Detailed customer data is increasingly available from a growing number of sources. Harnessing this information is a priority for any organization looking to transform its data into an invaluable asset: a competitive advantage.

Arguably, only the companies that use that information to optimize their business performance are truly competing on analytics. These companies have realized the importance of analytic tools and methods, and are adopting them across their businesses, taking a collaborative, enterprisewide approach. Unfortunately, however, most companies still have underdeveloped analytical capabilities.

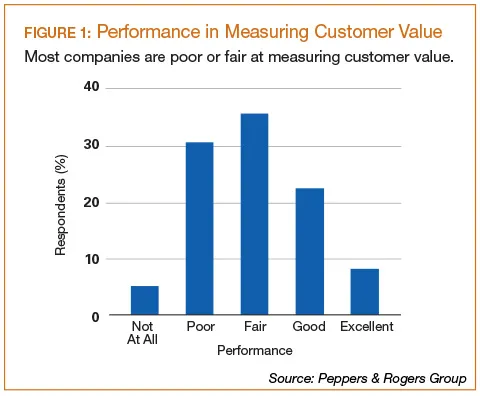

Not surprisingly, according to a recent study by Accenture, among major decisions made by executives, only 60 percent are backed by analytics; 40 percent are made by intuition.1 Additionally, Peppers & Rogers Group research found that only about one third of companies rate their current performance in measuring the value of individual customers as good or excellent; about double that number reported poor or fair performance (see Figure 1).

Recognizing a missed opportunity among so many organizations, Peppers & Rogers Group conducted additional research to determine the underlying causes of companies’ problems with managing their customer analytics functions. Four challenges stood out as being of the greatest concern: organizational silos, credibility of the analysis, data quality, and data relevance.

- Organizational Silos: Silos of conflicting responsibilities, and lack of accountability as a result

- Credibility: The ability to gain credibility for analytics' return on investment (ROI) measurements, especially for the softer benefits

- Data quality: Data cleanliness and accuracy, including the ability to integrate customer data from multiple silos

- The right data: Having and leveraging the right data for high-value activities like understanding potential wallet size or determining future value

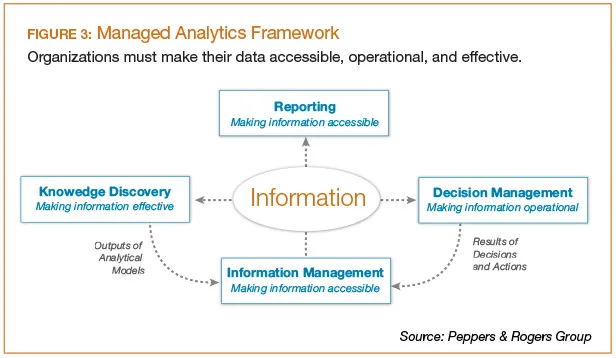

Analytics is the foundation for winning in today’s hyper- competitive environment. Companies must make their customer information accessible and operational by translating data into actionable information. Doing so requires overcoming the four challenges, as well as understanding how to manage an enterprisewide analytics operation in a way that creates measurable value. Here’s how:

Organizational Silos

The need for customer data to be available companywide and accessible by various participants (including the customer), at the right time in the right format, has become a necessity—one that requires collaboration. Instead, cross-departmental clashes are all too common. Our respondents cited this issue, silos of conflicting responsibilities and lack of accountability, as one of their top challenges in running a successful enterprisewide analytical operation.

Many businesses have departmental or functional operations that work independently and seldom share data. Additionally, misaligned incentives or competitive goals among business units discourage collaboration. As a result, there are conflicts over shared resources and data that can contribute to lost opportunities.2

The overall result is a “silo effect,” where the organization is effective vertically, within a department or division, yet lacks efficiency and flexibility in activities that require cross-departmental cooperation.3 However, the success of an enterprisewide, customer-oriented analytics operation depends on the inclusion of all business units and employees, many of whom have direct contact with customers.

Closing the gaps created by organizational silos is a significant undertaking. The way to properly manage an enterprisewide analytics program starts with building the right organizational structure—that is, one that shares information—and establishing corporate priorities and procedural guidelines that are communicated to all business units.

