Competition for loyal customers is high in the banking sector. Every bank is trying to be the “ideal” bank for their customers in exchange for trusted and profitable relationships. They try to provide an ideal set of products and an ideal level of customer service quality across an ideal combination of channels. Many banks use loyalty programs to build trust and reach that ideal state. However, most of these reward programs are product-based and don’t go far enough to establish trust and build real customer loyalty. In other words, they don’t take into account the different products, services, or channels customers use in their relationship with the bank.

The secret to gaining customer loyalty is to build real relationships for each segment across the customer lifecycle. Consequently, progressive banks now consider and reward a customer’s entire banking relationship portfolio. Their loyalty programs are designed to grow and nurture loyal customers, building on each positive interaction to create a trusted foundation.

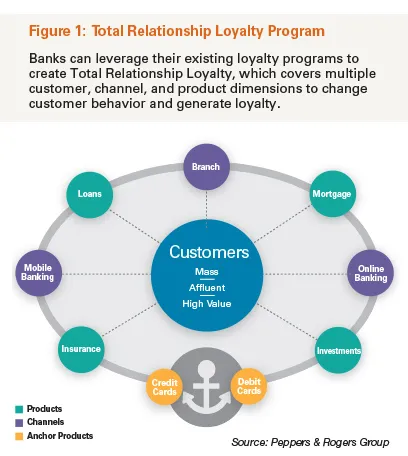

The concept of loyalty is shifting away from frequency programs to true customer engagement and affinity. Loyalty marketing is not a discrete function separated from the rest of the business; it’s part of an integrated business strategy. We call it Total Relationship Loyalty. TRL lays the foundation to create a comprehensive program based on three customer dimensions:

- Customer value and tenure

- Product ownership and usage

- Desired channel behavior

Total Relationship Loyalty puts into action the idea that customers should be rewarded for their entire relationship with a bank. It enables banks to establish a complete view of the customer by looking holistically across these three dimensions (see Figure 1, page 33). In short, TRL increases a bank’s bottom line by rewarding customers for building up their product and service portfolio through the right channels. Banks that already run credit/debit card rewards programs can effectively leverage this as the anchor portfolio to build a profitable TRL program.

The TRL model allows banks to reward customers based on many different aspects of their relationship with the bank. For example, customers can earn rewards when they use banking products and services such as debit or credit cards, open new checking or savings accounts, bank online, or get approved for a loan. In addition, they are rewarded for their retention and lifetime value in the form of number of years as customers, number of accounts, and combined balances.

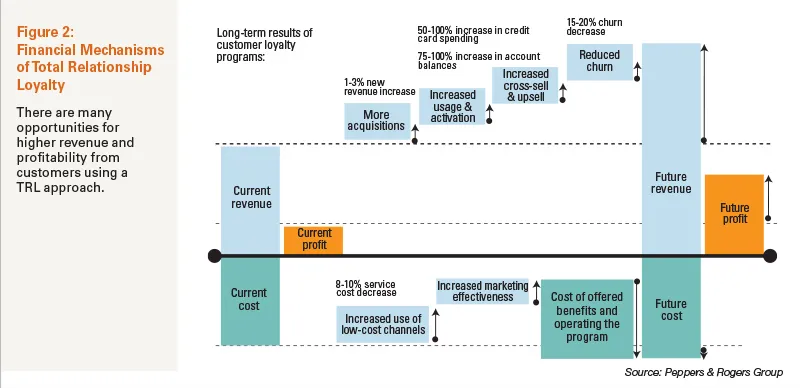

A Total Relationship Loyalty program takes action to change customer behavior and generate loyalty. When executed properly, customer loyalty can be a catalyst for sustainable growth in the form of increased revenue and decreased costs. However, a traditional campaign-based approach is not enough. The goal of an efficient loyalty program is to grow the customer portfolio, influence retention, and maximize customer value. This is not a one-off endeavor. Rewards programs are longer-term investments than basic campaigns.

And that long-term investment pays off. Taking a TRL approach has a number of financial benefits. It creates revenue drivers like higher acquisition, cross- and upsell activities, retention, and increased sales and resource efficiency. It also positively impacts costs through trans-action migration to cost-efficient channels and increased marketing effectiveness through better targeting, unique offerings, and leveraging merchant communciations. All of these have a net positive impact on profit (see Figure 2).

