Multinational corporations with numerous operating groups can all too easily adopt disparate cultures, processes, and technologies over time. Creating a common strategy and rallying point is essential to maintaining a unified, holistic enterprise that will thrive and endure—and is exactly the approach Nordea Bank took to ensure the success of the merger that launched the organization, and that it uses to this day to assure its long-term business success.

Nordea provides corporate merchant banking, retail banking, and private banking to approximately 9 million customers, including 5.9 million e-banking customers. It operates more than 1,400 branches in Sweden, Denmark, Finland, Norway, the Baltics, and Poland, and a 24/7 call center. As of September 2009 its assets were €488 billion.

The company was born from the mergers of Merita Bank in Finland, Nordbanken in Sweden, Denmark’s Unibank, and Christiania Bank og Kreditkasse in Norway in 2000. Nordea’s executive team decided that the company’s growing pains would be diminished by developing a common customer-centric focus among all the branches in every country. It built a relationship banking model, the lynchpin of which is a tiered segmentation strategy based on customer value.

“We have been on a journey toward being a customer-centric bank with a customer-centric strategy,” says Claes Tell, head of sales and development for Nordea’s retail banking division. “That is a strong inheritance from the banks within the merger. The starting point was to take the customer-centric view to create our operating model. That is, of course, not easy. Our bank, like many other banks, has very strong product units that are still eager to push their products to customers. Therefore, we needed to set up an organization and operating model to support our customer-centric view in the way we treat customers. That is done at a central level, but also in how we treat individual customers.”

Customer value tiers

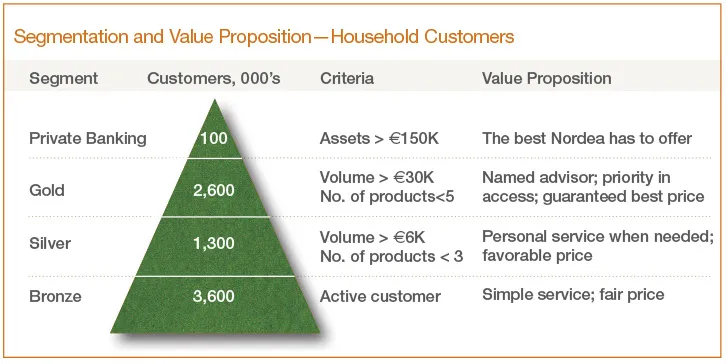

Robust customer data and advanced technologies afford the bank endless segmentation possibilities. However, for that segmentation to be understood and acted on at the branch level, it must be a simple model that is easily communicated. “It’s difficult to talk to the line organization when you have many layers of customers that are constantly changing,” Tell says. Consequently, every Nordea retail banking customer is assigned to one of three customer value tiers: Gold, Silver, or Bronze. The segments are based on volume of interactions and number of products owned.

An active customer with at least one product is automatically placed in the Bronze segment. Customers with at least €6,000 in interaction volume and more than three products are part of the Silver segment, and Gold customers are those whose interaction volume is greater than €30,000 and who have purchased more than five products.

“We cover large markets and we have a large customer base,” says Tell. “It’s important from a growth perspective that we focus on the right customers and retain the right customers. That’s the foundation for the segmentation. By doing so we make sure to allocate our most valuable resources—Personal Bank Advisors—to the right customers, according to the value they bring and the size of their business. We are very much focused on addressing the right customers with the right resources.”

As a result, each value tier has a specific treatment strategy that is adhered to in each interaction channel, Tell says. Bronze customers receive “simple service at a fair price,” according to the company’s annual report. Silver customers, meanwhile, receive favorable pricing on products and personal service when needed. The top-tier Gold customers are offered the best prices for products, priority access in the branch and call center, and are assigned a Personal Bank Advisor (PBA) who meets with them individually at least once a year for “360-degree meetings” to review and update their financial portfolio.

Tell says upwards of 30 percent of Nordea’s retail banking customers fit into the Gold customer group. He says the bank employs approximately 4,000 Personal Bank Advisors across its branch network, with at least one advisor per branch. “It’s very easy to capture customer insight and do targeting, but to have real effect we very much rely on the efforts of PBAs out in the branches,” Tell says. “We give them the tools and messaging they need to meet and treat the right customers.”

Relationship banking in action

Even in these days of high-tech self-service, nothing can replace the benefit of an in-person meeting. “Our foundation is that of a relationship bank,” Tell says. “Our belief is that the Personal Bank Advisor is really key to having a close relationship with the customer. We have the Web and the contact center, but in the middle of this it’s very good for the customer to have a personally assigned bank advisor there when needed.”