Companies that successfully compete on analytics have leadership teams that motivate employees to exploit analytical thought processes, understand and communicate the value of data quality, encourage companywide data sharing, and communicate to employees the importance of analytical tools and accurate customer data—explaining what customer analytics will accomplish, who will be involved, and what, if any, trade-offs will be necessary.

Business unit heads must align their activities, goals, and compensation with their organization’s overarching corporate strategy. They also must assign responsibility and accountability regarding data quality assurance and data integration practices. Senior management should be closely involved in the alignment process, and a senior-level champion should be responsible for ensuring cross-departmental alignment and accountability.

Ultimately, the credibility of the analytics operation hinges on senior management’s commitment to developing a disciplined and holistic organization, focused on fact-based and timely results—and then clearly communicating both the corporate analytics strategy and any resulting successes with all business units.

Credibility

The ability to gain credibility for analytics’ ROI, especially for the softer benefits, is the next barrier to realizing the true value of an enterprisewide analytics program. Whether adjusting a current analytics capability or starting a new effort from scratch, business leaders must have a clear definition for success. For example, one goal may be to improve marketing campaign effectiveness as measured by response rate; another may be to increase the effectiveness of the sales force as measured by improved close and activation ratios. Doing so clarifies what the employees are supposed to deliver, as well as demonstrates ROI.

The first and easiest component of the ROI calculation to measure is cost. The second, and sometimes more difficult to measure, is value creation. It’s relatively easy to build strong ROI for efficiency. Any opportunity to reduce errors and trim operational or marketing costs, for instance, is an easy business case to make.

Measuring value creation, however, can be difficult because often benefits are not as quantifiable. One area of value creation whose ROI is popularly tracked is sales. According to a Forrester Research study, a key measure for tracking the success of customer engagement is its impact on sales volume. More than half of the survey respondents (57 percent) said improved sales volume is the key determinant in the success of an organization’s customer engagement initiatives, followed by new customer acquisition (40 percent) and customer retention (38 percent).

Gaining credibility by measuring the ROI of analytics is essential, but often requires sophisticated information management, integrated communication across the organization, competent employees, and, most important, a commitment to customer centricity across the organization. Once the required foundation is in place it’s vital to ensure the accuracy and quality of results.

Another crucial element to gaining credibility for analytics investment is customer feedback. Voice of the customer studies allow companies to determine the success of actions taken based on customer data; communicating that information to all internal stakeholders helps gain support for analytics investments.

Ultimately, the most successful approach to gaining credibility for the analytical investment is to launch pilot projects to prove ROI and present sample results.

Data Quality

Data quality can also affect the credibility of analytics program investment. Inaccurate data will result in a loss of confidence, because incorrect decisions could be made based on poor data. Not surprisingly, the companies Peppers & Rogers Group surveyed ranked data quality and integration problems as the biggest obstacle to implementing and achieving success with analytic efforts. Although customer strategy is not all about data, a detailed understanding of data quality is critical to the success of any customer analytics investment. Data quality refers not only to the accuracy and consistency of data, but also to the extent to which good data is integrated and used companywide.4

Well-integrated customer data is essential for delivering meaningful analytical conclusions and accurate decision support processes. Ideally, a companywide data center should integrate all of the data from across the organization. This should include qualitative customer research, as well as behavioral, financial, and operational data. Once the data is linked to individual customers, insight can more easily be derived from existing information.

However, creating a holistic view of customer data can be hindered by dozens of internal barriers. Obstacles include internal politics, organizational silos, heterogeneity of operational IT systems, lack of closed-loop integration between operational and analytic systems, and the inability to generate and leverage customer insight.

Additionally, in large companies, customer data is not only spread across different business units, but is usually stored in an inconsistent way across systems. The complexity mounts for organizations that operate in multiple countries and use multiple systems to store and process the data. Moreover, most systems aren’t designed to work together, often because data collection is not designed for analytical use, but for operational usage—and each group using the data has different interests, priorities, and timetables regarding the use of that data.

Improving and maintaining high-quality customer information and integrating that data starts with a detailed data collection and management strategy, sufficient planning, and careful design of data collection systems using appropriate tools and services. It’s also essential to understand business needs and priorities that have data requirements, as well as to balance the cost of data investments with the value of the analyses to avoid the collection of unnecessary data. True data integration happens when data sources are combined to provide a cleaner, smaller, nonredundant data store.

