As consumers take more control of their healthcare decisions, insurance companies are catching up to other industries in how they interact with members and deliver customer experiences. The member experience is beginning to differentiate payers.

So what is the state of CX among health insurance firms? TTEC Digital recently conducted an assessment of four leading U.S. health insurers, where we assessed channel experience and overall service. Mystery shopping, voice of the member, and other interviews helped provide a snapshot of the member experience across the following channels: IVR, website, chat, phone, social media, email, and mobile app.

The results are not surprising—while there are pockets of CX excellence within some channels, there are plenty of opportunities for further integration and service enhancements (see Figure 1).

What’s working

We see traction among health plans in embracing and adopting digital channels for service and support. It’s clear most have started on their digital journey. For example:

Growing use of chatbots and virtual assistants to handle quick self-service requests. A few insurance companies have even developed Alexa skills to help explain common healthcare terms, assist members in finding a doctor, and conduct other simple, informational tasks using voice commands.

Mobile options: Most insurance companies have made content available on mobile via apps and offer text messaging for updates in the moment. And for brokers and benefits administrators, some apps allow electronic document transfer and access. While we haven’t seen a high degree of maturity yet, most companies have established a presence in this channel.

Simplifying data: We are seeing companies starting to simplify the data they provide members and prospects. Confusing jargon and complicated information are being made easier to understand, and data consolidation and dashboarding help tell a story that’s relevant to members in both digital and traditional channels.

Key CX improvement areas

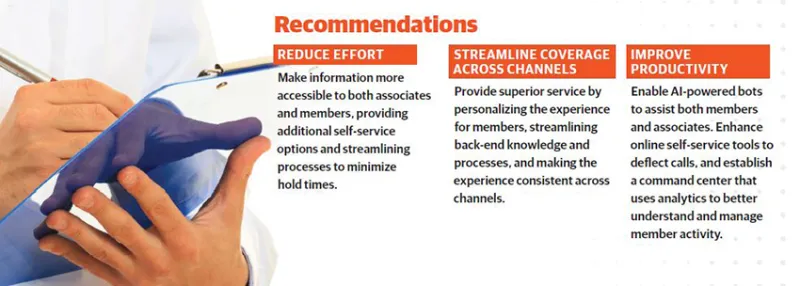

- Self-service containment. Today, most members start their interactions with self-service. Yet too many can’t resolve their issues themselves, driving members to call, which increases costs. Members across companies complain of long IVR menus and too much time to answer social media posts. Even website FAQs are complex and hard to find.

- The support experience is taxing. Extra member effort is required to connect across channels, and if they do engage via online channels, they get funneled to traditional channels that are disconnected from social media. Associates trying to help members often find themselves at dead ends or with unhelpful resources. These disconnected channels waste time and frustrate members and employees alike.

- Cross-channel experience is inconsistent. Too often, multiple transfers are required to find the right information. The email channel is not proactively managed, with long wait times for answers. And a growing concern is that there is inconsistent information on health insurance exchanges and insurer websites. As more players like Amazon and Google enter the healthcare space, this inconsistency will only worsen.

- Poor associate productivity/engagement. Knowledgebases are siloed and articles hard to find. There is limited knowledge governance, so articles are often outdated or incorrect. What’s more, the associate desktop has multiple tabs and requires toggling back and forth.