It’s unquestionable that business leaders and customers loathe fraud. But onerous safeguards that slow down the customer journey are a close runner-up. Companies are under pressure to protect their customers’ data without creating friction in the process. And while it isn’t easy to maintain that balance, there are detection practices that are palatable to customers.

When it comes to fighting fraud, it’s better to err on the side of caution, right? Sort of.

Overzealous efforts to detect fraud can snare legitimate transactions, i.e., create false positives, which costs companies. In fact, fraud false positives cost retailers $8.6 billion in lost revenue—$2 billion more than the amount they saved in fraud prevention—reports BI Intelligence.

Manually reviewing each customer transaction is also too time-consuming. Consider airport parking. Ticket fraud and stolen vehicles are significant problems at airport parking lots. But asking attendants to manually match tickets with a vehicle’s license plate, model, and make is just not practical.

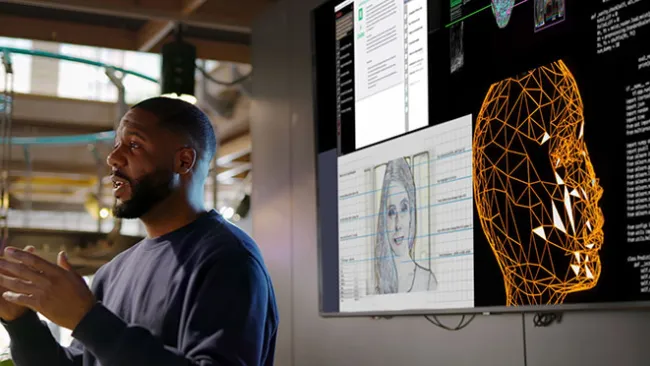

The solution lies in a combination of automated and human screening. Airports are increasingly deploying cameras that capture front and rear images of vehicles that drive through the entry lane. The images pass through an optical character recognition system that logs the license plate and ticket number into a database.

When the driver is ready to exit the lot, the entry and exit license numbers and the ticket are compared electronically. If the plate numbers and ticket don’t match, an attendant is immediately summoned to check the exiting vehicle. This is just one example of how digital technology and humans can work in tandem to combat fraud without burdening the customer.

Here are other customer-friendly fraud detection tips:

- Use technology that works behind the scenes. Real-time checks like device fingerprinting and behavioral analysis are examples of non-intrusive methods that help detect fraud.

- Provide options. Allow customers to select the method by which they want to be alerted of unusual activities related to their account.

- Don’t be greedy. Especially for new customers, only collect data what’s absolutely necessary. As customers come to trust you, they’ll willingly share more information.

- Get your data ducks in a row. The more data sources companies can correlate and analyze, the easier it will be to detect and prevent fraudulent activities and transactions. Aligning an airline passenger’s departure city, credit card holder location, customer loyalty history, and IP address, for example, can often reveal abnormal behavior and possible fraud.

- Collaborate on shared intelligence. Leverage shared databases to identify fraud faster. For example, IATA Perseuss is a platform where airlines can share information about fraudulent activity that they have encountered.

- Be proactive. Lax network security may be giving hackers access to the company’s servers. Ensure that:

- Logins expire after a short period of inactivity.

- Passwords are strong, stored safely, and changed frequently.

- All devices that are plugged into the network are scanned for malware each time they are inserted.

Taking a blanket approach to fraud protection is not effective if it deters customers from using the product or service. Fraud prevention is most effective when human creativity and constant monitoring are combined. The combination of expertise, speed, and scale should create an invisible safety net that customers never notice.