Total Relationship Loyalty in action

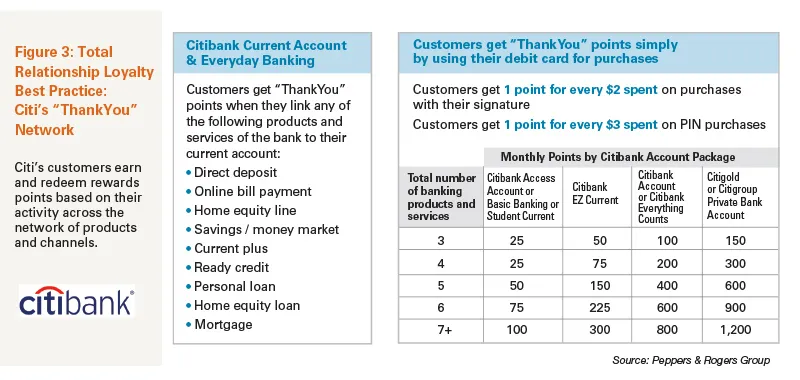

Banks around the world have begun to implement certain aspects of a Total Relationship Loyalty strategy. For example, Citi’s ThankYou program is one of the most successful and internationally acknowledged Total Relationship Loyalty programs in the global retail banking business. Customers earn ThankYou points each month based on their activity across the bank’s network of products and channels—through credit card, checking, and savings account activity, or when they visit partners like investment firm Smith Barney, travel site Expedia, or online shopping partners. Customers can also purchase points to reach certain earning milestones. Members’ points are collected into a central account where they can be redeemed for products or gifts divided into categories such as electronics, travel and experiences, gift cards, cash, savings, and charity. It also offers a “make a wish” option, where members can ask for specific rewards beyond the standard rewards in the program.

In addition to a comprehensive credit card reward program, Citi has engineered its program to focus on its debit card portfolio, as well (see Figure 3). Points are based on customers’ current account packages combined with the number of products and services they own. Customers also earn points for using their debit card for purchases. In 2010 the program won COLLOQUY’s Master of Enterprise Loyalty award for its integration across the enterprise.

Other players around the world are beginning to focus on TRL, as well. In the Middle East region, Mashreq Bank now links customer behavior and value to its Salaam rewards program across the enterprise. The program allows members to earn points for existing and new product usage, as well as how much and how often they use their credit and debit cards. Its Mosaic financial simulator shows customers how they can best earn monthly relationship points; customers can redeem points through an online gift boutique or by exchanging points for credits to their accounts.

Such examples are limited right now. But companies that use TRL know that building and deploying a TRL program means adding a competitive advantage with current customers that is hard for others to challenge. It’s an endeavor that is worthwhile in the long term, though can be complex in the making.

Total Relationship Loyalty framework

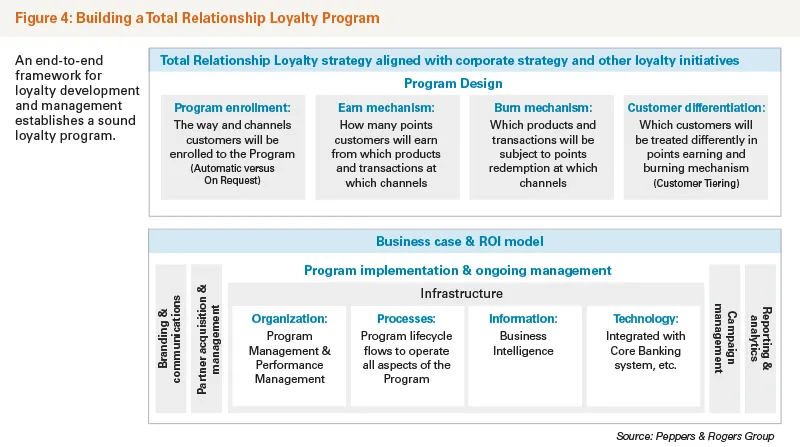

A TRL program requires a multipronged strategy across internal divisions and stakeholders. It cannot be a single initiative in a single department. It must be aligned with corporate strategy and other loyalty initiatives. Peppers & Rogers Group has created an end-to-end framework to help banks develop and manage their Total Relationship Loyalty strategy (see Figure 4, page 35). The framework comprises three distinct, fully interconnected project phases: program design, implementation, and ongoing management.

