Contemporary banking customers increasingly prefer alternative channels. With the help of the Internet, mobile phones, and other emerging technologies, customers are fully aware of their many options, and they are exercising them. This trend is forcing financial institutions to reconsider their channel strategy, especially if they want to increase shareholder value over the long term.

As customers take control of the relationship with their service providers, they demand a smooth, personalized multichannel experience, built according to their needs, not the priorities of the business. So what is a company to do?

There are three common practices that most financial institutions perform without really looking deeply enough at the impact on the customer experience. Below are specific actions these firms should consider before they make any changes in the customer experience.

PRACTICE 1: Maximize the Number of Channels Offered and Functions on Each Channel

Competitive “me too” pressures and IT’s tendency to follow the newest “shiny object” often overshadow customer experience and financial feasibility when making a decision on new channel and function offerings. Before making any impulsive channel and technology investment, executives must review the key elements of a multichannel model. This includes conducting a review of their multichannel strategy, as well as of the role and functionality of each channel.

Multichannel strategy review: When reviewing a firm’s multichannel strategy it’s important to consider the optimal level of multichannel integration necessary. This will often depend on the complexity of the offer, as well as the current level of channel integration. Integrating channels and increasing products and services provided through these channels can increase costs. Banks with relatively conservative investment budgets may prefer to implement fewer functions to current channels.

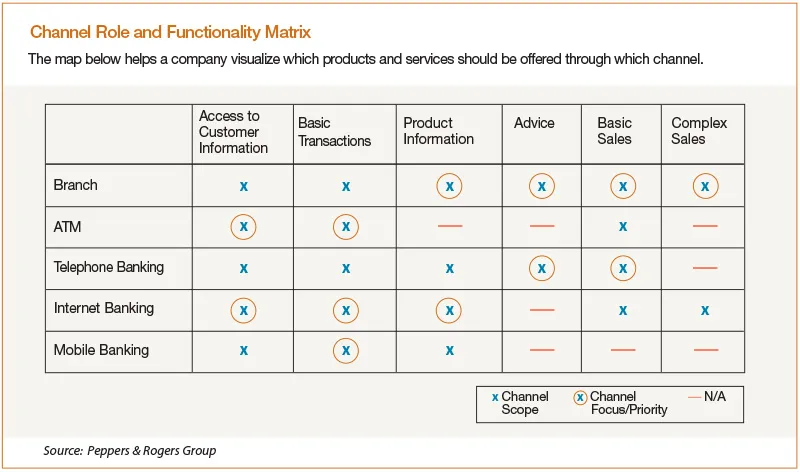

Channel role and functionality review: After identifying the appropriate channels to integrate, the next step is to review the role of each channel in a multichannel model. Creating a matrix of channels and services can help customers prioritize and develop a plan for how to best use each channel (see figure 1).

Services provided on a particular channel can also be selected as the focus of that channel, depending on the channel specifics and strategy. For example, customers can be offered almost all services through the branches but the main focus of a branch would be to perform complex sales and provide in-depth information to its customers. On the other hand, the main purpose of Internet banking could be as a platform for routine banking transactions and providing service information.

By defining channel focus and core competencies, financial institutions can implement their channel strategies more effectively since customers will be directed to the most efficient channel. The key point here is that banks should not force customers to use a specific channel against their will, but should instead make those channels attractive.

PRACTICE 2: Migration of Customers to Alternative Channels

Migration of customers to direct, so-called “low-cost” channels has significant benefits. However, it also can pose significant risks. Opportunities for migration to low-cost channels may actually destroy customer value if implemented incorrectly, because they can negatively impact the customer experience. Before pushing customers to alternative channels, companies must understand their customers’ needs and behaviors and then review their internal capabilities.

