Understanding and tapping into customer loyalty can lead to significant long-term business benefits. For many companies, however, reaching this goal can be elusive.

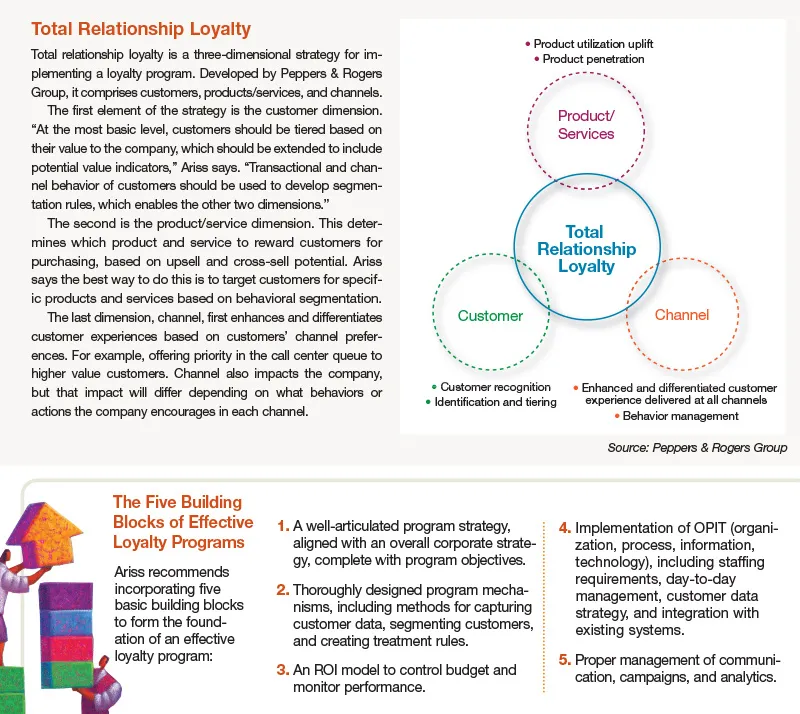

Myriad rewards programs, segmentation schematics, and distracting marketing fads make designing the right loyalty strategy a daunting challenge, but creating organizational alignment around how to define and measure it can help.

“You have to start with a definition of loyalty, and realize that not all customers are relationship-oriented,” says Tom Lacki, Ph.D., a Peppers & Rogers Group senior advisor. “Perhaps more important, realize that loyalty programs are not an alternative to creating and delivering a superior customer experience.”

For companies that do venture into developing a loyalty program, understanding customers’ needs and expectations is a must, as is tracking the right metrics.

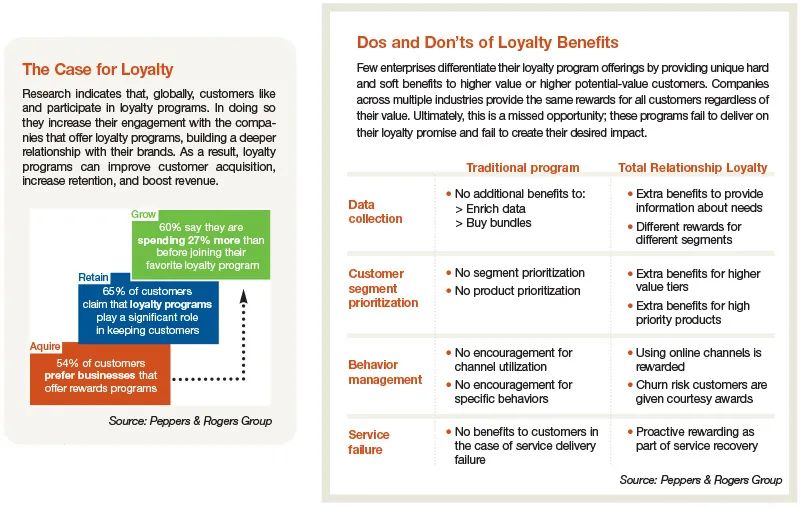

“With the proliferation of loyalty programs comes a greater awareness of customer service issues, and consumers feel that they deserve special treatment as a reward for their loyalty to a brand,” says Peppers & Rogers Group partner Mounir Ariss. “Many businesses have successfully managed to reduce churn and increase cross-sales by utilizing rewards programs.”

