We live in a digital world but as consumers and brands embrace the ease, convenience, speed and other perks of going digital, we are increasingly susceptible to its dark side: fraud.

The enthusiasm with which consumers have embraced digital content and e-commerce is predicated on trust. Four out of five consumers trust that businesses have made the protection of their personal information a top priority, according to a recent report by Experian. But the report also found that 63 percent of businesses have experienced the same or more fraud losses in the last twelve months. What’s more, 54 percent of businesses are only “somewhat confident” in their ability to detect fraudulent activity compared to 40 percent who are “very confident.”

Combating modern-day fraud

First and foremost, any strategy pertaining to online payment/transaction fraud should focus on monitoring suspicious transactions. Companies that are actively looking out for suspicious activity are better prepared to act when they see it, which can help them stop fraud in its tracks or even before it occurs.

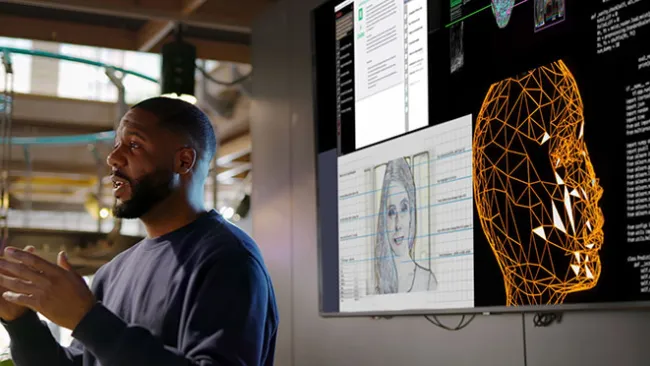

Technology should be any company’s first line of defense when it comes to battling fraud. Fraud identification filters, algorithms, and knowledge management databases power fraud detection bots that can react quickly – in less than a second – and alert companies to millions of attacks and suspicious activities, research shows. But bots alone won’t get the job done. They’re great at detecting fraudulent activity, but they are not perfect.

Humans are necessary for a couple reasons. A bot could inadvertently flag legitimate transactions as suspicious, for instance and vice versa; and there are many cases that are too complex, new or unwieldly for bots to accurately handle. Therefore, a team of people dedicated to fraud prevention, detection and mitigation is needed.

Fraud investigators and analysts review every case using static and dynamic indicators. They examine evidences from many sources: user-supplied information, proactive information search on the parties involved, digital fingerprints detected behind all user activity, profile building through Internet searches, and history on the platform, just to name a few. They focus on inconsistencies and abnormalities in information. The process gives the investigators valuable insights that is passed along to companies, with the ultimate goal of detecting newer trends and evolve the risk mitigation infrastructure.

Stopping fraud in its tracks

While fraud, unfortunately, is nothing new, the technology cybercriminals use keeps evolving and attack rates have risen 24 percent globally year-over-year, reports ThreatMatrix. Malicious bot attacks are another form of fraud hurting businesses, particularly in the e-commerce realm, a sector that was the global target of more than 2 million bot attacks in the second half of 2018 alone.

With technology changing and cybercriminals becoming savvier, preventing fraud-related issues is a continuous process for brands, one that demands a mix of human intervention and technology tools. At the same time, consumers secure transactions but don’t want to endure extra hassles for the privilege. This puts an additional burden on businesses: to increase security without complicating the customer journey.

The difficulties that companies face in combatting fraud can have major implications for consumers and brands alike. In the aftermath of experiencing fraud, consumers typically change their perceptions and behaviors. If businesses don’t pay attention to those shifts, consumers can end up hampering the effectiveness of businesses’ fraud measures.

Against this backdrop, focusing on fraud is critical for businesses. Consumers want and expect online transactions to be secure. They want to conduct business, make purchases and communicate with companies without fear, and it’s up to businesses to provide that secure customer experience.

Fending off fraud is no easy task, but it’s possible if businesses take the right precautions and steps. These include investing in technology that can stop malicious bots and other automated attacks; and investing in AI, machine learning, and data scientists. And, perhaps most importantly, they need to have an independent fraud prevention team – including human investigators – dedicated to this effort.

All of this may seem like a large undertaking, but it is time and money well spent. Having a fraud prevention strategy and infrastructure in place protects companies from fraud while also making consumers feel more confident about doing business with them. It’s a win-win.