In 2003, office supplies retailer Staples introduced the tagline “That was Easy” and a red “Easy” button to underscore the ease with which workers could get the products they needed to do their jobs. Times have changed. Today, the office supplies industry is undergoing a massive upheaval. Demand for paper-based merchandise is shrinking as businesses shift to digital, fewer people are shopping in physical stores, and competitors like Amazon and Walmart are selling many of the same office supplies for less.

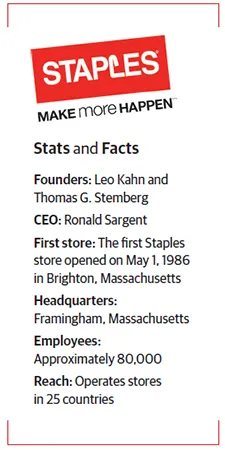

Staples is under pressure to revamp its image and better meet the needs of today’s empowered and tech-savvy consumers. As customer expectations grow, last year Staples notably replaced “That was Easy” with a new slogan, “Make More Happen.”

In addition to this change, Staples is betting on major enhancements to its business-to-business division, Staples Advantage, to help it keep up with rising competition and evolving customer expectations. The wholesale market is also highly lucrative. In 2013, U.S. wholesalers sold $7.4 trillion worth of goods to businesses, compared to retailers who took in $4.5 trillion in revenues, according to the U.S. Census Bureau.

Improving the company’s online B2B offerings with more personalization, convenience, and omnichannel services is a priority, says Sadaf Kazmi, vice president of B2B eCommerce at Staples. “We’ve invested a lot of resources into revamping our online storefronts to make it easier for businesses to find all the services and products that they need,” Kazmi says. “We are also transforming StaplesAdvantage.com to provide a much more personalized experience that caters to individual users and a more streamlined user experience that includes things like a compressed checkout flow, simplified navigation, and an overall more efficient online experience.”

The company tracks numerous data points and applies data analytics and machine learning, Kazmi adds, to engage B2B customers along their buying journey. For example, when a customer logs into StaplesAdvantage.com, the company uses information about the person’s historical purchases, time of year, clickstream behavior, and other data points to make tailored product recommendations and send reminders for reordering supplies.

“The site is smart enough to understand their buying patterns and that’s where the personalization takes over,” Kazmi explains. “And we work closely with our marketing and sales partners to make sure that as the customer evolves and matures, the contacts we have across those touchpoints through messaging and offers, for example, are relevant and consistent.”

Staples also keeps a close watch on customer feedback. Employees keep track of online customer sentiment through social listening tools and the product management team receives daily alerts on trending customer experience issues. Customer feedback is critical for helping the company move forward. For instance, in response to feedback that customers want more convenience, Staples Advantage launched Print-to-Store, which allows customers to order print jobs through StaplesAdvantage.com and pick them up at any Staples store.

And later this year, Staples will begin rolling out the ability for B2B shoppers to purchase items online and pick them up in stores. “We know customers shop in a cross-channel way and we want to make that a better, seamless experience for them,” Kazmi says. Cross-functional teams working together to connect the dots across the organization are essential for providing a consistent customer experience.

“We try to make sure with our omnichannel initiatives that as we assemble the team, we have representation from our retail partners, online properties, analytics team, etc.,” she says. “We want to make sure the right people are at the table from the beginning and that we have executive sponsorship to ensure that the initiatives get shepherded along and that there’s broad organizational support for those initiatives.”

In regards to mobile, Staples already has a mobile site and app. Kazmi declined to disclose details of the company’s future mobile strategy, but noted that the next step includes “evolving our mobile properties in the later half of this year with more personalized features that also drive convenience for the user.”

Staples Advantage’s efforts to win customers have been successful, representing a bright spot for the company. Last year, Staples Advantage’s sales totaled about $8 billion, representing more than one third of Staples’ $23 billion in annual revenue. However, overall sales continue to decline for the retailer. Staples Inc. pulled in $4.9 billion in total company sales for the second quarter of 2015, a 5 percent decrease compared to Q2 2014. The company expects sales to decrease in the third quarter as well.

Other traditional office suppliers are also challenged in their attempts to drive sales in a rapidly changing marketplace. Staples’ competitor Office Depot, which had absorbed the former Office Max chain, was also struggling, and earlier this year, Staples announced that it will acquire Office Depot for $6.3 billion. Maintaining profitable big-box stores in the e-commerce era is difficult though, and both companies plan to close stores. Staples said that it plans to close 225 of its nearly 2,000 stores in North America by the end of 2015 and Office Depot, which has about 1,000 stores, said it would close 135 stores.

Staples and Office Depot both face fierce competition from online retailers, including e-commerce giant Amazon, which recently enhanced its B2B supply marketplace with a new platform, Amazon Business. The new platform provides shoppers with many of the same functionalities as Amazon’s consumer retail site, like comparing prices across a wide array of products, as well as other features including being able to set up multi-user accounts, speak with product experts, and integrate procurement systems. Staples Advantage offers many of the same services, as the company and its competitors are locked in a constant race to beat or match prices and product services.

And the move to shutter many of its brick-and-mortar stores places more pressure on Staples’ e-commerce sites, making it critical that the company gets its online experience right. Indeed, one of the most challenging parts of meeting customer expectations “is that things change quickly,” Kazmi says. “For any company, it’s important to keep pace with the rapid rate of change in the marketplace and there are always opportunities to optimize and improve as we continue to gain insights [into what customers want].” ?