Optimizing those loyalty programs, however, means knowing which customers are likely to exhibit loyalty in the first place, and how to best reach them.

According to Forrester Research Vice President and Principal Analyst Bruce Temkin, service seekers are most likely to be the most loyal.

“Companies can target these consumers by delivering, and better communicating about, improved customer service,” he says. “These customers may take a bit more investment, but...they’re likely to buy more from you in the future.”

Building Relationships With Loyal (and Potentially Loyal) Customers

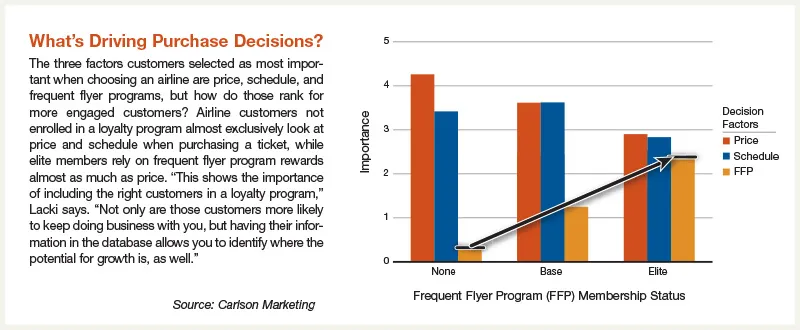

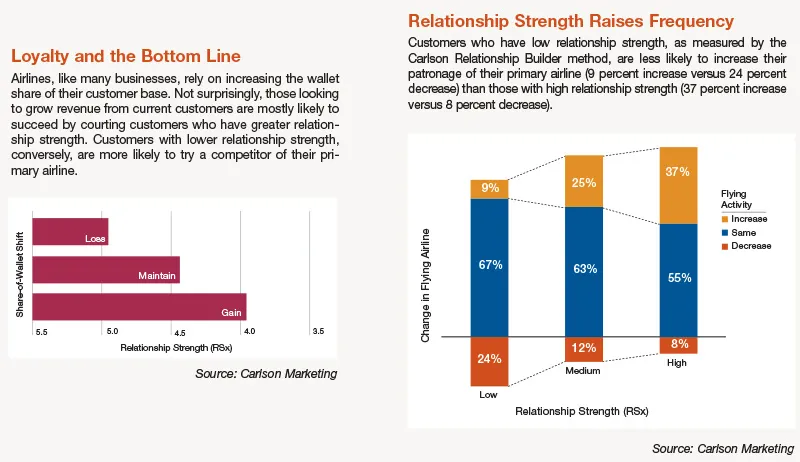

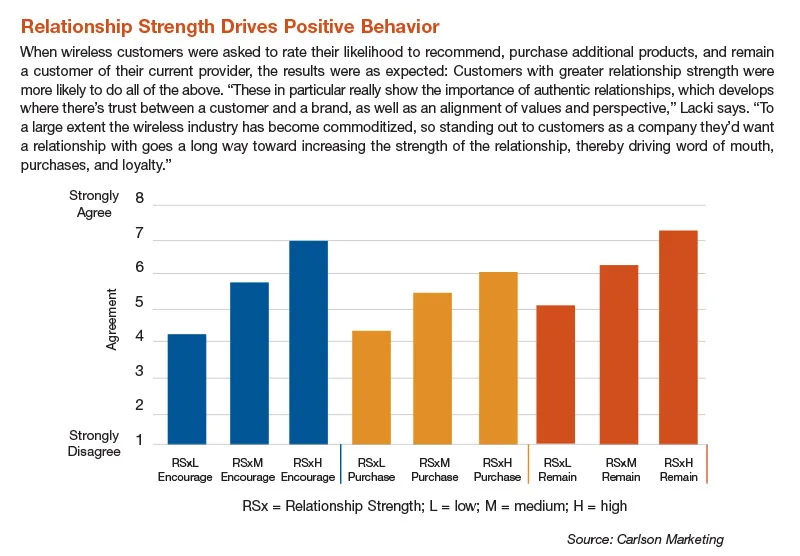

Customer loyalty—or the lack of it—directly impacts a company’s ability to maintain lasting, profitable relationships. Research conducted through the Carlson Relationship Builder series examines how much of an impact relationship strength, and other factors, have on loyalty and its value to an organization.

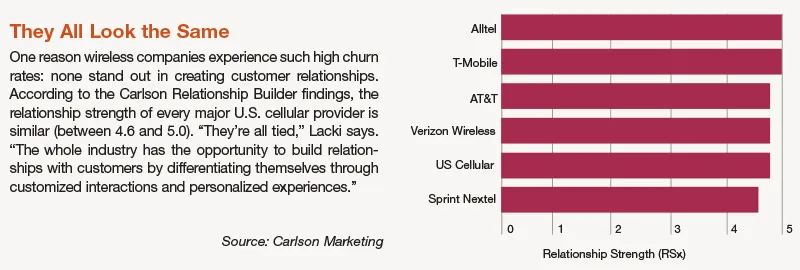

The two most recent installments focused on the airline and wireless industries, which typically experience especially low customer satisfaction and high churn rates. Despite that fact, there is potential to build loyalty in both cases. “Not all customers are relationship oriented,” says Tom Lacki, Ph.D., a Peppers & Rogers Group senior advisor. “But when you look at customers at a granular level, there’s a significant portion who are predisposed to developing relationships.”

Airlines tend to focus more on transactional loyalty programs, which reward customers who spend the most or travel most frequently. Wireless companies, on the other hand, tend to use behavioral loyalty programs to engage customers. In both cases, however, Lacki emphasizes the importance of customer experience in building a profitable relationship. “Loyalty programs are not the alternative to creating and delivering superior customer service,” he says. “They exist to supplement good customer experiences, and reward behavior that companies want to instill in their customer base.”