Understanding customers: Customer segmentation must be the starting point of a multichannel migration strategy. In most cases, three-pronged segmentation—based on value, needs, and behavior models—allows institutions to understand their customers and customize channel offerings accordingly. While designing the multichannel strategy, the value segment of a customer base determines the tactics to be used for increasing profits, while behavior and needs draw the boundaries for these tactics.

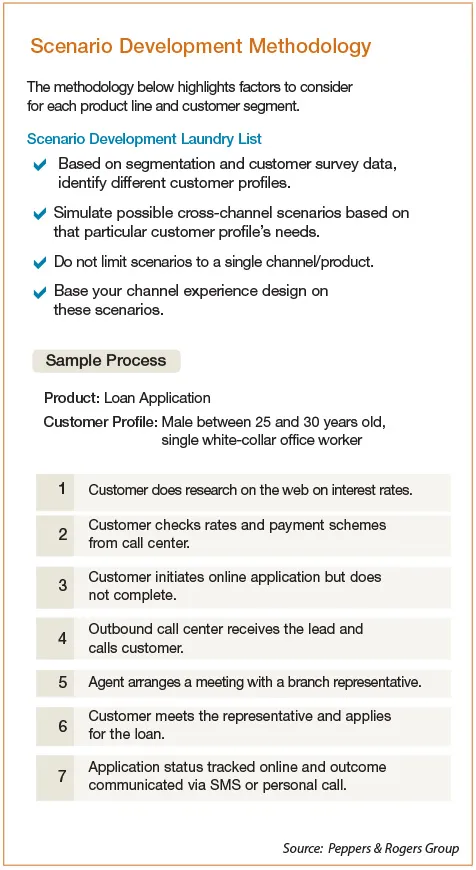

Develop cross-channel customer journey scenarios: Developing a successful migration strategy requires an understanding of customers’ real-life channel experiences. One way to acquire that knowledge is to create simulated scenarios for key customer segments based on customer research. Figure 2 demonstrates a sample scenario development methodology.

Understand internal cost and revenue structure: A majority of migration decisions are based on the assumption that direct channels such as the Internet are less costly than traditional channels. However, for most institutions, legacy accounting practices make it impossible to figure out the real activity-based cost structure by transaction type and channel. Institutions, in order to design a sound multichannel strategy, must understand current cost and revenue structures and even make revisions if necessary before deciding to migrate a group of customers to another channel.

Understand channel capabilities: Before deciding on a migration strategy, executives must ensure that the targeted channel for migration provides at least the same capabilities as the original channel. The organization must analyze each channel according to functionalities in terms of interface and system-related capabilities. Consider timeliness, available guidance, level of detailed information available, interactivity, and the like.

PRACTICE 3: Channel-Centric Management: Avoid the Silos

Many financial institutions start down the migration path, but success is limited by a siloed, channel-centric focus. To make an impact they must adopt a multichannel, customer-centric perspective where cross-channel roles and responsibilities are clearly defined across the organization. The main focus areas should be the organizational structure, ownership of the customer among channels, pricing, and implementation of cross-channel KPIs.

Organizational alternatives: Having the right organizational structure in place is mission critical when it comes to multichannel management. If the corporate structure, success metrics, and incentives are not aligned, internal conflicts will limit progress.

Business units should be established or restructured in order to manage, carry, and coordinate channel-related tasks effectively. Although there is no ideal solution, there are three basic structures for channel management within the organization to consider based on the needs and condition of the organization:

1. Independent channel units

In this structure each channel has a different team, and individual business units request actions from the related channel unit. Although it positively affects the expertise and know-how on the particular channel, customer experience across channels is easy to ignore, hampering multichannel integration efforts. Other drawbacks of this structure include overlapping requests that increase unnecessary workloads and decreases synergy between channels in terms of utilization of common resources.

2. Separate channel units under each business unit

This structure is the establishment of small channel units within each business unit that are capable of answering the particular needs of the business unit. The advantage of this structure is the elimination of the coordinating entity between business units, IT, and customers, which can easily lead to inconsistency across different customer touchpoints.