Personal Bank Advisors identify Gold customers and high potential customers in the lower tiers to arrange a 360-degree meeting. Customers are asked to prepare information about their current financial situation and future plans both with Nordea and other banks. The PBA reviews the customer’s situation and makes recommendations about products and services. “This is a quite strong value proposition,” Tell says. “We do not take a product-oriented approach when it comes to meeting these customers. We approach them to give them advice.”

Nordea created tools to help the PBA work with specific topics at a 360-degree meeting. For example, if a customer is interested in opening a savings account, the PBA can work with the customer to access modules within the bank’s proprietary customer management system that help explain risk and establish savings targets. There are also modules for categories like life and pensions and investing, and for other banking services.

Depending on the number of high-potential customers in each branch, a PBA could be responsible for as many as 500 customers over the course of a year. “There is an obvious need to help prioritize who to meet,” Tell says.

Transparent segmentation strategies

While segmentation is not unique to the financial services industry, Nordea made the unique decision to externally communicate to customers the segments they are in. This creates an aspirational relationship for those in lower tiers, and helps Gold customers feel they are part of something special. “The communicated benefit to customers is that we can give you our best advice through assigning you to a PBA,” Tell says. “Secondly, there is the pricing issue, where they know they will get the best prices if they are in the higher segments.”

In addition to the externally communicated segments, Nordea created internal contact policies for certain subgroups, as well. Gold customers, for instance, are divided into two groups: care customers and balance builders. “By putting those labels on the customers, we have a way to communicate to our PBAs and the branches that some customers need more attention than others, due to the fact that they are building balances and have a greater need for banking services,” Tell says.

Balance builders are considered to have more potential value, and are treated with the highest priority. Care customers, while still important, are considered a group to maintain instead of grow. “We of course want to focus our resources on where we can find the most potential,” Tell says.

Nordea also uses customer insight modeling based on behavior information and other legacy data available to create other target subgroups. “It’s a way for us to be more focused in our ambition to meet and treat the right customers with the largest potential and also, of course, work with customers with the largest need. We hope that their needs coincide with our ambition to do sales.”

Nordea uses its proprietary customer management system to run its customer insight analysis, predictive modeling, and other analyses at the corporate level. Customers are placed in the correct segments and contact policy groups within the system. Nordea then pushes that information to individual PBAs through the common front-end system at branch. The information in the system also becomes leads for front-end staff in the branch or contact center, as well as individual sales messages in the online banking platform.

This integrated data approach helps keep Nordea on its customer-centric journey across all of its touchpoints. “We have found that it’s very important that we’re working in the same way, because that is how we can benefit from the common framework for how to operate in the different markets,” Tell says.

Employee relationships drive customer relationships Nordea’s customer relationship strategy impacts employees as well as customers. The program would have stalled if not for the buy-in from employees in every region and every channel. That buy-in starts at the top. “The reason for us being successful in having our customer-centric processes implemented in every branch in every country has been due to a very high-level commitment from the CEO of retail banking,” Tell says. “And that has been cascaded through the line managers.”

Buy-in happens in the field because employees’ input is valued as an integral part of the programs’ continued evolution. Best practices from individual branches in all markets are shared throughout the organization to help make improvements. Additionally, employee incentive schemes are tied to customer satisfaction, sales, balanced scorecard, and the implementation of the processes. “The main thing has been to make sure everyone works in the same way,” Tell says.

Nordea’s top executives receive weekly and monthly reports from the branches to monitor progress and performance. “We have been very firm on following up, and have been walking the talk when it comes to implementing any updated processes at every branch,” Tell says.

The bottom line

Nordea’s journey toward customer centricity has already produced impressive bottom-line impact. Income per Gold customer is three times higher than Silver customers, which ties revenue directly to customer relationship strategy. In addition, more customers are moving into the Gold segment. New Gold customers increased 5 percent from Q3 2008 to Q3 2009, even during the brunt of the global recession.

Customers in the higher value tiers are also more satisfied. In one market, for example, Gold customers on average rate Nordea a 79 in customer satisfaction, compared to 75 for Silver and 70 for Bronze. Gold customers with an assigned Personal Bank Advisor on average rate Nordea higher than other customers in specific areas such as price/value, loan products, and savings advice. In addition, customers who have met with their PBA rate Nordea higher than the ones who have not. In one market, Tell says, general satisfaction for Gold balance builder customers who have met with their PBA was 77 compared to 67 for the control group.

Tell admits that there is still much more to do to become a truly customer-centric organization. In the short term, next steps include bringing new customers into the program and improving customer intelligence.

Tell’s advice for others looking to improve customer value and segmentation: Don’t make it too complicated. “You need to be down-to-earth and concrete in your strategy and in your execution, and it must be in line with the organization’s maturity level. You need to be committed to the strategy you have chosen.”