Loyalty by Industry

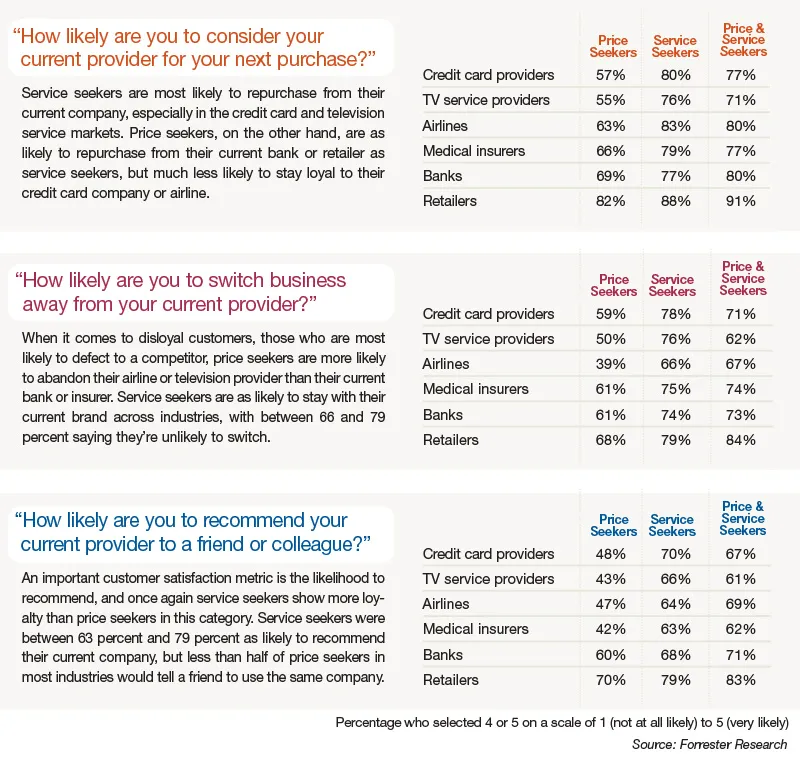

Forrester Research surveyed consumers to determine which are price seekers, service seekers, or a combination of the two. Respondents then indicated which companies they frequent in a variety of industries, and whether they’d use that company again, switch to a competitor, or recommend the company to a friend. The results, revealed in the report “Service Seekers are More Loyal than Price Seekers,” show that service seekers are the most loyal customers. “Service seekers outnumber price seekers across all industries, and it turns out they’re more loyal,” says Forrester Vice President and Principal Analyst Bruce Temkin, author of the report. “Investing in better customer service may not only attract more customers, but it will likely bring in more loyal customers, as well.”

Why Shoppers Keep Coming Back

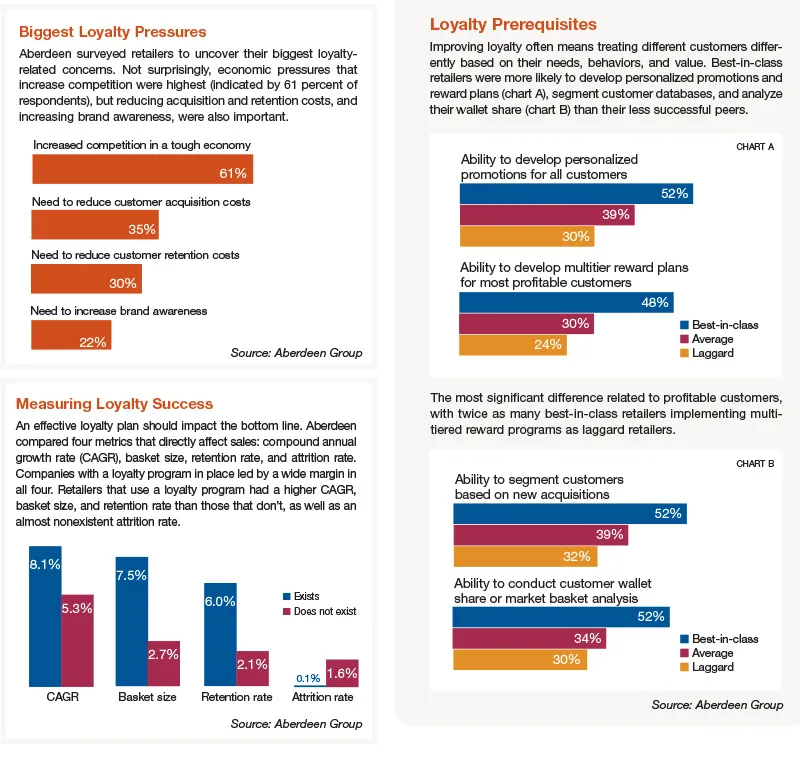

It would be easy for retailers to focus on the short term given today’s economic climate. Those that also consider the long term, however, are more likely to survive during, and thrive after, the downturn, according to a new report from Aberdeen Group and Carlson Marketing. “Cutting Edge Customer Loyalty,” authored by Aberdeen’s Sahir Anana, explores whether the most successful retailers owe their success to customer loyalty programs.

The report splits retailers into three groups—best-in-class, average, and laggard—based on three factors: average basket size, customer retention rate, and customer attrition rate. Considering these factors, it’s clear that companies focusing on customer loyalty are far more likely to be best-in-class than average or laggard.