In 2021, fintech and other industries hit the reset button on customer innovation and the employee experience. Now, leading financial institutions are doubling down on those innovations and insights to drive both resilience and growth. Here are five customer experience trends that the fintech industry can’t ignore.

1. As banking gets more digital, customers need more support

After leading the way in making banking more convenient, fintechs will continue to redefine the financial customer experience. As the nature of money changes with the rise of cryptocurrencies, artificial intelligence, and the integration of different business processes, expect fintechs to develop more ways for customers to do more with their money that add value to the customer experience. And expect customers to look to these brands to help them navigate this new financial journey.

Money is personal. And customers will want to talk to a real person when they feel personally vulnerable, whether through fraud, a complicated transaction, or other emotionally charged experience. Fintech brands need to be mindful of the customer journey and know when to insert the human element and when to use digital, efficiency-focused tools to provide a differentiated experience at scale.

2. Proactive frictionless customer support will be a competitive differentiator

In order to continue taking share from incumbents, fintechs will have to create value faster than their competitors. Proactive frictionless customer support—anticipating, identifying, and resolving customer issues based on customer intents before customers are aware of them—is a massive opportunity for fintechs to deliver value while reducing costs.

In addition, back-office automation can help brands streamline the experience and lower costs to serve by automating processes that support Know Your Customer (KYC), Anti Money Laundering (AML) and Customer Due Diligence (CDD) activities, among others.

3. Intelligent 24/7 support will become the norm, powered by humans

As 5G ushers in a new age of hyper-connectivity, 5G-enabled immersive banking experiences, augmented reality, facial recognition, etc. will come to be expected. Limited customer support hours or an FAQ will no longer be acceptable. Automated 24/7 support is not enough. Having a strong cadre of support professionals and a robust digital interface enables companies to address unexpected issues that may arise.

4. Cybersecurity and data privacy become strategic priorities

Consumers are increasingly concerned about cyber incidents, fraud, personal data collection and how it’s utilized, especially when it comes to financial information. For fintechs, intelligent identity and access management (IAM) solutions will increasingly become the foundation for great digital banking experiences. Robust cybersecurity and fraud prevention and response solutions will shift from being IT’s responsibility to be strategic boardroom priorities that can make or break customer loyalty and long-term brand strength.

5. True omnichannel service will move closer to reality

Meeting customer expectations for omnichannel service is essential to the continued growth of fintechs. We at TTEC predict that the accelerated need to provide a consistent environment for customers across touchpoints and channels is a key opportunity for organizations to prioritize targeted cross-channel connections as a form of business resilience and future growth.

Fintechs have an unprecedented opportunity to revolutionize the world of finance. Beyond the technology, the customer experience can be revolutionized too.

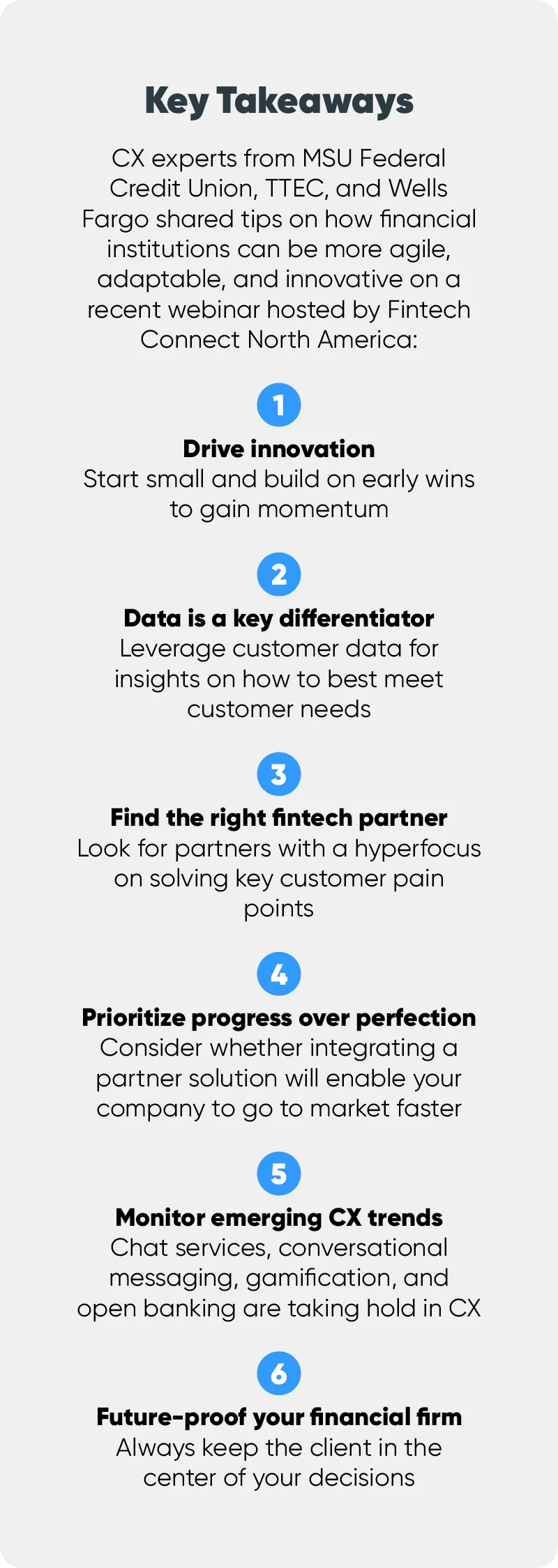

Watch the on-demand webinar “Using innovation to adapt and remain agile with the advantages of new tech - adapting to the new normal” to learn more about how financial brand achieve the performance excellence and agility needed to thrive—now and in the future.