the research shows that there exists substantial room for most banks to improve their crowdsourcing activities to get direct customer input into new products and services. Only 28 percent of respondents use crowdsourcing initiatives, and those banks rated the effectiveness of their initiative on average at only 3.3 out of 7.

The struggle to activate data through analytics

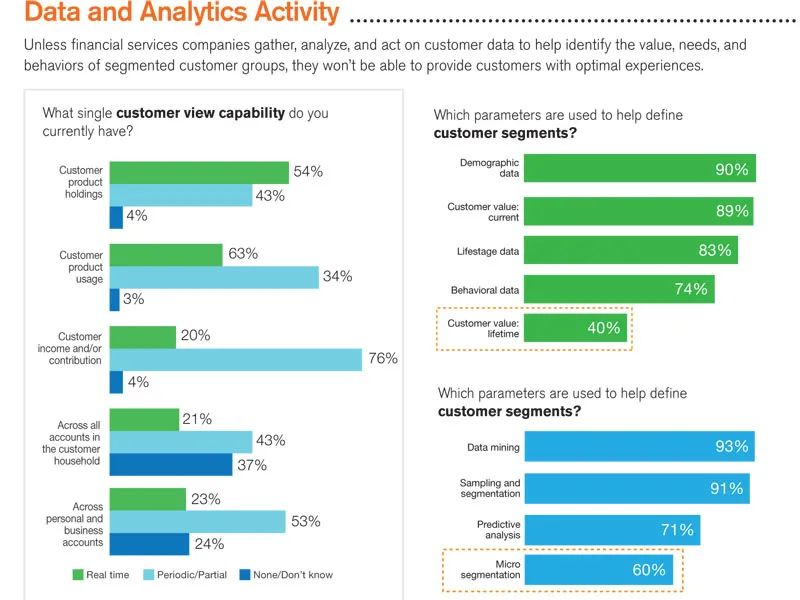

Unless financial services companies gather, analyze, and act on customer data to help identify the value, needs, and behaviors of segmented customer groups, they won't be able to provide customers with optimal experiences.

Financial services firms often have knowledge about customers at an asset level or at an account level, but there's limited effort made by them to understand customer needs, behaviors, and expectations. Once firms gain that understanding, they can move through stages such as creating and delivering differentiated customer experiences, and aligning business models with customer segments.

Some customer-centric banks are using data, next-generation analytics, and adaptive engagement strategies to communicate with customers on their terms, across a variety of channels (see Akbank sidebar). However, more than 25 percent of survey respondents reported that they do not have a dedicated organization for customer analytics.

Using Big Data to make information accessible is a challenge for many marketers, but is gaining traction as a way to achieve customer-centric outcomes. Much of today's customer information is in the form of unstructured data: customer service call recordings and online chat, open-ended survey responses, images, videos, emails, tweets, etc. There is so much unstructured data out there now that any reasonable company has to be prepared to apply more and more sophisticated analytical tools to make sense of it.

Financial firms struggle to effectively use customer data to increase engagement, relevance, and personalize marketing communications. The research reveals that 64 percent of respondents do not use real-time event management in marketing communications. In parallel, more than half of respondents do not have a structured process for delivering one-to-one personalization in marketing communications.

To reach the potential of real-time engagement, banks must first assess their customer data management maturity. According to the research, banks rated their single customer view capability on average at 4.4 on a scale of 1 to 7. For example, only half of the banks surveyed indicated that they have single customer view for customer product holdings in real time. For the other KPIs such as customer product usage, a relatively small minority of respondents have this capability. However, those without this capability plan to enable it by 2017.

Uncovering new value propositions

Customer-centric banks have long understood the need to manage their overall customer portfolio, rather than just their portfolio of products or services. These banks know that aligning around customers must be the fundamental factor guiding how a company is organized, what it manages, and what it measures.

According to the research, lifetime customer value is used by only 40 percent of respondents in their segmentation strategies. In addition, though a majority of respondents (89 percent) indicated that there is a trend toward further segmentation, 40 percent do not use micro segmentation.

Multidimensional segmentation provides companies with insight into actionable consumer segments, along with the best ways to meet their needs and increase their value. In order to maximize the benefits of segmentation, companies need to understand their customers from multiple dimensions: demographics, life stage, financial contribution, potential value, profitability figures, behaviors, and needs. An ideal customer segmentation strategy should consider all these dimensions in order to provide a holistic view of the consumer.

Banks lack measurement activities

The research revealed significant opportunties for banks to broaden their use of customer experience with a wider range of business performance measurements. Nearly half the respondents indicated that their organization does not have any customer experience metrics in place, but more than half do plan to in the next three years.

It may be difficult to draw direct connections between customer-centric programs and specific metrics such as revenue, but there are ways to measure some of the aggregate results that customer experiences influence. This impact can be measured through a number of indicators, including traditional KPIs such as positive ROI, profitability, and customer-centric KPIs such as improved Return on Customer, and increases in customer acquisition, retention, and referrals. Forrester Research has also examined years of data to confirm strong correlations between customer experience and loyalty measurements like willingness to repurchase, retention rates, and referrals.

Of KPIs being used by banks to measure customer experience, Net Promoter Score is a favorite. It represents a well-adopted measurement that has a dramatic impact on both the top and bottom lines of companies, which translates into share price.

Any NPS study should be planned to produce specific business cases and action items for different types of customers in different segments, channels, business units, etc. Also, further steps like embedding NPS into employee performance should be discussed in advance. Research shows that 69 percent of respondents measured Net Promoter Score. A majority (76 percent) of a bank's NPS calculations are made at the business unit level, following branch and region level.

Challenges remain

Financial companies are more challenged than ever with becoming truly customer-centric and gaining the trust of their customers. Transforming an organization into a truly customer-centric entity is not an easy task that happens overnight. However, organizations that invest in the right organization, processes, and technology are able to become more client-focused, using this strategy as a differentiator in a cutthorat environment.

Yet one of the biggest challenges for banks implementing customer-centric strategies is that many financial benefits are long term. However, the connection between customer centricity and economic strength is no coincidence. If a customer has a great experience today, it will likely increase her satisfaction and loyalty to a company. She may even rave about the experience to her friends, family, and social connections. But any direct financial benefits from this customer or incremental revenues from her recommendations will likely occur at a future date.

Still it may be difficult to draw direct connections between customer-focused initiatives and specific metrics such as revenue, but there are ways to measure some of the aggregate results that customer experiences influence. Establishing a business case and key performance indicator (KPI) targets in the beginning of a customer-centric program is critical to having standards to measure against along the way.

Banks that use customer data to draw correlations between customer-centric initiatives and business performance have an opportunity to become more efficient and to accelerate their business beyond their competitors. Nevertheless, many organizations have struggled to connect the quality of a customer experience with business performance, including increases in shareholder value, largely because, until recently, the technological and analytical capabilities to do so haven't been available. Those that can make these correlations are also able to cost justify resource allocations aimed at improving the customer experience.

Conclusion

Customers now hold the power in their relationships with banks. This newly empowered customer base makes for an uncertain future for many banks, which have been primarily focused inward.

Banks can increase the profitability of their retail businesses by balancing their customers' needs and expectations with the costs of everyday operations. The research from Peppers & Rogers Group and Efma is encouraging in that it shows that banks are enabling customer-centric activities. But there is still a long way to go.