Integrated customer data design and common terminology are among the prerequisites for gathering and analyzing intelligence about customers and making decisions based on that data. But when it comes to defining a “unique ID” solution to ensure data quality, any technology-related decisions should be driven by the enterprise customer strategy, the related business requirements, and an assessment of the people and processes necessary to implement the business requirements and support the business rules.5

In addition to data quality management and transformation strategies and tools, data quality depends on human resource management strategies, hiring practices, management style, and corporate culture. Data quality and integration problems are not solved only by implementing advanced technologies. Cultural problems are usually more complex and harder to solve—and data quality management requires changes in employee behavior.

There should be a stated process to capture and integrate all existing and new data, as well as to coordinate updates companywide. One way to drive the behavioral changes needed is to use an incentive system that includes rewards and sanctions, and encourages open reporting on data quality problems. Additionally, training staff to recognize the right data will help with these efforts, as well as help to reduce user errors, increase productivity, and improve compliance with key controls. Training should include the tools used, core data principles, and data quality practices. It is also imperative to communicate why and how the end data is used.

Ultimately, only when corporate strategies, data management principles, and human resource methods are combined can an organization achieve what is required to implement an analytical approach (see Figure 3).

The Right Data

Extracting value-added knowledge, however, requires focusing on the right data for the right objective. Having and leveraging the right data for high-value activities like understanding potential wallet size or determining future value surfaced as one of the main challenges identified in our survey. Many companies, for example, engage in information management without properly establishing the ultimate plan for how they will use the data. Overcoming that challenge is essential to business growth.

Leveraging the right data enables more effective relationship building with customers through the entire customer lifecycle, from demand generation to sales. And with the right information it is also possible to be predictive; for example, measure potential wallet size, discover which customers are likely to purchase a specific product, determine which customers will return a profit sooner, and predict which customers will remain customers.

Companies need first to define what high-value activities the data will support and what kind of data is necessary to meet these objectives, and then construct a data structure suitable for each objective. It should, of course, include the most up-to-date customer and transactional information.

Accessing the right data and mining and leveraging it requires having the right analytical team in place, whether on staff or outsourced. How well a company can transform data into insight depends on how qualified the employees are not only in computational sciences and using advanced analytical tools, but also in translating the results into actionable business information. Most companies do not have either the required tools or a workforce with skills to take on complex, cross-functional analytical projects.

Businesses with underqualified staff can take one of three approaches: train their employees, outsource management of analytic functions, or use a combination of both. Whether training staff or partnering with an external provider, it’s essential to define for the analysts what that right data is based on the company’s corporate and departmental goals, how it impacts the business, and how best to unearth and share the information.

Conclusion

Taking a data-driven approach in business is a winning strategy, but it can be challenging to transform an organization to the point where it can actually leverage the right data. Technology is rarely the biggest issue holding companies back from doing so. It’s usually the human factor that prevents firms from taking a more data-driven approach. In many organizations data is stored in inconsistent formats across incompatible systems, making it difficult to mine for insight. Additionally, most organizations are faced with organizational alignment that creates silos and impedes a collaborative approach to analytics.

Success lies in the hands of senior management, who must believe that taking a data-driven approach can improve business results—and then must communicate that to the rest of the organization. Top management should help eliminate conflicting interests by helping to align corporate and departmental goals. They must also align compensation with those goals and assign accountability. All stakeholders should be involved throughout the process to ensure their interests are represented.

This holistic approach to analytics can help to focus the organization on a unified set of goals and help transform data into a competitive advantage.

Endnotes

1. King, J., “Can Web 2.0 Save BI?,” ComputerWorld, Sept. 1, 2008

2. Kaplan, R., Norton, D., Alignment, Harvard Business School Press, Boston, 2006

3. Murphy, D., Grady, J., Maftoon, J., Salinas, A., Making CRM Stick, 2001

4. Beg, J., Hussain, S., “Data Quality: A Problem and an Approach,” Wipro Technologies, 2007

5. “Understanding Unique ID Solutions: Strategic and Operational Approaches for Identifying Customers,” Peppers & Rogers Group, 2008