The proliferation of loyalty programs today is making all too many companies look the same to customers. This is especially concerning to business leaders using those programs as a primary retention strategy to help weather the current economic storm.

Therefore, to avoid customers’ potential boredom and reengage them with those loyalty programs, companies are now challenged with developing programs that stand out. Truly successful loyalty programs will incorporate new and innovative loyalty technologies, strategies, and program designs. As crucial as that approach is, there are some key components of loyalty programs that will continue to be integral, such as building trust with customers and offering meaningful rewards.

Creating or fostering positive emotions about a company and its products, however, takes more than providing services on time or using promotional techniques. It takes a long-term understanding of the customer base and an alignment between what the customer values and the value proposition of the enterprise.

By integrating loyalty program basics with a deep understanding of the customer, companies will see these benefits:

- Providing competitive advantage

- Raising barriers to exit for the targeted segments and individuals that are most vulnerable

- Increasing customer profitability

- Decreasing attrition and churn win-back costs

- Cross-selling and up-selling services to continuously maintain lifetime loyalty

- Maximizing customer “stickiness” by using information technology to provide “multiple points of contact”

Characteristics of successful loyalty programs

Loyalty programs that are recognized throughout the world as “best in class” share certain similarities. These similarities can be defined as prerequisites for success, principles every company must pay attention to when designing, enhancing, and managing its loyalty program (see figure 1).

The first requisite characteristic is that a loyalty program must be easy to use. Customers don’t have the time or desire to be engaged in a complex relationship. Companies need to keep their loyalty programs simple to maximize customer involvement. Hotels and airlines that have complex blackout date systems with varying points for redemption are classic examples of loyalty programs gone wrong.

The most common mistakes companies make with their loyalty programs include:

- Putting rules on how points can be used

- Using complex point scoring systems

- Putting time constraints on point redemptions

- Offering extensive choices for points redemption

- Overburdening customers during the sign-up phase with extensive forms

- Making the sign-up and usage process difficult by offering limited channels of interaction

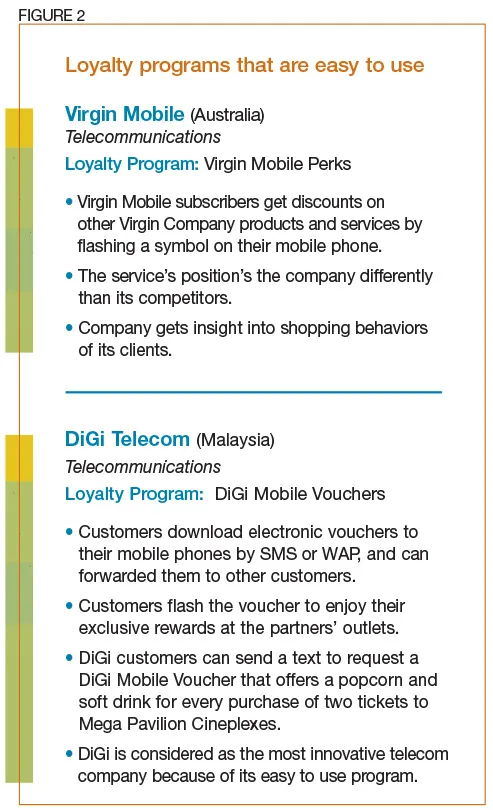

Most important, the program should be easy to understand. This means that both employees and customers should be able to explain the program to others without any difficulty. Virgin Mobile and DiGi Mobile are two examples of companies whose loyalty programs are easy to use and are perceived as such by customers (see figure 2).

Most of the successful loyalty programs also have attainable soft and hard rewards. Since every customer is different, some prefer economic or hard benefits, while others are interested in value-added services. For some members, soft benefits are not just rewards; they become opportunities of a lifetime. These customers will aspire to redeem the rewards, which translates to growth in spending, increased share of customer, and increases in overall retention for the company.

In fact, special access and unique privileges gain importance as customer value increases. As companies appeal to more affluent, higher-volume, or higher-spending customers, soft-benefit recognition elements become the most significant differentiator. Soft-benefit rewards are the most difficult for a competitor to duplicate and are instrumental in reducing churn in top-tier segments. Starhub and M1 are two examples of companies that have soft and hard benefits in their loyalty programs (see figure 3).

