Do customers and businesses have the same priorities when it comes to customer experience? The answers have a big impact on current and future business decisions. Research from TeleTech found that while in some cases both groups align, in others, they are miles apart.

The 2015 TeleTech Customer Experience Benchmark Study recently surveyed 176 customer experience professionals across a number of industries about their customer experience priorities and spending plans. The data was then compared to a similar survey of 3,515 consumers to gauge their perceptions of how businesses deliver customer experience. The results show that customer experience is considered a critical business driver, but few firms are meeting current customer expectations.

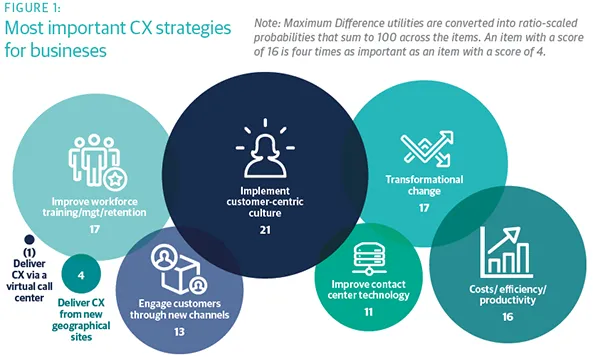

The study found that a customer-centric culture ranks as the number one or two goal for CX leaders in all industries surveyed—health insurance, consumer banking, property and casualty (P&C) insurance, communications & media, technology, retail, and automotive. Other top strategic goals include improving workforce training, management and retention; conducting transformational change; and improving costs, efficiency and productivity (see Figure 1).

The goals reflect the fact that commitment to customer experience is growing. According to the study, 96 percent of business respondents say they expect their amount of customer experience investment to stay the same or increase in the next three years. Mobile is expected to have the highest level of investment over the next three years, particularly for respondents in healthcare, banking, insurance, and retail. Companies will also invest in enhancing sales capabilities and creating digital demand.

Yet the research did not show that consumers desire better mobile usage as strongly as businesses plan to improve it. A surprising finding from the study is that consumers prefer companies invest in other experience areas well ahead of mobile improvements. A 61 percent majority of consumers prefer that businesses invest in improving first call resolution as a top priority, followed closely by training employees to be empowered and knowledgeable (60 percent), and reducing complexity (transfers, people involved) when solving an issue during an interaction (44 percent). Mobile improvement ranks twelfth on a list of 13 investment priority choices, above only tiered product/service support (see Figure 2).

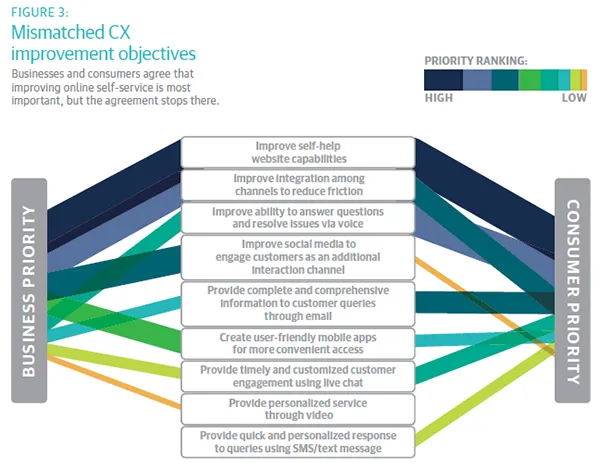

The research also found that some interaction preferences are misaligned. Both companies and consumers agree that they want to see improvements in online self-service as a top customer experience objective. But businesses rank social media and mobile as their third and fourth objectives, while consumers rank them eighth and sixth, respectively. Consumers—even younger demographics—are more interested in improving voice, email, and live chat ahead of mobile and social. (see Figure 3).

Takeaway: Alongside investment in next-gen technologies like mobile, social media, or video, companies need to continue to focus on getting the basics right, resolving issues without friction and determining root causes that may lead to other problems. The channels themselves are less important than the experiences customers have within the channel.

Long live voice, other channels lag behind

What’s also notable from the research is that business and consumers agree that voice interactions still dominate. Business respondents report that voice is not declining as a channel of choice, particularly for issues that are time sensitive or complex. Similarly, 72 percent of consumers believe that “speaking directly” to an associate is important, especially when they are in a hurry or when the issue is complex. And most consumers report they are very receptive to it as a method of communication when it comes to making purchases or getting support. This is true for consumers young and old.

As for other channels, only 50 percent of business respondents report that their company is using chat for customer interactions, 40 percent use text, and only 13 percent use video. With their eye on the future, 15 percent of business respondents believe that social media is growing fastest as a customer experience channel, and 12 percent say that chat is growing fastest. Yet only 4 percent of businesses surveyed are investing in chat more than the other channels.

Takeaway: Go where your customers are. Invest in new channels that customers prefer, and don’t spend money on channels that aren’t in as much demand. Observe how and why your customers experience your brand now, what they want in the future, and optimize those channels to create a superior experience.

