As the healthcare industry transforms toward patient-centric services and delivery, pharmaceutical companies realize that a change in their paradigm is crucial—from a disease-centric view to a patient-centric perspective. Traditionally, pharmaceutical companies have been "pill" suppliers with little role in the healthcare delivery and marginal interaction with the patient. But today's reality presents the industry with a remarkable opportunity.

The prescription drugs manufactured by a pharmaceutical company are more than merely products that treat a disease or improve a symptom: they represent the foundation of a potential relationship which, if nurtured, holds the possibility of not only enhancing the wellbeing of the patient but also of organically growing the business of the company. Central to the success of that relationship is trust, the absence of which hinders the opportunities to expand beyond a provider of pills to a partner in wellbeing.

To understand the current state of patients' trust in prescription drugs and in pharmaceutical companies, Peppers & Rogers Group recently gathered online survey data from more than 2,400 adults in the U.S., each of whom had taken a prescription drug in the last 12 months. We queried their opinions about that drug and its manufacturer.

Overall, the research shows that trust influences tangible business outcomes such as compliance, patient engagement, and sales of new products and services.

Interpreting trust with the Trustability Index

In their recent book Extreme Trust: Honesty as a Competitive Advantage, Don Peppers and Martha Rogers, Ph.D., founding partners of Peppers & Rogers Group, coined the term "trustability" to refer to a heightened level of trust. By trustability, Peppers and Rogers refer to "proactive trustworthiness," where trustworthiness in turn is composed of competence (doing things right) and good intentions (doing the right thing). This framework was used to create a three-pronged "Trustability Index" upon which to measure trust in relation to pharmaceuticals via product competence, customer competence, and good intention.

Peppers and Rogers describe product competence as delivering a good quality product that meets the need or solves the problem it is designed to handle, and customer competence as providing a superior customer experience by understanding the customer's individual needs and interacting with the customer smoothly and efficiently. Good intention is defined as "ensuring that the way your organization makes money aligns with the needs and best interests of your customers," which is accomplished by focusing on both the short- and long-term customer relationships.

Our analysis indicates that pharmaceutical companies have tremendous opportunity to establish patients' trust and redefine patient engagement (see Figure 1). Overall, patients have a very positive view of the products in terms of product competence, reflected through the efficacy and safety of the drug. Patients expect a better customer experience from pharmaceutical companies, representing the customer competence aspect of trustability. Finally, patients have an undecided view of pharmaceutical companies on whether they "do the right thing" or have good intentions.

- Product Competence: 59 percent of patients rate the product competence of their primary drug highly. Our analysis indicates that patients equate "trust" in prescription drugs to "efficacy and safety."

- Customer Competence: 58 percent of patients are not satisfied with the customer experience provided by pharmaceutical companies, and 27 percent of patients are neither satisfied nor dissatisfied.

- Good Intention: Two out of three patients (67 percent) believe that pharmaceutical companies do not focus on doing the right thing.

- Trustability: The three elements of trust combine for a comprehensive analysis of trustability. Overall, the research shows that 24 percent of surveyed patients do not believe that pharmaceutical companies are trustable and 42 percent feel neutral toward the pharmaceutical companies' trustability.

With measures of product and customer competence as well as good intentions in hand, an intriguing question arises: what is the relative importance of each of these three components of trustability in delivering a variety of business outcomes that are central to the current success and future growth of pharmaceutical companies?

The impact of trust on your business

Overall, most patients have a positive view of products in terms of efficacy and safety. But the relationship stops there. Pharmaceutical companies would be well advised to think beyond product competence to more inclusively consider the significant impact of customer competence and good intention on enhancing compliance, improving patient engagement, increasing advocacy and dedication, and potentially expanding share-of-patient through the sale of new products and services.

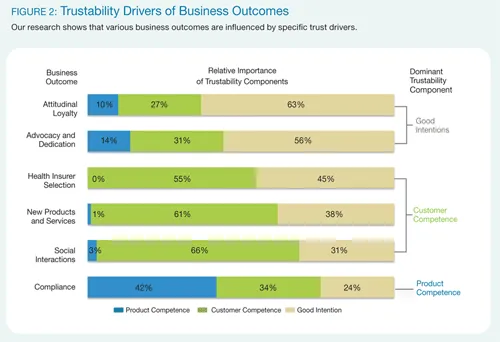

As part of the research, data were gathered on six diverse business outcomes: attitudinal loyalty, customer advocacy and dedication, health insurer selection, new products and services, social interactions, and compliance. Respondents rated 29 statements that were grouped into categories to facilitate the understanding of the likelihood of engaging in a variety of profitable behaviors, the likelihood of purchasing new products and services, and the degree of agreement to attitudinal dispositions. For each of these business outcomes, there is a differential impact of product competence, customer competence and good intentions, with each outcome primarily influenced by one of these three trustability components (see Figure 2).