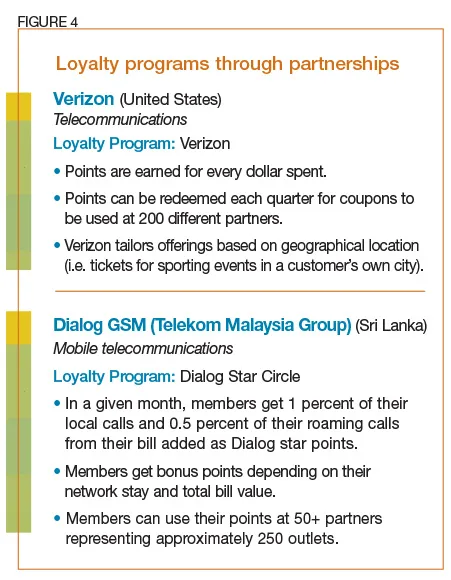

An additional feature of successful loyalty programs is that they provide options; that is, the program has looked externally for partnerships and thus choices for its customers when it comes to redemption options. A successful loyalty program should be operationally and financially ready to consider these different options when the right times come. This added value of offering options through partners is important for the company in terms of more visibility and exposure, as well as for its customers in terms of flexibility and choice. Verizon and Dialog GSM are two examples of companies that use myriad partners as essential elements of their loyalty programs (see figure 4).

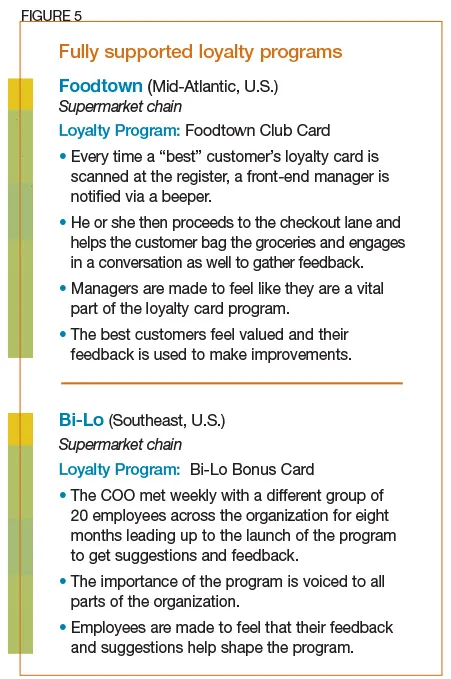

The success of a loyalty program requires commitment from all internal and external parties that are involved with the program to any varying degree. The marketing department of a company alone cannot ensure the success of the loyalty program. To that extent, companies need the support of the whole organization in the launch and execution phases of the loyalty program, as well as in providing insight for and support with ongoing enhancements.

Obtaining organizational support involves:

- Creating excitement throughout the organization about the launch and enhancement of the program

- Gaining insight from different departments in the design and enhancement phase of the program

- Working in conjunction with stakeholders (particularly IT) during the project

- Training all front-line staff on the purpose and strategy of the program

- Capturing feedback from employees and customers regarding the program on an ongoing basis

- Making modifications to the program based on feedback

- Rewarding and celebrating success of the program

Foodtown and Bi-Lo are two examples of companies that excel at involving the entire organization in the loyalty program (see figure 5).

An additional trait of successful loyalty programs is that they are unique. This means they are designed to tailor-fit the company (e.g. its strengths, weaknesses, culture). It also means a company can use them to treat different customers differently, recognizing all customers are unique in their wants, needs, and motivators. Companies should never use a one-size-fits-all approach in designing a loyalty program.

Questions to ask before launching a loyalty program:

- What rewards or benefits would motivate my best customers to become more loyal?

- How do I want the program to portray my company; that is, what is the positioning I desire within the marketplace and in the customer’s eyes?

- How will my loyalty program be unique?

- How will my loyalty program differentiate my various customer groups?

- What characteristics (i.e. corporate culture, diverse offerings, pricing) of my company do I need to consider in designing my loyalty program?