Misaligned perceptions

Though all businesses surveyed say they are strong in customer experience areas, consumers disagree, particularly about channel integration and transaction time. Only 28 percent of consumers rate the companies they do business with as high in ease of switching from one channel to another. Figure 3 shows that reducing the number of people and/or transfers to resolve an issue is ranked as the third most important investment area by consumers. The good news is that firms are attempting to address this. They rank improving integration among current channels as number two out of a list of eight.

Interaction speed and efficiency is another customer experience expectation gap. A majority—58 percent of consumers—rate “less wait time during calls” as one of their top three communications priorities, second only to a user-friendly website. At the same time, 70 percent of consumers rate transaction time as highly important when working with companies.

Industry-specific consumer insight

Across all industries, consumers are willing to spend more time at the beginning of an interaction so they don’t have to repeat information later. Yet other customer insights emerged relative to the unique needs of certain industries. Below are some highlights:

• Cost and reputation influence purchase decisions most for technology, automotive, consumer banking, communications & media, and P&C insurance. Price has the biggest influence on health insurance and retail, and location factors into decisions for consumer banking, automotive, and communications & media industries.

• Speaking directly to an associate is the most important communication attribute in banking, P&C, communications & media, and automotive.

• Consumers of health insurance, automotive, P&C insurance, communications & media, and retail say that the fewer times they have to interact with customer service the more loyal they are to a brand.

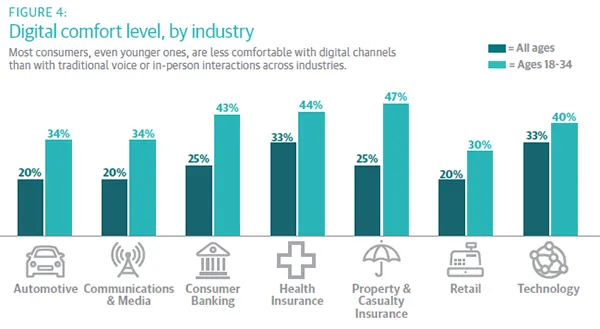

• Customers in different industries have different comfort levels when it comes to using digital technologies for sales and service (see Figure 4).

• Voice and in-person interactions are most preferred.

Not all consumers are the same

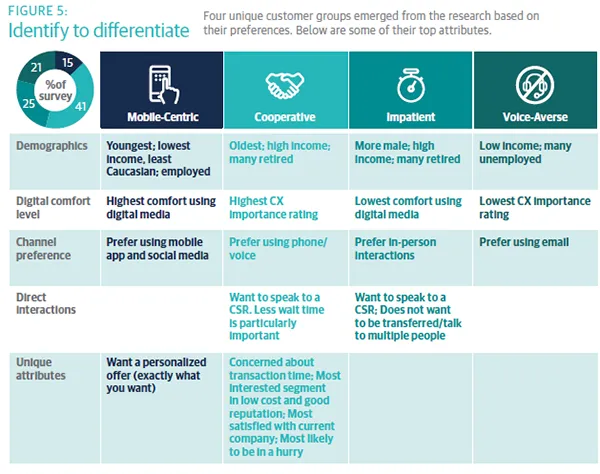

The consumer part of the Customer Experience Benchmark research revealed some interesting patterns among the 3,515 respondents, based upon their ratings for a series of preference statements. Using cluster analysis, we created four distinct customer segments: mobile-centric, cooperative, impatient, and voice-averse (see Figure 5).

The largest group of customers fall into the cooperative group, representing 41 percent of respondents. They are willing to share more personal information for a better experience, spend more time at the beginning of an interaction to save time later, and pay more for better, seamless customer experiences. Another 25 percent are impatient customers, who value fewer customer experience interactions and feel they spend too much time trying to resolve customer issues. The voice-averse group, representing 21 percent of consumers, prefers chat, email, text, and social to voice calls. And the mobile-centric customers, representing 13 percent of respondents, prefer that all sales and service interactions be done through a mobile device, and they find social media a good place to find information about products and services.

Takeaway: This level of insight is incredibly valuable for companies looking to prioritize customer experience areas. Knowing customer preferences and needs, firms can tailor more relevant interactions to the channels that customers want to use (see Figure 6). Different treatment strategies can be applied to different customer groups. And companies can go one step further with customer value analysis to prioritize how to most effectively and efficiently serve different types of customers.

Conclusion

The biggest lesson learned from the 2015 TeleTech Customer Experience Benchmark Study is that consumers want a simple, frictionless experience whenever they interact with a brand. The reports of voice’s death are greatly exaggerated, and while mobile is a business priority, consumer adoption hasn’t quite yet caught up. Companies are spending money to improve elements of the experience while remaining efficient, but they need to do better to match consumer priorities and preferences.

Customer experience excellence is a continuing journey, so we plan to revisit this research regularly to identify how the space is evolving. Today’s benchmarks show some positive areas, but also many areas of opportunity. So as expectation and experience gaps between business and consumers shrink, the intersection of consumers and business will only get stronger. ?