Drawbacks include underdeveloped channel skills limited to business units’ requirements, and like independent channel units, they cause overlapping requests that increase unnecessary workloads, and decreased synergy between channels in terms of utilization of common resources.

3. An independent channel management unit

In this structure the channel management unit is an independent autonomous entity that governs and coordinates the information flow between business units and the IT department. This structure brings increased efficiencies in the resource utilization of different channels, development of wide know-how and expertise regarding various channels, and more effective prioritization of requests by business units. It also enhances the IT department’s request-handling performance by providing a consistent single point of contact for incoming requests.

On the other hand, an independent unit will lengthen the request process by adding an extra link in the chain as the middleman between the business units and IT department. It may also cause conflicts regarding the prioritization of requests of different business units.

Customer ownership: Another important driver of success for customer-centric channel management is the responsibility for the “ownership” of the customer relationship among channels. Institutions can choose between different ownership structures, varying from a single-channel-centric model to an independent ownership model.

The first model gives the ownership to a single channel, in most cases the branch, as a result of historical and physical weight of the channel, whereas the second model provides freedom of each channel to become a profit center by owning its own customers.

Executives need to consider their institutions’ specific conditions before deciding on which model best matches their business strategy. Both models have benefits and risks. For example, the first model lacks incentives for other channels to consider profitability, as they are positioned mostly in a supporting role. However, the second model opens the door for cannibalization as a result of competition between channels.

One approach is to determine customer ownership using five criteria:

- Largest credit balance

- Largest debit balance

- Largest number of products

- Highest number of transactions

- Where the customer first opened an account

The ownership is defined by the order above, and the owner of the customer is the branch regardless of the fact that the customer uses other channels more than a branch. This is a best practice for branch-centric organizations because it places branches in the center of the customer relationship.

Pricing alternatives: Channel pricing is also an important component of customer-centric channel management. Although one can adopt a number of hybrid structures, two major models emerge in the industry, similar to the customer ownership models: one product one price versus multichannel pricing.

The one-product–one-price model adopts a straightforward approach where there is only a single price for the same product across all channels regardless of the customer segment. A customer applying for a personal loan receives the same rate at the branch compared to online channels.

The model is mostly applicable where branches are the focal point of the strategy. However, it does not address customers’ different needs as it does not differentiate between customer segments and channels.

The multichannel pricing model suggests different pricing by customer segment and channel. A customer applying for a personal loan can receive a different rate based on the channel of application and his/her segment. However, as the ultimate customer-centric model for pricing, it brings a risk of causing cannibalization among channels as well as increased complexity for managing costs.

Setting the right KPIs: Consumers select different channels for different purposes, such as gathering information, seeking product advice, or completing a sales transaction. This makes it difficult to measure channel performance accurately. To ensure accurate channel performance management, banks should consider a number of key metrics that will help to define their KPIs according to their corporate strategies. These metrics are identification of customer channel segments, identification of channel revenues and costs by channel segment, and calculation of true conversion rates across channels.

Customers may display different channel usage depending on the type of channel, as well as the products and services offered in each. For example, a customer may gather information about a product from the website (say investment funds), go to the branch and ask for advice about which fund to purchase, and then go home and call the contact center to place an order after evaluating the product with her spouse. In this case she is a hybrid customer regarding channel usage; non-hybrid customers may be using only the branch or only the website for all their needs.

As consumers increase their use of multiple channels even when doing a single transaction, contribution of a channel to the organization’s sales activities cannot be measured by looking only at the number of total sales transactions completed on that particular channel. After identifying channel segments, banks can calculate the contribution of each segment to the total revenue and costs incurred for each channel. This information can be used to set more clear and effective channel targets.

Ultimately, there is no ideal approach for multichannel practices. Each institution should consider its own reality in terms of corporate strategy, business model, and customer behavior to tailor its own approach and meet the unique needs of its customers.