Fintech disruptor raises the bar with a smarter customer experience

With agile proactive support, TTEC enabled a unicorn fintech company to maintain a high level of customer support through the pandemic, launch new fraud screening services to protect customers, and much more.

Fintech disruptor raises the bar with a smarter customer experience

With agile proactive support, TTEC enabled a unicorn fintech company to maintain a high level of customer support through the pandemic, launch new fraud screening services to protect customers, and much more.

TTEC top vendor

in 2021

CSAT score in fewer

than 6 months

attainment

The challenge

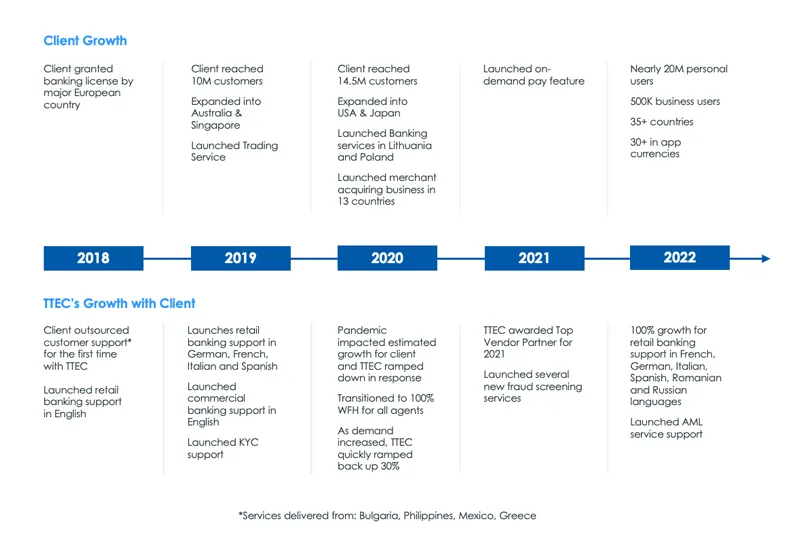

A U.K.-based unicorn fintech company with a wide range of banking services took pride in its fast responses to customer enquiries and excellent customer support. The company’s services were largely conducted via a mobile app. When volume began to outpace the capacity of its in-house team, the company needed an experienced and trusted partner to supplement its 200-member customer support team. It wanted a partner that could support its in-app chat functionality, comply with strict industry regulations, and consistently deliver a superior customer experience.

Our solution

TTEC was engaged in 2018 to support conversations with personal and business banking customers in addition to overseeing Know-Your-Customer (KYC) and Know-Your-Bank (KYB) operations. In fewer than six months, TTEC onboarded several hundred multilingual associates to deliver consistent in-app chat support across multiple lines of business and time zones.

Starting with English support as the fintech company expanded in multiple geographies, TTEC quickly expanded to teammates providing retail support in German, French, Italian, and Spanish from contact centres in Bulgaria, Greece, Mexico, and the Philippines. As the partnership developed, TTEC delivered scalable, agile, proactive support in multiple ways:

- At the onset of the COVID-19 pandemic, TTEC swiftly ramped down to maintain excellent customer support without incurring unnecessary overhead costs for the client. When demand began to increase a few months later, TTEC quickly ramped back up.

- Associates’ safety and well-being was prioritised during these uncertain times. TTEC quickly mobilised associates to work from home and provided the tools and resources to continue feeling connected to their teammates and team leads.

- In addition to handling customer enquiries as the client’s needs grew, TTEC provided identity verification and anti-money laundering (AML) compliance to prevent and mitigate fraud, in addition to KYC and KYB services.

- In 2021, TTEC assisted in launching additional chat-based fraud screening services for the client’s retail and corporate banking lines of business, such as reviewing fraud alerts, verifying the identity of customers, and offboarding customer accounts that violated the client’s terms and conditions.

- While the core service was defined by rigorous performance measures, TTEC proactively provided feedback on friction points that affect customers the most and identified drivers impacting CSAT scores. TTEC also offered solutions to optimise workflows and reduce customer pain points.

- The demands of the financial regulatory oversight placed emphasis on the quality of training and TTEC ensured all teammates were fully equipped for their role, by providing regular data privacy and fraud training in collaboration with the client.

- TTEC also operated a team mentoring performance model. This ensured performance was measured by team results, which incentivised team members to help each other deliver an excellent experience for customers.

The results

TTEC’s expertise, training, and agility were integral to the fintech firm’s ability to scale customer support up or down as needed in multiple languages, ensuring that customers consistently received excellent service across multiple lines of business.

CSAT scores rose more than 20% in fewer than six months. Based on a scorecard the client created in 2021, at a 105% average, TTEC consistently exceeded the client’s capacity attainment KPI, such as monthly requests for additional teammates who speak multiple languages. In 2021, the fintech company recognised TTEC as a top vendor partner.

What’s more, TTEC remains the client’s longest-running partner providing customer support to date. Working alongside the client’s internal teams, TTEC drove the enterprise forward with best practices and initiatives that were focused on improving four key pillars of success: process, policy, technology, and people optimisation opportunities.

The relationship is developing all the time and the transparency of communications and performance measurements is helping both partners understand the challenges and opportunities as the client extends its global reach. TTEC helped define what success looks like and provided a forward-looking roadmap to ensure the fintech firm’s operations are best in class at all times.