Program design

The objectives of the program design element are to ensure alignment with the bank’s corporate strategy, design the building blocks of the loyalty program, and identify customer interaction methodology. The design covers all end-to-end aspects, from the high-level components to the blueprint for implementation and operation.

Each bank is different, with its own organizational structure, culture, and customer considerations. We recommend that banks start by defining the vision, mission, and operating guiding principles for the loyalty program. Next, create the value proposition and differentiation of program tiers based on customer value and segment strategies. Why would customers want to enroll? What is the business case for creating such a program? What types of rewards will be offered?

Then, create a blueprint design. Devise how customers will be enrolled in the program and via which channels, as well as how many points customers will earn from which products and transactions at which channels, and define a wide range of flexible redemption options. Look at customer value and decide how customers with different values will be treated differently when it comes to earning and redeeming points.

With the nuts and bolts of the operation designed, the focus can then move outward. Decide which loyalty partners to align with based on what customers want. Create a partner network model, with specifics on how they will integrate with the overall system.

Finally, design how the program will be branded and communicated, both internally and externally. Define elements and channels for program communication campaigns, and create a communication plan for specific customers and parts of the program that are priorities.

Program implementation

The implementation phase of the project is divided into two parts: planning and support. In the planning stage, it’s necessary to develop operational requirements of the loyalty program and develop a thorough plan for implementation.

We recommend that banks define specific aspects of the program, such as the customer lifecycle, the process map and organization, and who is responsible for different pieces of the program. In addition, set detailed KPIs and metrics to align all stakeholders to the vision and mission of the program.

To keep momentum in the implementation phase, banks should prioritize quick wins and initiatives based on urgency and difficulty of implementation; develop an implementation roadmap; and design a project management office structure for ongoing management once the program launches.

Implementation support is comprised of organizational support, system implementation support, and campaign management. Depending on the organization, that may mean restructuring internal resources to incorporate loyalty management and monitoring progress on the technical side. And this new approach to loyalty means a customer-focused approach to campaigns and customer communications, as well. Changes may be needed in marketing materials, messaging, campaigns, employee scripts, and in how the resulting data is collected and analyzed to make appropriate changes.

Ongoing management

After the program is launched, ongoing management is crucial to keeping the program relevant and valuable to both the bank and its program members. Someone has to manage the customization and delivery of rewards, as well as monitor and make adjustments to the rewards or partners. There is also a wealth of insight generated by the Total Relationship Loyalty program that must be managed, in the form of performance metrics and individual customer insight about reward preferences, popular channels, and more. Finally, customer interactions are a crucial part of a successful loyalty program and overall business success. Proactive and helpful customer care, marketing programs, and campaigns are the lifeblood of most companies, and require consistent focus.

Besides KPIs, revenue targets, and news media coverage, there are a few common best practices gleaned from companies doing TRL right:

1. Garner support for a long-term strategy—Remember that this is a long-term project that might not bring immediate returns. Incremental revenues will recover initial investments in the long run.

2. Be attractive to customers—Rewards must be attainable and affordable, relevant to customers, and cater to their needs. The redemption process must be simple, and offer a wide range of strategically meaningful program partners and benefits.

3. Be profitable—The cost of the program must be recoverable. The cost of running operations plus redemptions should be significantly less than incremental revenue generated.

4. Focus on operational excellence—every detail in operations should be well thought out and engineered to create a smooth process. Internally, the roles and responsibilities are clear and the organizational structure is well prepared.

5. Use customer intelligence effectively—Customer data must be collected and analyzed regularly to discover market opportunities, improve campaigns, etc.

6. Get committed—Partners in the program must be fully on board and committed to the program objectives and design to make it a success. When possible, give them a financial stake to solidify their commitment.

7. Focus on branding and marketing communications—Simple branding works best. Extensive awareness creation at the first launch is critical. And don’t forget the importance of transparency in the program details and rules.

As channels and products move to the background in the evolution of the company-customer relationship, so too must loyalty programs. The Total Relationship Loyalty framework provides the starting point for companies looking to harness their loyalty programs and customer relationships as a competitive differentiator. After all, real loyalty comes from a customer’s total relationship with your bank. Shouldn’t your loyalty program reflect that?