Good Intention: Attitudinal loyalty, and advocacy and dedication. Attitudinal loyaltyand advocacy and dedication are essential to establishing a productive and authentic relationship, and both business outcomes are primarily influenced by respondents' perception of the good intentions of the pharmaceutical company. For example, current attitudes are predictors of future behavior. Respondents' level of agreement to statements such as "you are proud to be a customer of your primary drug" and "you feel a strong sense of attachment to your primary drug" reflect the degree to which an affective bond exists between the patient and the drug. That bond, like advocacy and dedication, is primarily influenced by the good intention component of trustability.

In today's socially connected world, advocacy is an outcome of interest to all businesses, measured by respondents' rating of the likelihood to "recommend your primary drug to a friend or colleague," for example. While drugs are unique in that the patient may have an influence on (but not control over) the selection, enhancing awareness and preference through positive word-of-mouth recommendations may influence the purchase decision, especially in cases where a generic equivalent exists.

Customer Competence: Social interactions, new products and services, and health insurer selection. Each of these three business outcomes is primarily influenced by customer competence. Social interactions refer to respondents' likelihood to "participate in an online community of individuals with similar health concerns" or to "proactively use social networks to comment favorably on your drug," for example. These outcomes should be of interest to pharmaceutical companies because involvement in an online community is one way to develop patient engagement, and, in that way, indirectly influence compliance. Additionally, proactive commentary on social networks enhances the brand image of the drug.

The opportunity to grow share-of-patient and to establish new revenue streams may be achieved by the introduction of new products and services. Respondents were asked to rate the likelihood of purchasing a product or service from the manufacturer of their prescription drug, assuming it was offered at a competitive price that was paid personally out-of-pocket. Overall, the influence of customer competence dominates, indicating that receptivity to purchasing such products and services and to thereby expanding share-of-patient is influenced by the quality of patients' experiences.

Finally, the outcome "selecting a health insurer based on their coverage of your prescription drug" is primarily driven by the customer competence component of trustability. While health insurers have a tremendous influence on prescription drug utilization through drug formularies, patients have shown certain loyalty to their "preferred" prescription drugs.

Product Competence: Compliance. In this research, compliance was measured through respondents' ratings of the likelihood to "take your primary drug as often as your doctor instructed" and "refill your prescription for your primary drug promptly to ensure that it is available to take," for example.

As shown in Figure 2, the primary trustability driver for this outcome is product competence, the extent to which the prescription drug is perceived as effective and safe, accounting for 42 percent of the relative importance among the three components of trustability. The strategic implication is that for a pharmaceutical company to enhance compliance, it needs to not only deliver an effective and safe product, but also to help develop positive patient experiences and establish patients' beliefs that the company is committed to "doing the right thing."

From pills to patients: Engagement built on the bedrock of trust

Across the set of business outcomes examined, the relative importance of good intentions (49%) dominates, followed by customer competence (37%) and product competence (13%). With product competence—the effectiveness and safety of the drug—shown to be the least salient factor, the case is clear: pharmaceutical companies would be well served to develop strategies and to make investments to deliver improved patient experiences and to improve patients' perceptions of the good intentions of the company.

The business case is compelling, built on the potential to improve patients' lifetime value through enhanced patient engagement.

The magic behind patient engagement

Most pharmaceutical companies understand and value the importance of patient engagement and many develop patient programs aimed at increasing patient engagement. However, many of these programs don't address the underlying issues.

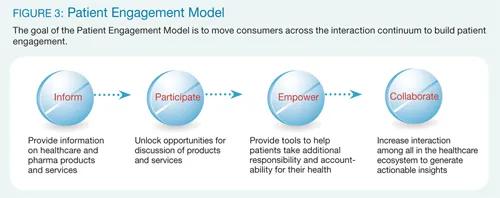

Peppers & Rogers Group's Life Sciences practice has developed a Patient Engagement Model (PEM), founded on deep understanding of the patient based on research results and industry expertise. Patients differ across three dimensions—needs, behavior, and value. Understanding those differences and using that insight to build strong, lasting, and beneficial relationships is the primary objective of patient-centric initiatives. We built PEM based on the idea that pharmaceutical companies should improve their patient initiatives across the PEM continuum: Inform, Participate, Empower, and Collaborate (see Figure 3).

Pharmaceutical companies have traditionally focused on the Inform and Participate areas, providing information to patients and caregivers through few channels (e.g. websites, portals, contact centers, social media). In some instances they have engaged patients in a more meaningful manner through Empowerment and Collaboration, but that is not yet the norm. There is a tremendous opportunity for pharmaceutical industry to transform its involvement in healthcare delivery and improve patient engagement.

An understanding of a patient's behavior, needs, and value allows companies to create segmentation strategies based on the engagement level of patients. Segmenting patients by engagement levels while understanding their motivations and behaviors, pharmaceutical companies can customize interaction plans that optimize their experience throughout the patient journey. Using Peppers & Rogers Group's PEM can provide pharmaceutical companies the framework to assess their current engagement approach and successfully implement new ones. Peppers & Rogers Group's enhanced PEM can unlock patient value and enable pharmaceutical companies to focus on health outcomes, which have been the focus in the healthcare industry.

By unlocking patient engagement through trust-based activities, pharmaceutical companies can fight competitive pressure, maximize internal resources, and strengthen relationships with constituents across the healthcare ecosystem.