Any company can collect data; all it takes is a customer base, input fields, and a database. All-State Legal has all those things, which allowed for the extensive collection of customer information. However, drawing insight from that data proved far more difficult. Although it is a relatively small company, it has complex data analysis needs because it provides stationery and printing supplies to the legal industry through four sales channels.

While adept at gathering customer information and asking the right questions, All- State Legal lacked the analytics capabilities to capture nuances in its customer data that would improve its service levels. “We have programmers and IT staff, but we struggled with the analytical skill to have actionable insight into our customer data,” says Susan Jacobs, All-State Legal’s director of marketing and client services.

In March All-State Legal partnered with the managed analytics team to develop a strategy for best utilizing the wealth of customer data the company had collected over the years. While it serves a homogenous vertical market (90 percent of its customers are law firms), All-State Legal customers’ needs vary greatly. “We expected customer value and behavioral characteristics to be very similar,” says Lale Dagli, a consultant who worked on the project. “We were surprised how different they, in fact, were.” High-value customers, for example, differed greatly in their order cycle stability and their channel usage. Some used the Web exclusively, while some ignored it entirely.

Once Jacobs and her team were armed with the insight into how customers behave and which provide the most value, they developed a seven-point plan to improve sales and marketing efficiency, reduce customer turnover, and increase service levels. “We knew exactly what our business problems were, but we couldn’t take a particular problem and identify the customers who were most vulnerable or strongest in that category,” Jacobs says. “There was no way to pinpoint SWOT aspects in our databases.”

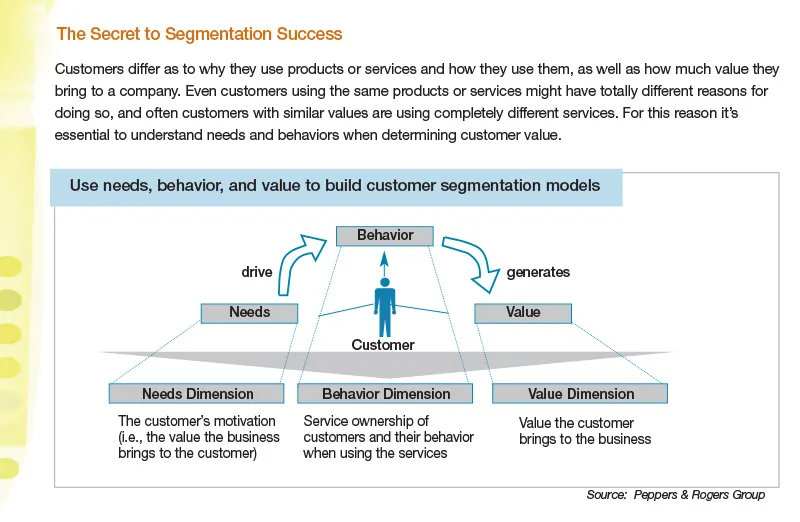

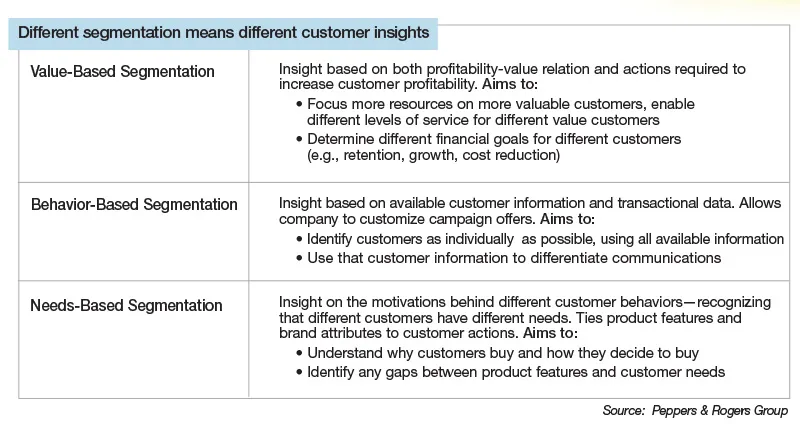

Segmenting customers was the solution. Jacobs implemented a customer segmentation model based on both customer value and behavior, using the analysis of order data, invoice and shipping logs, and firmographic information (i.e., customer data). Customers’ value scores are directly related to revenue generation, but their behavioral scores include statistics like dollars per order, order cycle stability, and channel usage. Based on the two scores, all active customers fell into one of seven value segments. All-State Legal had a good idea of which customers were valuable before, but Jacobs says that adding a behavioral aspect to the mix provided a deeper perspective, especially for the sales staff.

Next, the company focused on reducing churn by identifying customers who were most at risk, as well as possible actions to reduce vulnerability. Churn included not only customers who might end their relationship with All-State Legal, but also those who might reduce their buying. “In many cases we hold onto customers for decades, but lose pieces of business along the way,” she says. “Focusing our attention on customers who are at risk for defection or reduction is a significant milestone for us.”

The team identified who was most at risk by analyzing order cycle and recency (i.e., how recently All-State Legal engaged with the customer). By analyzing past orders and publicly available data, Jacobs and her team can see which customers are late for placing their next order, as well as which customers’ purchases had significantly decreased.

Using the segmentation and churn analysis, All-State Legal implemented marketing campaign rules to target different customer groups with different messaging. The messaging was also targeted based on a customer migration analysis, the results of which predict how customers will move up or down the value chain based on their lifecycle stage and behavior. Jacobs and her team analyzed the responses by examining the impact on sales by channel, product, and customer. So far the most noticeable result is tracking how long conversions typically take; as a result, Jacobs has eliminated customers from the mailing list who don’t respond within that period.

Lastly, All-State Legal developed rules around cross-selling within its inbound call center. Every call center interaction includes a promotion for the “next best product” for that customer, determined statistically, based on similar customers’ purchasing behavior. That information is then handed off to the field sales team for follow-up. “In all of these implementations, we plan to measure over time what the impact is by comparing our metrics to before we began using analytics,” Jacobs says. “For every dollar that we spend on marketing or data analysis, is it developing more sales, profit, or some combination of the two?”

Ensuring each dollar is effective means not only studying customer data, it also means consistently gathering new and updated information to avoiding wasteful spending. “Data integrity was a challenge in the beginning because most of the data tables and definitions were outdated,” says Onder Oguzhan. “Now that it’s current, segmentation and churn analysis are repeated monthly, and campaign analysis data is updated quarterly.” All the analytics reports, including the customer segmentation and churn analysis, are rerun on All-State Legal’s database regularly to ensure that changes to customer information, including those made by the sales and marketing teams, are factored into the analytics.

Since much of the analysis and segmentation occurred this past summer, All-State Legal doesn’t yet have updated metrics to gauge the results of the project. Jacobs says she expects to have measurable results by fourth quarter 2009, and is optimistic about the program’s success. Regardless of the hard metrics, she says the project has given the company the opportunity to look beyond how the marketing and sales teams use customer data, and to implement changes on an operations level to make the whole company more customer centric.

Every department within All-State Legal now views customer data in a different light. The company thinks more like its clients, looking past numbers and seeing customers the same way lawyers see past facts and relate to the people they’re representing. “Our operations team is adopting segmentation, particularly with priority scheduling for high-value customers,” Jacobs says. “Our service team has taken a similar approach, removing or reducing fees for our most valuable customers as well.”

The data is too fresh to measure changes in customer satisfaction, but Jacobs says she expects it will rise as a result of these initiatives. “This has done something amazing for how we view customers internally as an enterprise,” she says. “We’re much more conscious of where we spend financial and human resources to optimize the experience for customers.”