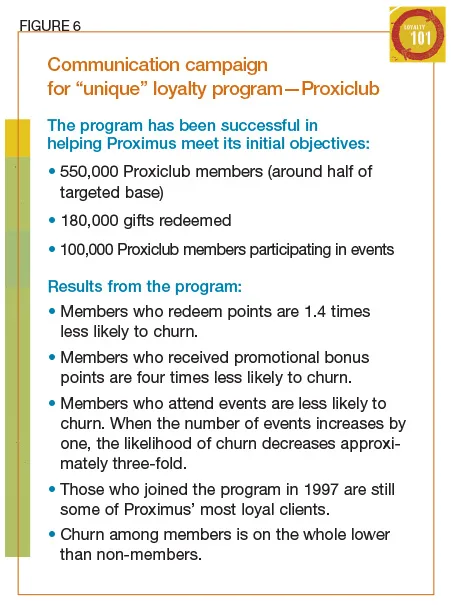

Uniqueness is perhaps the most challenging aspect of a successful loyalty program. For example, Proximus Mobile, a Belgian mobile phone provider, created a program to achieve several goals including reducing churn, increasing emotional links to clients, increasing customer satisfaction, getting to know their customers to better respond to their needs, and countering the competition.

The company targeted the program to 1.3 million of its 4.3 million customers. The points-based program includes three Club tiers—gold, silver, and welcome—to segment individuals and businesses based on usage and value. Members earn points upon entry to the program, on their birthdays, and annually (all as “gifts”); for every Euro spent on cell phone calls, SMS, and MMS; and for signing up for the Citibank Proximus Visa Card. Members then can use these points to receive perks like call minutes, calling cards, cell phones, discounted tickets to events, movie tickets, and office supplies. Members also receive the Proxiclub Card, which they can use to obtain discounts on program partners’ goods and services. These partners also provide special offers and promotions to Proxiclub Card holders.

The program currently has about 550,000 members. Members have redeemed about 180,000 gifts since the program launch. Proximus supports the continued growth and success of the program with a strong communications campaign (see figure 6).

Loyalty programs must consider customers’ quirks

Once a company ensures the placement of success characteristics, it can further improve loyalty program performance by understanding and acting on the fact that different customer groups respond differently to the same loyalty offering.

Consider the findings of a study on a convenience store franchise. The key research question was whether loyalty programs change consumers’ patronage levels and exclusive loyalty to the firm. Consumers who were heavy buyers at the beginning of its loyalty program were most likely to claim their qualified rewards, but the program did not prompt them to change their purchase behavior. In contrast, consumers whose initial patronage levels were moderate gradually purchased more and became more loyal to the firm. For light buyers, the loyalty program broadened their relationship with the firm into other business areas.

Consequently, moderate buyers are the most attractive target. These consumers perceive enough relevance and benefits from the program to change their purchase behavior and shift their purchases to one firm. This leads to the following hypotheses: Moderate buyers’ loyalty levels increase faster than those of heavy and light buyers after loyalty program enrollment.

The findings suggest a need to consider consumer idiosyncrasies when designing a loyalty program and illustrate consumers’ co-creation of value in the marketing process. These outcomes are important to examine because they are directly related to consumer profitability and the financial success of a loyalty program.

A loyalty modeling approach

A closer look at the study results reveals how the convenience store determined that moderate buyers are the optimal target for growth.

The convenience store loyalty program allows consumers to earn points for every dollar they spend at the store. Tiers of rewards are related to the total number of points accumulated. The program rewards consumers an average of $1 in free products or services for every $100 spent (i.e., 1 percent reward ratio), with higher-tier rewards carrying a higher reward ratio. Consumers need to enroll in the program to earn rewards, but program membership is free.

The study examined a random sample of 1,000 consumers from the program using two criteria: 1) the consumer joined the program in its first year of operation; and, 2) the consumer made at least two purchases. The latter constraint ensured that there was meaningful data for every consumer.

The data covered purchases during the first two years of the program. Altogether, the sample made 42,788 purchases. The number of purchases made by each consumer ranged from 2 to 369, with a median of 25. The median transaction size was $13.75.

Consumers’ purchase frequency is modeled as Equation 1, where Frequency-im is the number of transactions by consumer “i” in month “m,” and Month-im is the number of months consumer i has been in the loyalty program at month m. Logarithmic transformation of Month-im is used to accommodate the notion that purchase frequency is unlikely to increase forever and will gradually reach a maximum point that reflects consumption limit. The model has a dummy variable LastMonth-im, which is set to 1 if month “m” is the last month of transaction by consumer “i” and 0 if not.

