Innovation in the healthcare industry typically refers to new treatment strategies or breakthrough drugs. But for some health insurance companies, innovation can mean something different. Improving operations, efficiencies, and the overall customer experience can have an immediate impact on consumers as well as the balance sheet.

Each year, the Centers for Medicare and Medicaid Services (CMS)-the federal agency that oversees Medicare-rates Medicare Advantage and Part D prescription drug programs on a five-star scale, based on how well they performed in the prior year, with five stars representing the best performance. Plans with high ratings receive bonus payouts of up to hundreds of millions of dollars. In 2012, the total bonus payment is projected to be nearly $3.1 billion, with a few companies taking the lion's share-UnitedHealthcare is projected to receive $547 million and Kaiser Permanente is projected to receive $380 million, according to the Kaiser Foundation.

The idea behind this bonus payment system is twofold. First, it rewards plans that do well by awarding them a higher bonus payment. Second, it brings down overall Medicare program costs by cutting down on payments made to plans in excess of projected spending. For consumers, the system offers an easy way to shop for and compare plans during enrollment periods. This new program began in 2011 and is scheduled to continue until at least 2014. The first payouts were delivered in 2012.

What does a five-star health plan look like?

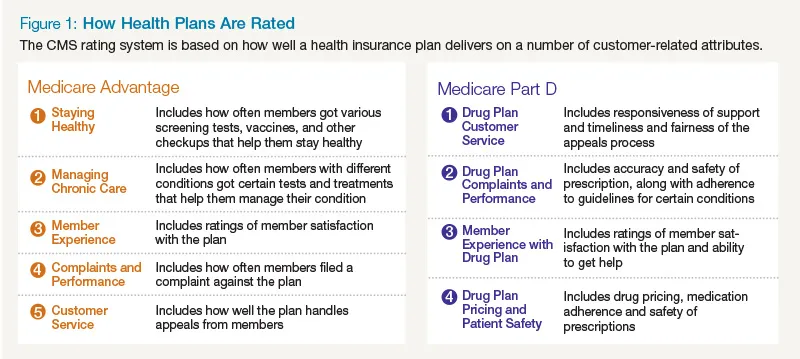

Medicare plans are measured by how well they deliver across five customer-related dimensions: staying healthy, managing chronic care, member experience, complaints and performance, and customer service. For example, the complaints and performance dimension measures the number of complaints submitted for every thousand members and the problems that Medicare found in members' access to service and in the plan's performance. Similarly, Part D programs are rated on drug plan customer service, member complaints and performance, member experience, and patient safety and pricing accuracy. For example, measures under the drug plan customer service dimension cover the time spent on hold when a pharmacist calls the health plan and the availability of foreign language options in the contact center (see Figure 1). A number of stakeholders provide feedback and data to inform the CMS rating, including consumers, doctors and hospitals, pharmacists, and regulators.

However, some measures are weighted more heavily than others. CMS broadly groups measures into five categories, including process-, experience-, access- and outcome-based measurements. Outcome-based measures that tie to the improvement of health and care are weighted heaviest while process-based measures are weighted the lightest.

Reach for the stars

The goal of the rating system and bonus structure is to ultimately create better health outcomes for plan members. Customer satisfaction with the health insurance industry overall is low. Consumers are used to a higher quality of service each day from vendors in other industries and seek that same experience from their health plan. Payers looking at only the dollar bonus amounts will miss out on the bigger opportunity to create a better health plan, which will create satisfied members and retain them over the long term. This leaves much opportunity for improvement among health plans.

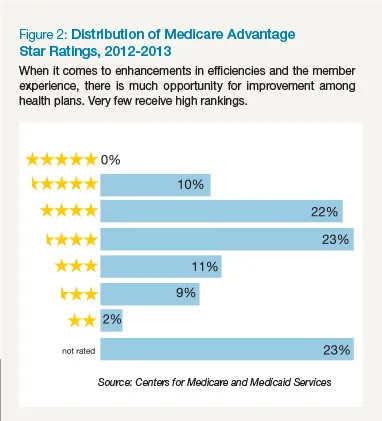

Figure 2 illustrates the ratings breakdown based on the most recent figures from CMS. Less than 1 percent of plans achieve 5-star ratings, and about 44 percent receive less than 3 stars.

However, some health plans have begun to take notice and have made changes in order to obtain a higher star rating. Of the 419 plans Medicare Advantage plans rated in both 2012 and 2013, 28 percent showed improvement over the previous year. Similarly, of 59 Part D plans rated in 2012 and 2013, 49 percent improved their ratings in 2013.

Insurers looking to improve must place the member at the top of their organizational priority list; in other words, they must create a customer-centric organization. Many of the measures that CMS rankings deal with how well elements of the healthcare system work together. This requires a transformation in the way payers treat their members by rethinking organizational design, customer experience strategy, and customer trust, among many other actions, to create a richer member experience. And CMS will periodically update its list of measures, making this customer-centric transformation a journey, not a one-time process.

Customers today have increasing choice when it comes to their health plans and they will exercise those choices, especially when there is a rating attached to a plan. For health insurers, this means that paying attention to star ratings and creating the right conditions for a higher star performance will become even more important going forward.

The way ahead requires a holistic approach

For insurers who want to stay on top of the star ratings program, a clear focus on higher overall plan quality is the right approach. Any improvements need to be holistic and considered from the point of view of the entire member lifecycle, not just focused on improving the individual measures that comprise the inputs to the star ratings. Ratings can drop for many reasons. While some of these are relatively easy to fix, such as getting members to have an annual flu vaccine, others might prove to be more of a challenge, such as patient adherence to prescription medication guidelines.

Consider the evaluation of a member's overall rating of a health plan. An overall rating is the sum of many factors, largely driven by that member's experience with the health plan across multiple interactions. At each of these interactions, a member's expectations on the desired experience can vary widely from member to member.

A member who has just turned 65, is still working, and lives at home has a different set of needs and expectations than an older member who is 80 and lives in a retirement home. A member with a chronic illness will require more attention and handholding than a member who comes in for screenings and basic checkups.

In order to create a satisfied member who will give a high overall rating for the health plan, the payer must create customized interactions that will meet each member's needs at multiple points in the member experience. To do this, each member's needs, behaviors, and value to the health plan must be carefully analyzed from the point of view of the member lifecycle. A holistic approach to improving ratings can thus ensure that the member's needs are met during each interaction and will leave the member satisfied and less likely to switch plans the next time enrollment period comes around.

Another benefit of a holistic approach is that CMS updates the inputs to its star ratings annually. The agency has structured the star ratings strategy to be consistent with its three-part aim: better care, healthier people and communities, and lower-cost care through improvement. Any future updates to the measures will incorporate this strategy. Therefore, an approach to create the ideal experience must look at all aspects of the member lifecycle; otherwise the result will be a piecemeal approach that will result in lopsided or short-term gains to the ratings.

Conclusion

Consumers rely on ratings and reviews to inform their decisions in nearly every other industry. So why not healthcare? The ratings bonus program from CMS presents an immediate opportunity for health insurers who operate in the Medicare space to get ahead of the competition and stay there as the healthcare industry evolves. Monetary, relationship, and reputational benefits are all at stake. It is the perfect time to innovate around customers.