It’s an incredibly disruptive time for the automotive sector in Europe. Right now, digital adoption, ride-sharing apps, and emission regulations are just a few factors that are reshaping a century old industry.

If we examine the space further, you’ll see that success in 2020 is not only about identifying the disruptors but knowing how to act on them as well:

A Changing Product Landscape:

The rise in demand and popularity of electric vehicles—a potential precursor to the rise of autonomous vehicles—reflects the progress in new vehicle technology. It also is an answer to increased government restrictions on urban vehicle access, as well as environmental protections, emissions standards and noise levels. These regulations are backed by taxes on non-compliant, older vehicles in contrast to subsidies and other tax incentives for new electric and hybrid vehicles (EV/HEVs). The effect is a rapid transition among consumers to electric vehicles or moving away from vehicle ownership altogether.

The ‘Gig’ economy

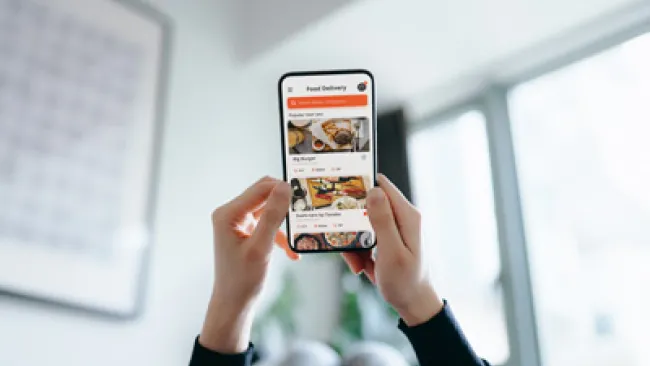

City life is becoming more car-unfriendly with road “diets”, access restrictions, more pedestrians and bicycle lane redesigns alongside low-emission tolls on central locations. Owners and prospective buyers are now required to navigate a maze of tax thresholds in their new car purchases. It is only natural that buyers are re-examining traditional ownership models and are instead turning to startup “gig” operators to provide “just in time” car-sharing and ride schemes.

Omnichannel capabilities

Customers want great experiences across all platforms and purchases. That’s why automakers are jumping into the app game for a broad range of tasks, including customer service, remotely starting or unlocking doors, appointment setting at dealerships and monitoring vehicle performance. These consumers see no distinction between using an app as a portal into their vehicle, the dealer network, or OEM customer service organisation, even though to the business they are three distinct entities.

1. Leverage the power of CX technology

In the European market CX software spending will increase from $34 billion in 2018 to $47 billion in 2022, according to IDC. How is all this CX technology being deployed? Initiatives such as integrated knowledge management or context-aware workflows link an OEM’s relevant back-end systems to support the provision of vehicles, service bookings, and access to dealer and supplier networks. These form a foundation which can be enriched by speech applications and automation to deliver more complex self-service knowledgebases and RPA chatbots for rapid enquiry and resolution of customer issues. Companies can achieve additional benefit by offering these services through apps with gamification strategies in place to drive uptake with less linear CX.

However, the launch of new technologies must always serve a business need and drive a delivered outcome and benefit. For example, bots can be an expensive asset if launched as a “Big Bang’” customer-facing solution. A less cumbersome and more impactful use of bots is to enable agent training first - this builds agent experience and tunes the bot’s system performance prior to the launch of the solution to customers.

2. Move from reactive to proactive CX metrics

Data analytics around customer interactions are often limited to the assessment and reporting of operational effectiveness. Operational metrics measure efficiency, but not the quality of the customer experience. There is no insight into why customers contact a company or what might influence them to increase share of wallet.

Further, companies can get more predictive by deploying propensity models, measuring customer sentiment, or developing customer personas around common issues and needs. Machine learning and AI-enabled technology within customer systems may also be able to identify customer patterns across channels and business units to determine root causes of customer interactions that can be fixed. This will allow brands to prevent customers from contacting the company in the first place.

3. Empower agents to focus on meaningful experiences

Automation, RPA and AI are emerging as ways to move customer interactions to a lower-cost model of customer engagement. Aligned with this shift, the human element of customer experience remains critical. It is important to alleviate pressures upon the existing agent community to encourage them to be at their best during customer interactions.

Most agents perform against metrics reflecting production-line values: average handle time, time to answer, average hold time, etc. This results in a high burn-out rate as agents wrestle against unrealistic expectations. In addition, success is often rewarded with additional volume-based tasks. In an industry where the longer tenures lead to higher agent retention, it is critical to move agents up the value curve into more challenging roles so they are inclined to stay and grow with the company.

4. Anticipate customer needs to prioritise elements of successful CX

Enhanced use of data analytics will provide the foundation for the move to more focused and impactful customer initiatives. Create a new, layered view of the customer experience based on moments that matter to individual customers. By anticipating the reasons and timing of interactions, generated by known “triggers” or events within vehicle ownership (servicing, parts, recalls, etc.), automakers can deflect contacts to manage interactions more effectively and even prevent them from occurring with proactive outreach.

Adapt to a new automotive era

In a changing world where every step (and misstep) is measured for cost impacts, a resource-intensive customer experience model raises alarm bells for management and investors in the automotive sector. Utilising smaller groups of cost-effective resources in a “hi-lo” mix of agents and automation boosts loyalty and generates revenue. These rich digital and self-service solutions delivered according to customer needs and predicted by data analytics allow the organisation to manage customer contact volumes through its lowest-cost channels.

The aim must always be to free funds for investment and to build an aware, cost-conscious, right-sourced automotive strategy that can tackle changing market dynamics. The industry may be at the centre of a perfect storm, but it has know-how to track its ferocity without harm and align itself on the right path for future success.

If you would like to learn more on how innovation will shake up the automotive sector, read TTEC’s white paper ‘Navigating the Perfect Storm in the Automotive Sector’.