This variable is included because consumers tend to reduce their purchase frequency at the end of a relationship. Thus, it is necessary to control for the effect of the last month’s purchases when studying the trend in purchase frequency. To allow for temporary inactivity, LastMonth-im is set to 1 only if a consumer’s previous purchase occurred at least three months before the end of the analysis period: (1)Frequencyim=aiO+ai1Log(Monthim)+ai2LastMonthim+≤im˜

The study uses two-level hierarchical linear modeling (HLM) to estimate the parameters in the model. Compared with traditional linear regression, HLM has two advantages. First, it does not require independent observations, as is often assumed in traditional regression. This use of nonindependent observations is important here because the purchase frequencies for a consumer are likely to be correlated across time. Second, HLM allows the model coefficients at lower levels to be randomly distributed, thus accommodating individual heterogeneity. Explanatory variables can be included at higher levels to explain such heterogeneity.

In the purchase frequency model, the regression coefficients in Equation 1 for an individual consumer are assumed to be normally distributed across the sample, and the expected parameter values for each individual consumer depend on whether the consumer is a light, moderate, or heavy buyer.

Equations 2–4 show the second-level equations used:

2) ai0 = ß0 + ß1LightBuyeri + ß2HeavyBuyeri + µi0,

3) ai1 = ß3 + ß4LightBuyeri + ß5HeavyBuyeri + µi1, and

4) ai2 = ß6 + ß7LightBuyeri + ß8HeavyBuyeri + µi2,

where LightBuyeri and HeavyBuyeri are two dummy variables indicating light and heavy buyers, respectively.

To interpret the coefficients in the equations, Equations 2–4 can be substituted into Equation 1, which produces the following results:

where uim = ≤im + µi0 represents random error. The intercept ß0 shows the expected purchase frequency of a moderate buyer during the first month of the program (when Log[Month-im]=0), the coefficients for the LightBuyeri and HeavyBuyeri dummy variables (ß1 and ß2) represent the differences in these consumers’ initial purchase frequency compared with that of moderate buyers, and ß3 is a key parameter that corresponds to the longitudinal effect of the program on moderate buyers’ purchase frequency. The change in behavior due to Monthim is ß3xlog(Monthim/Monthim–1). Because consumers’ purchase frequencies are hypothesized to increase as a result of the program, ß3 should be positive. The rate of purchase frequency growth gradually slows down as Monthim increases and log (Monthim/Monthim-1) becomes smaller and eventually approaches zero.

The terms ß4 and ß5 represent the differential effects of the loyalty program on light buyers and heavy buyers in comparison with moderate buyers. According to H2, both light and heavy buyers are not expected to increase their usage levels as quickly. This implies a negative value for both ß4 and ß5.

The coefficient for the LastMonth dummy variable, ß6, indicates how much purchase frequency decreases during a consumer’s last month in the relationship. The µi1Log(Monthim) and µi2LastMonthim terms represent the unexplained individual heterogeneity in purchase frequency change over time and during the consumer’s last month as a customer.

This research examines the impact of a loyalty program on consumers’ purchase behavior over a two-year period. It extends prior studies by explicitly modeling the dynamic change in consumers’ spending levels and their behavioral loyalty to the store.

The results suggest that, depending on consumers’ initial usage levels, the loyalty program had different effects on their behavior. Consumers who were heavy buyers at the beginning of the program were most likely to claim the rewards they earned and thus benefited the most from the program. However, their spending levels and exclusive loyalty to the store did not increase over time. In contrast, the loyalty program had positive effects on both light and moderate buyers’ purchase frequencies and transaction sizes, and it made these consumers more loyal to the store.

The most visible change for these two segments occurred within three months of members joining the program, and the growth continued at a steady pace.

At the end of the analysis period, these consumers’ average purchase frequencies were not statistically different from that of an adjacent tier. This supports the argument that loyalty programs can accelerate consumers’ loyalty lifecycle and make them more profitable customers. It also suggests a need to consider consumer idiosyncrasies when assessing the impact of loyalty programs.

Value enhancement

Enterprises that don’t master loyalty program basics and that fail to consider customer preferences and differences will continue to try to “buy” customer loyalty, but in doing so will fail to build profitable, long-standing relationships. Loyalty programs that focus solely on promotions to motivate customers will cause companies to face cost pressures in customer retention and will lower their profit margins.

Businesses must remember that most consumers consider loyalty programs value-sharing instruments. Thus, loyalty programs enhance consumers’ perceptions of a firm. In fact, loyalty as a value enhancer not only helps to ensure a loyalty program’s success, it also gives businesses the ability to provide superior value to the customer relationship, to boost retention, and to increase profitability.